Designing A More Connected Crypto Trading Experience

An all-in-one platform that streamlined the fragmented copy trading workflows, brings together real-time trader communication and tailored trading bots.

@Crypto-Arsenal

Timeline

Oct. 22 - Apr. 23

Tools

Figma, FigJam, Jira

My Role

Leading UX designer

with 1 Product Manager

& 3 Front-end Engineers

My Responsibilities

UX Research, Solution Ideating, Wireframing, Prototyping, Design System, User Testing

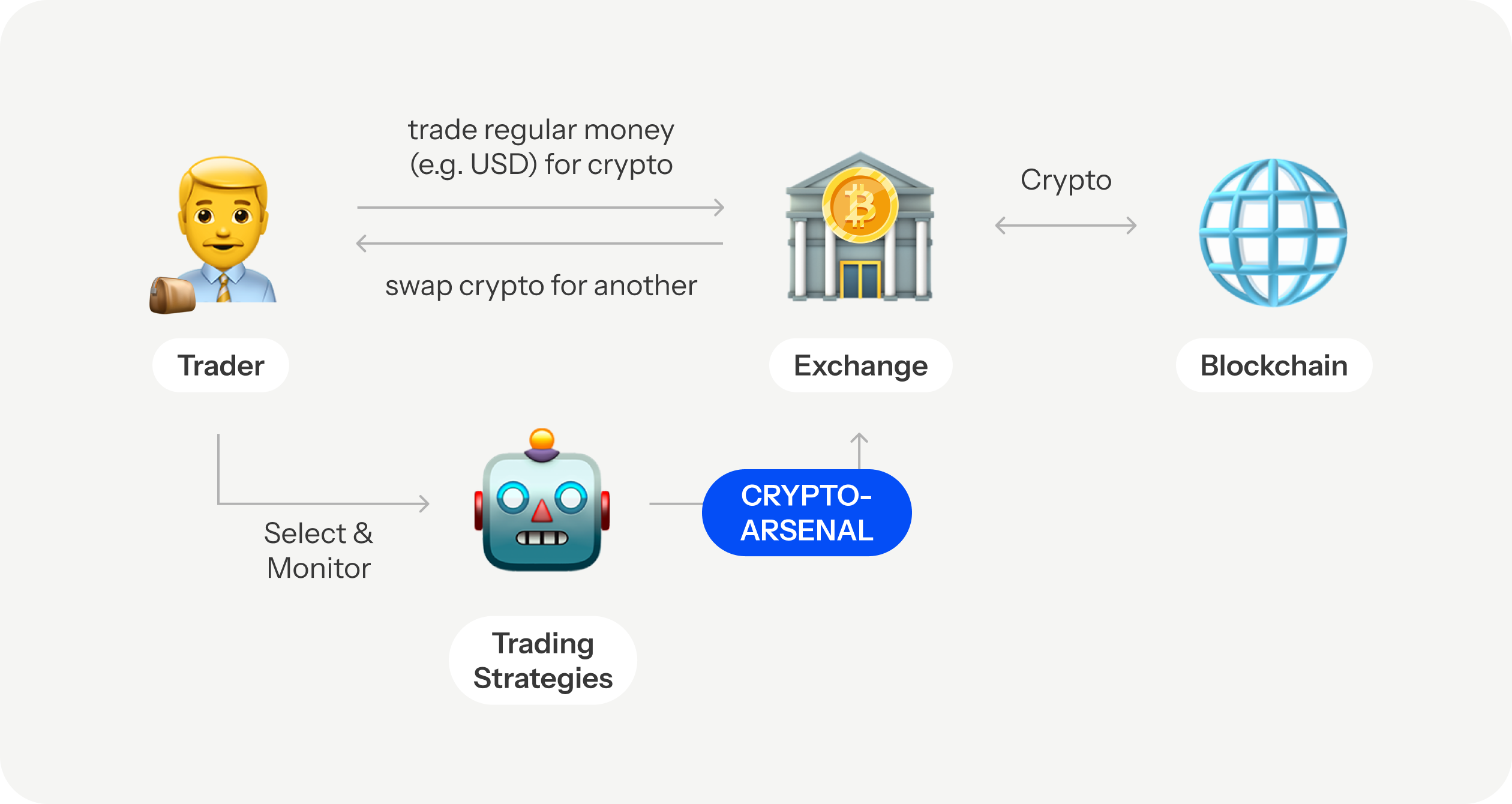

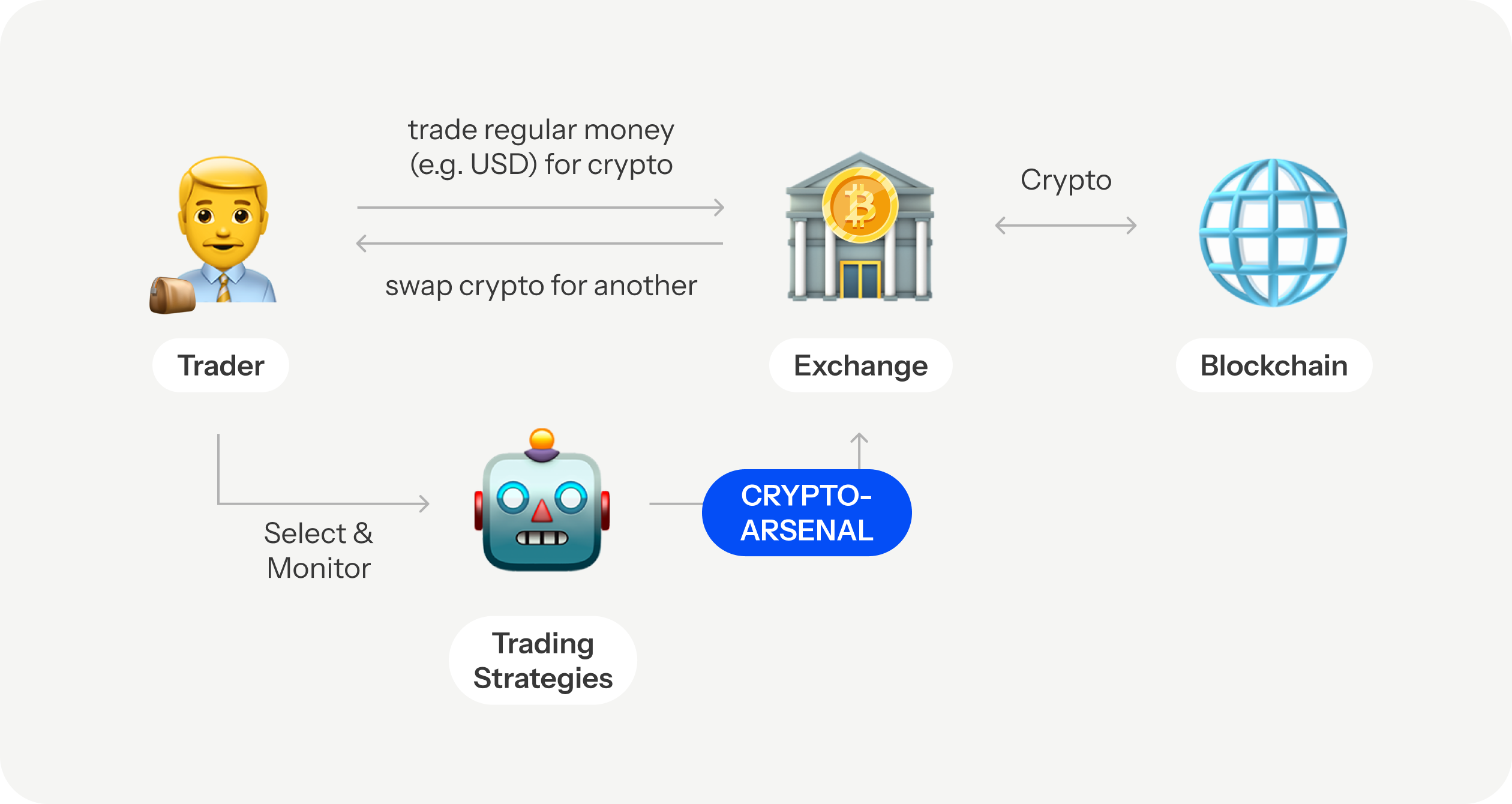

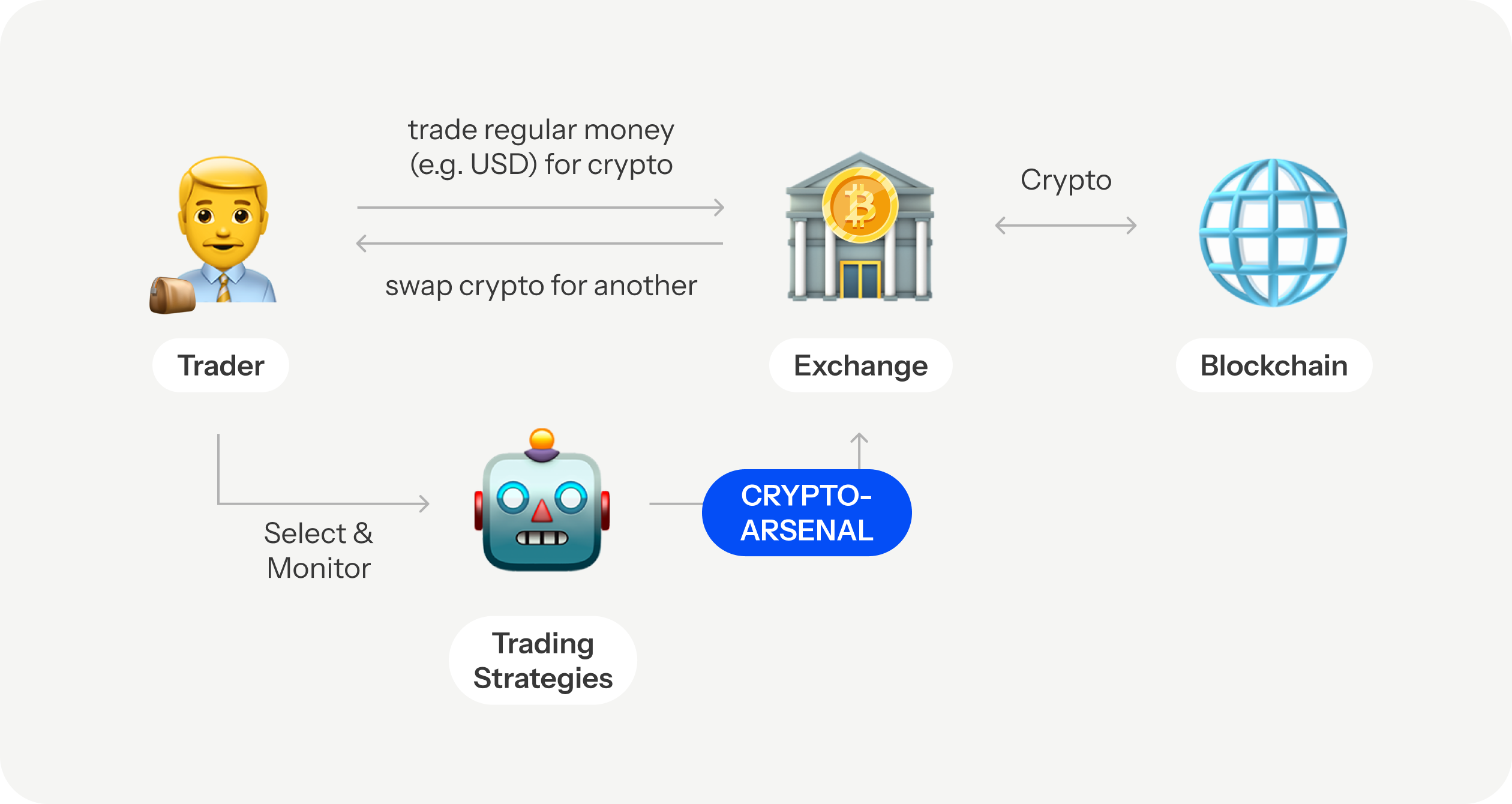

Starting with Crypto: What is it?

In crypto, trading strategies emerged to solve a key challenge — the need for traders to trade manually and constantly stay on top of the market.

These strategies are rules or algorithms that help traders monitor trends and execute trades more effectively.

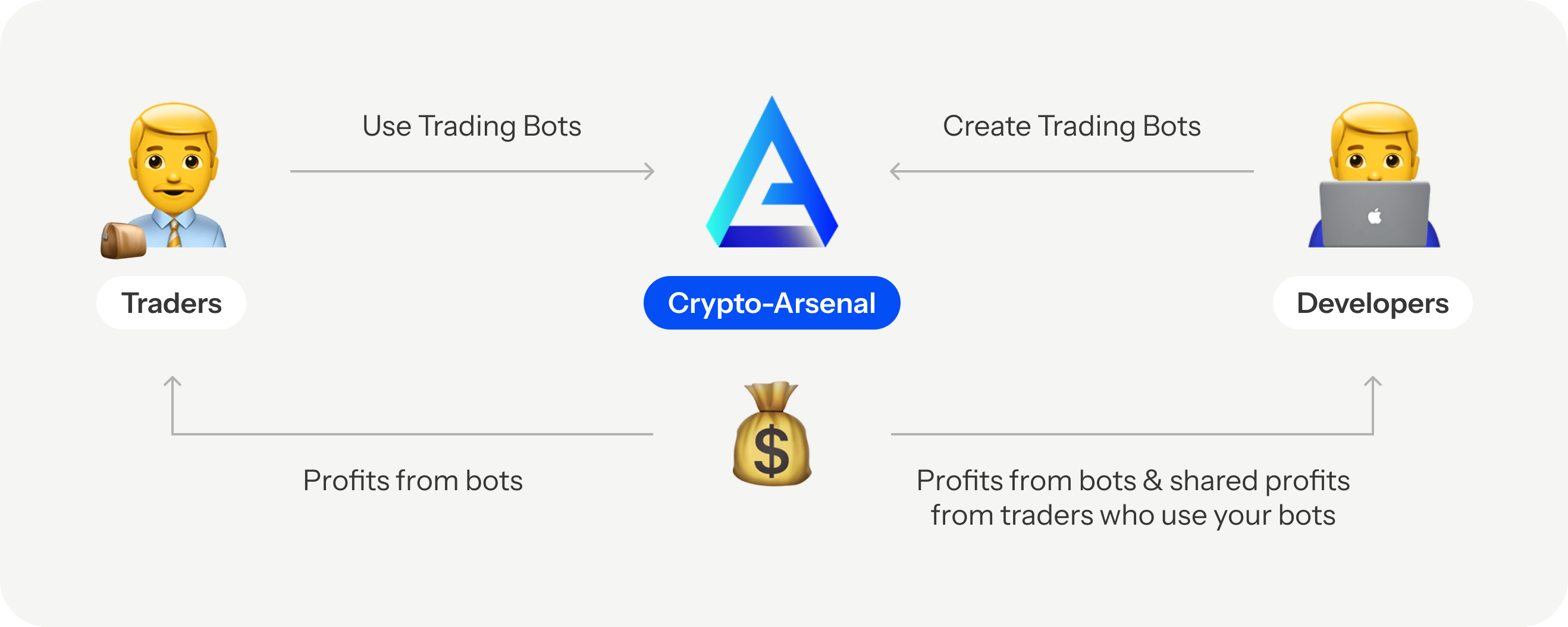

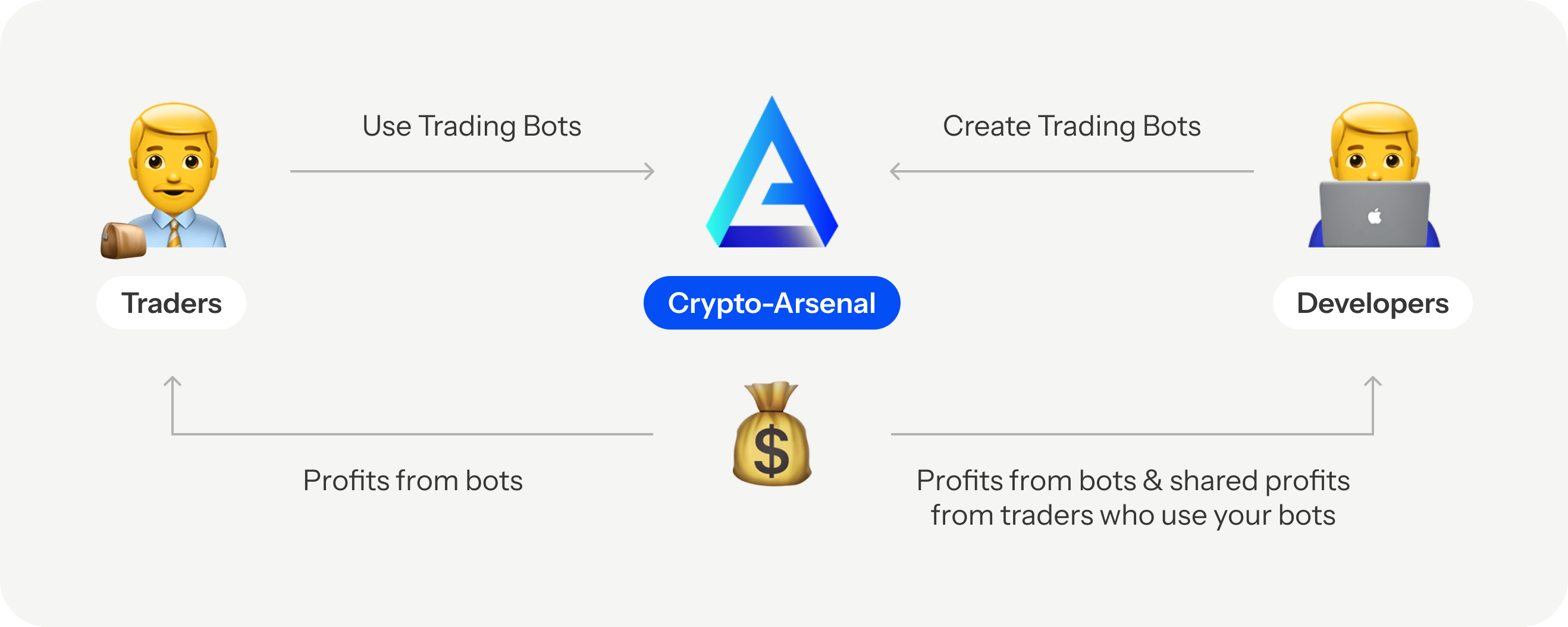

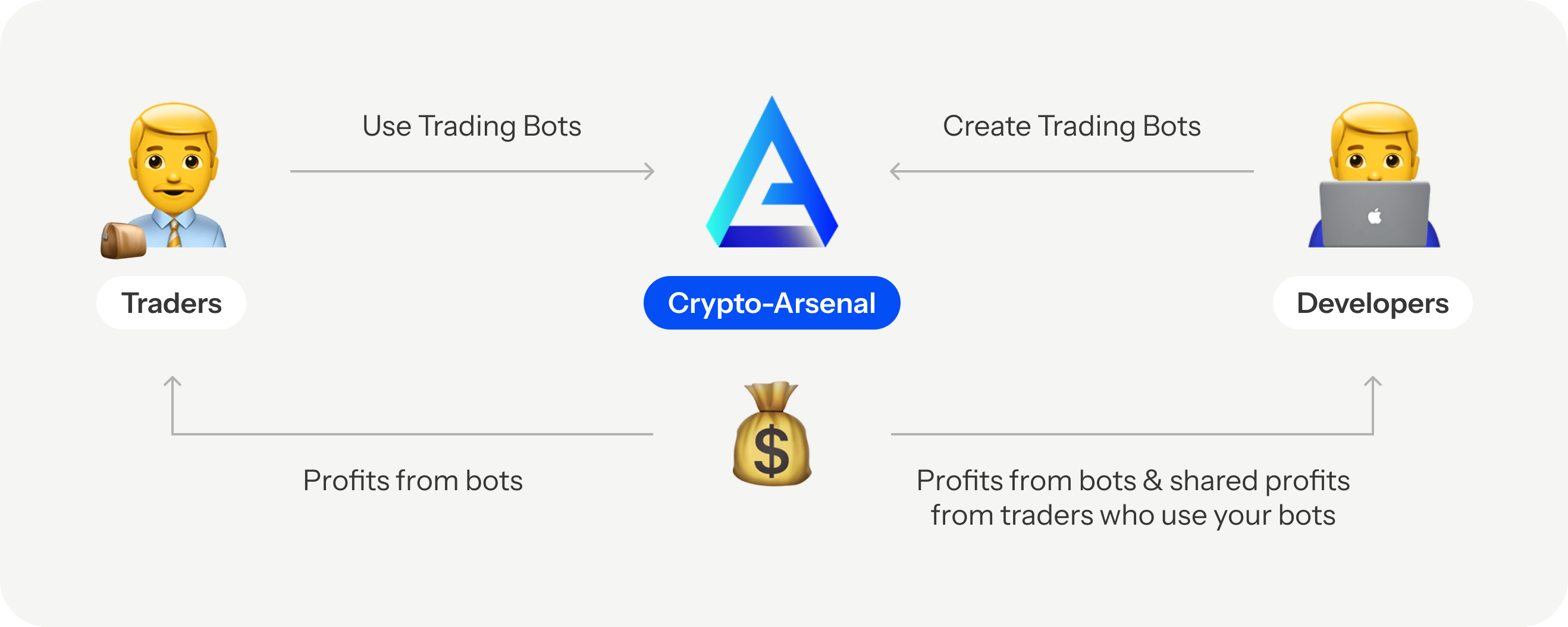

And within this ecosystem, Crypto-Arsenal plays the role of a bridge — connecting directly with exchanges and enabling traders to access automated strategies created by experienced developers.

By linking both sides, it helps developers monetize their expertise, while allowing traders to trade smarter with confidence.

However, we identified a Problem...

Many traders don’t have the expertise or time to monitor and fine-tune their strategies,

and it became a barrier that prevents them from fully benefiting from automated trading.

How might we help non-technical traders benefit more from automated strategies?

💡 That’s where the idea of copy trading comes in.

What is copy trading? and why?

Many traders don’t have the expertise or time to monitor and fine-tune their strategies,

and it became a barrier that prevents them from fully benefiting from automated trading.

“So how might we help non-technical traders benefit more from automated strategies?”

Why we built this—

It’s a win-win for our users and our business

For our users

- A more engaging trading experience

- Offers more customization and flexibility

For our business

- Expands market reach & user base

- Strengthens company’s competitive edge

First, let’s ask our users

“I want to offer exclusive strategies to traders who’ve been loyal followers.”

Alex Hsu

Transport at Suite Nectar

“I want to offer exclusive strategies to traders who’ve been loyal followers.”

John Wang

Transport at Suite Nectar

“I want strategies that match my level, but it’s hard to find tailored options.”

Jade Huang

Transport at Suite Nectar

“Having to use multiple platforms for copy trading feels inefficient.”

Richard Lee

Through interviews with users about their current experience with trading , we validated the pain points and identified 3 key user needs:

💡 Integrated Platform

💬 Communication Space

🎯 Tailored Trading Bots

💭

We believe that creating a unified platform for traders to both trade and communicate could serve as a viable solution.

Next, knowing our competitors and the market

I found that other crypto trading platforms barely focus on building connections between lead traders and their copy traders. But it’s a crucial part because traders only do copy trades if they trust the lead traders.

💭

Besides trading and communicating, we need to focus on building trust and connections to create unique distinctions.

Our Unique Approach

Design a more connected and more seamless copy trading experience for both lead traders and copy traders.

With our platform, lead traders can:

Publish trading bots and monetize their expertise

Share information with their copy traders easily

Classify and provide different types of bots t traders

With our platform, copy traders can:

Discover and follow trusted traders and trade with them

Get timely trading info and updates from lead traders

Trade with the tailored bots that match their preferences

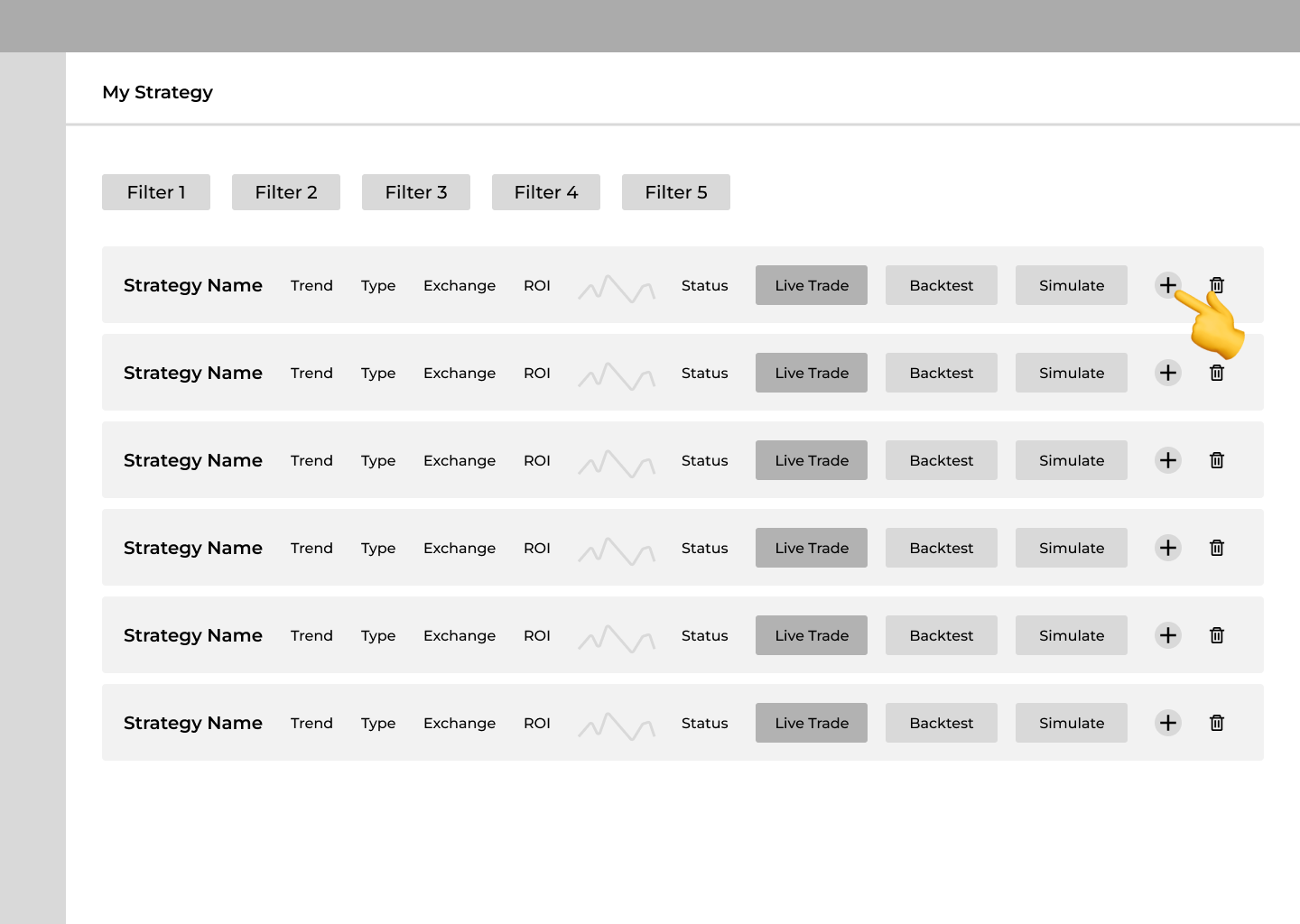

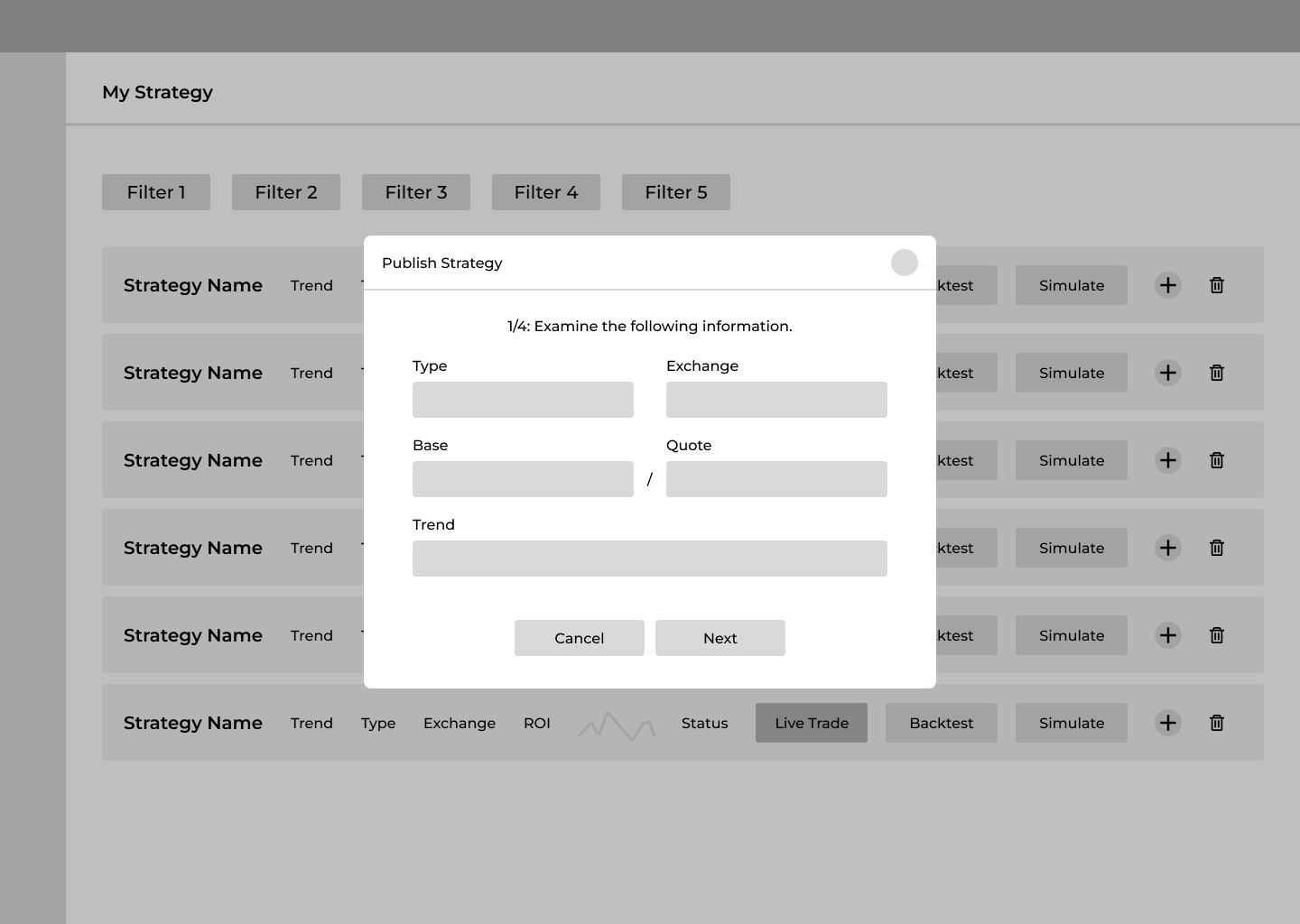

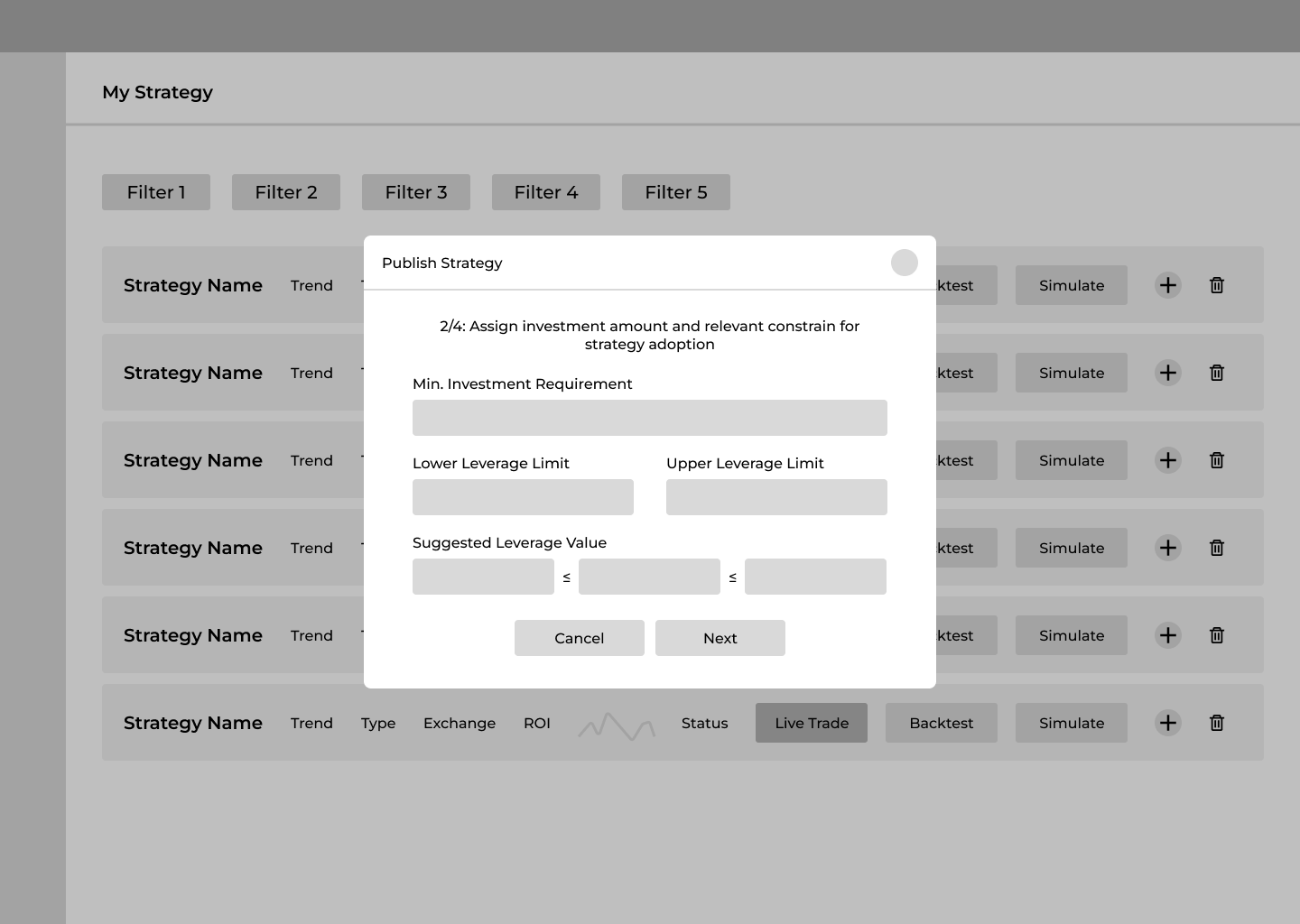

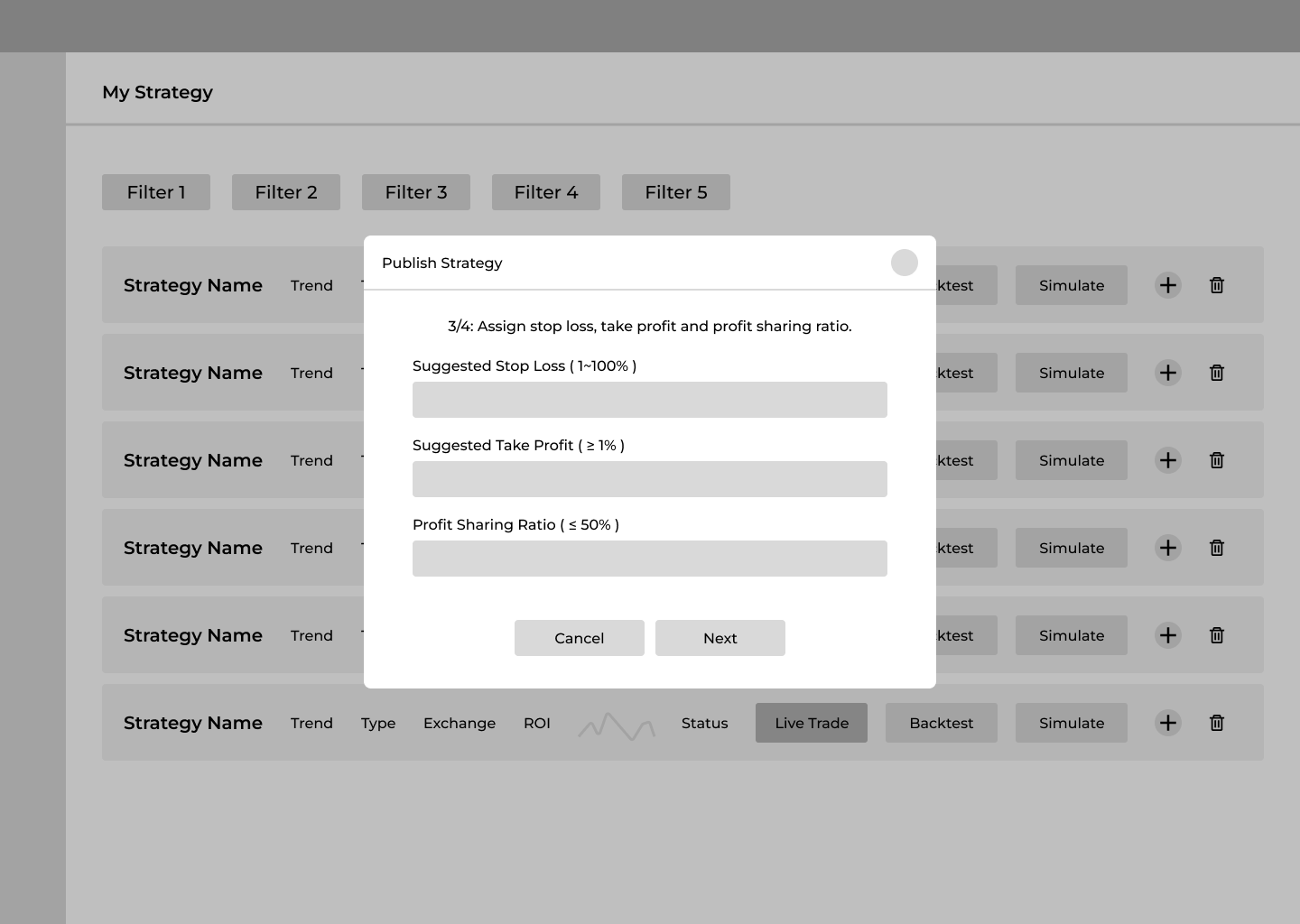

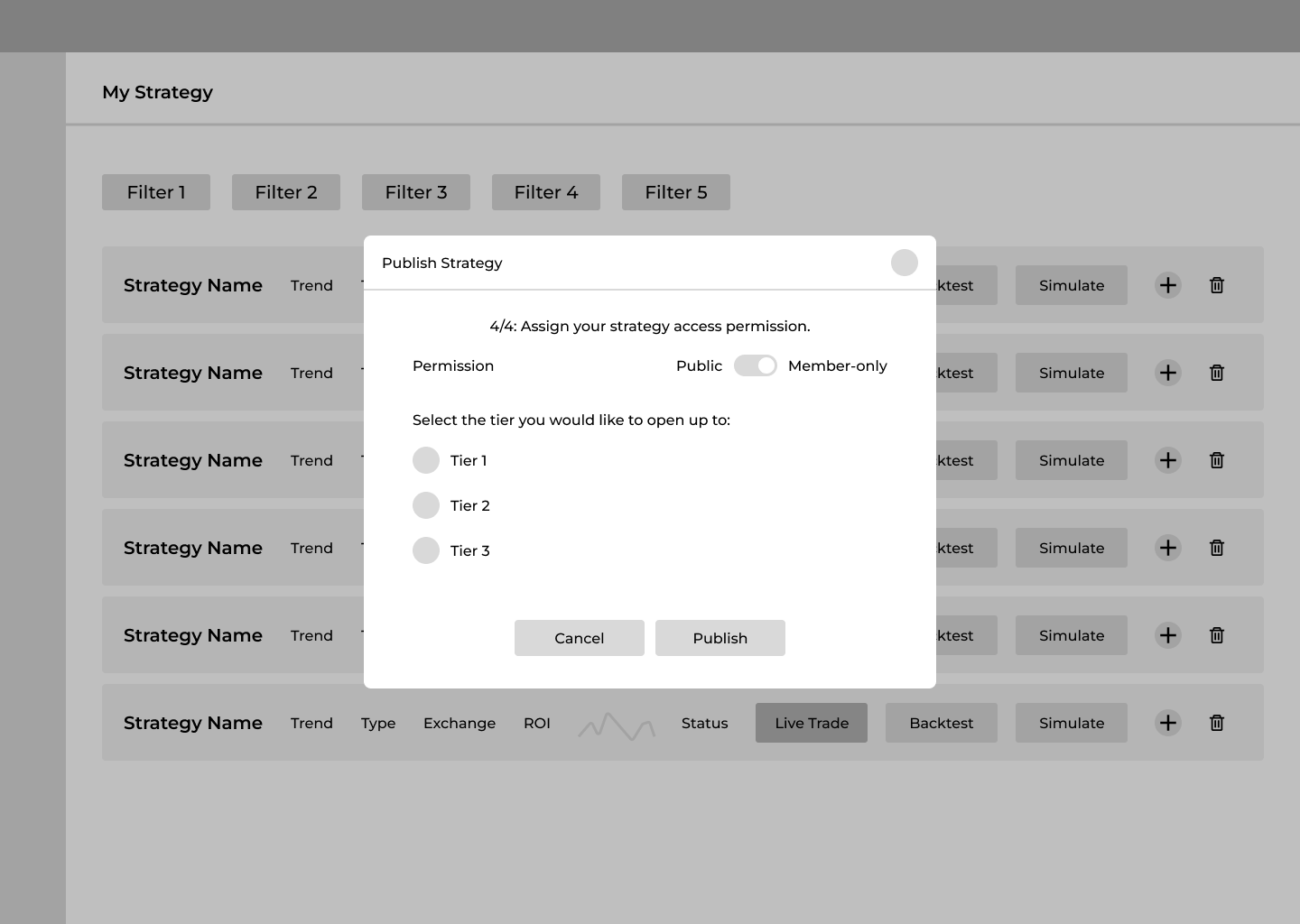

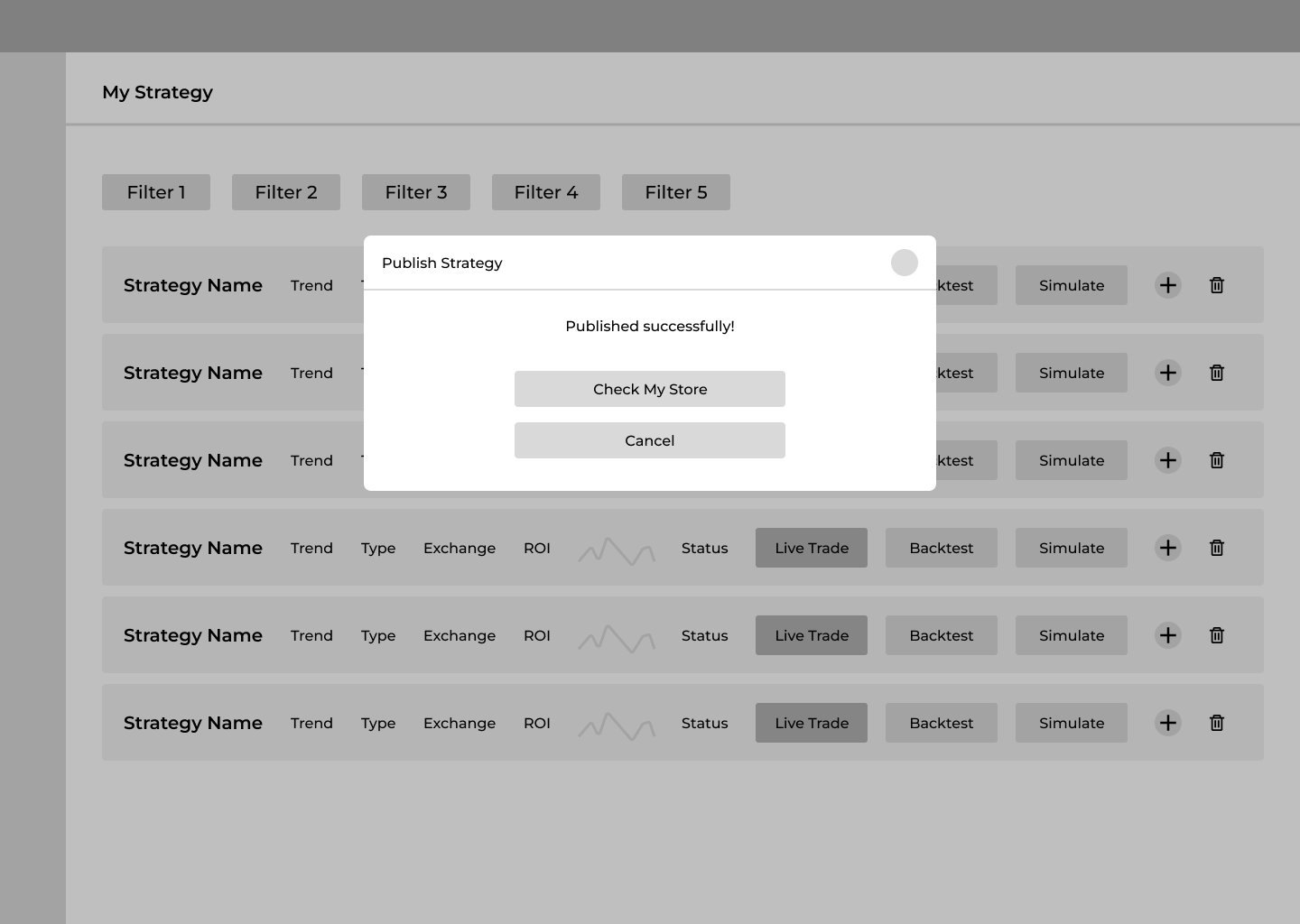

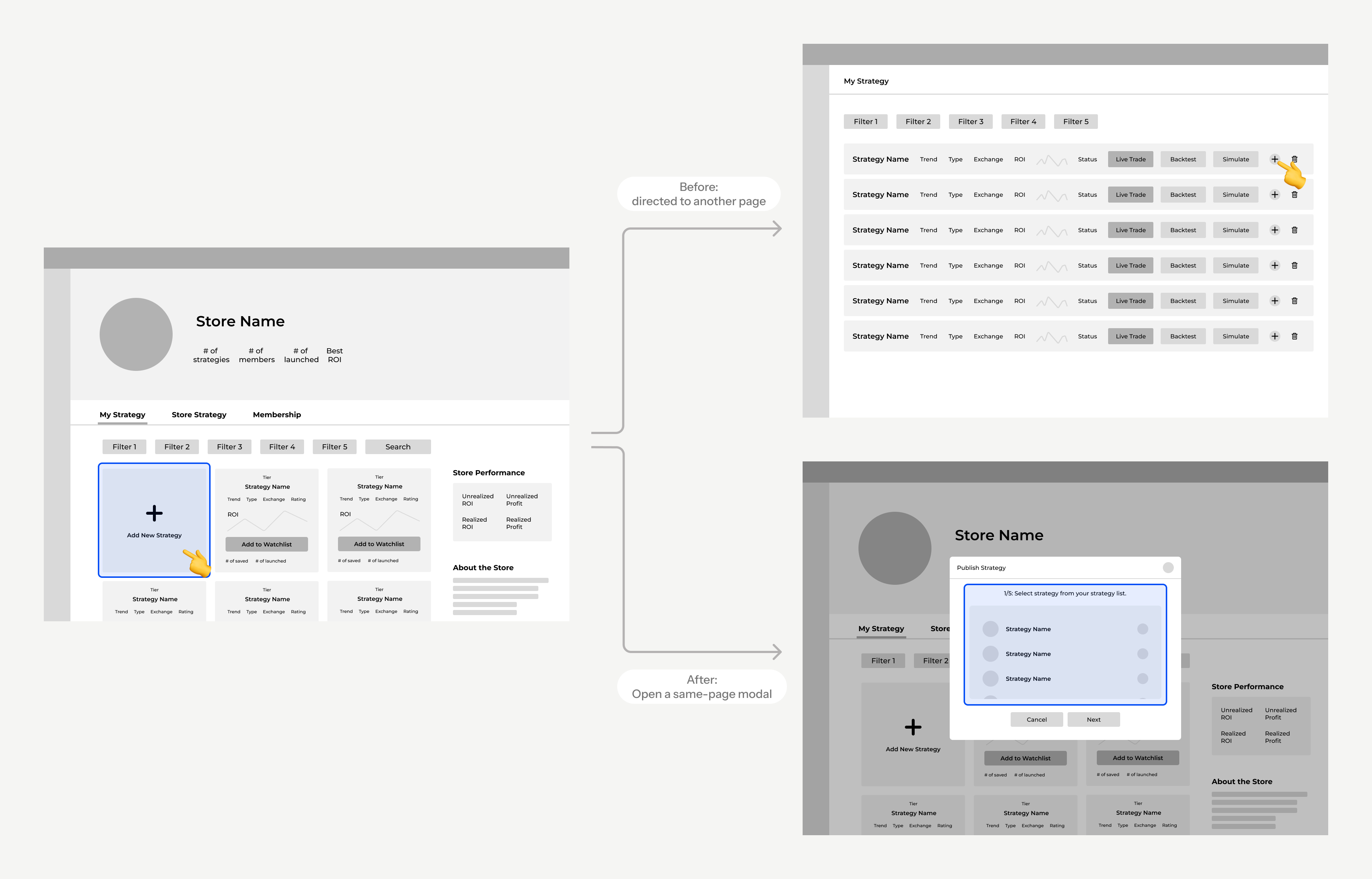

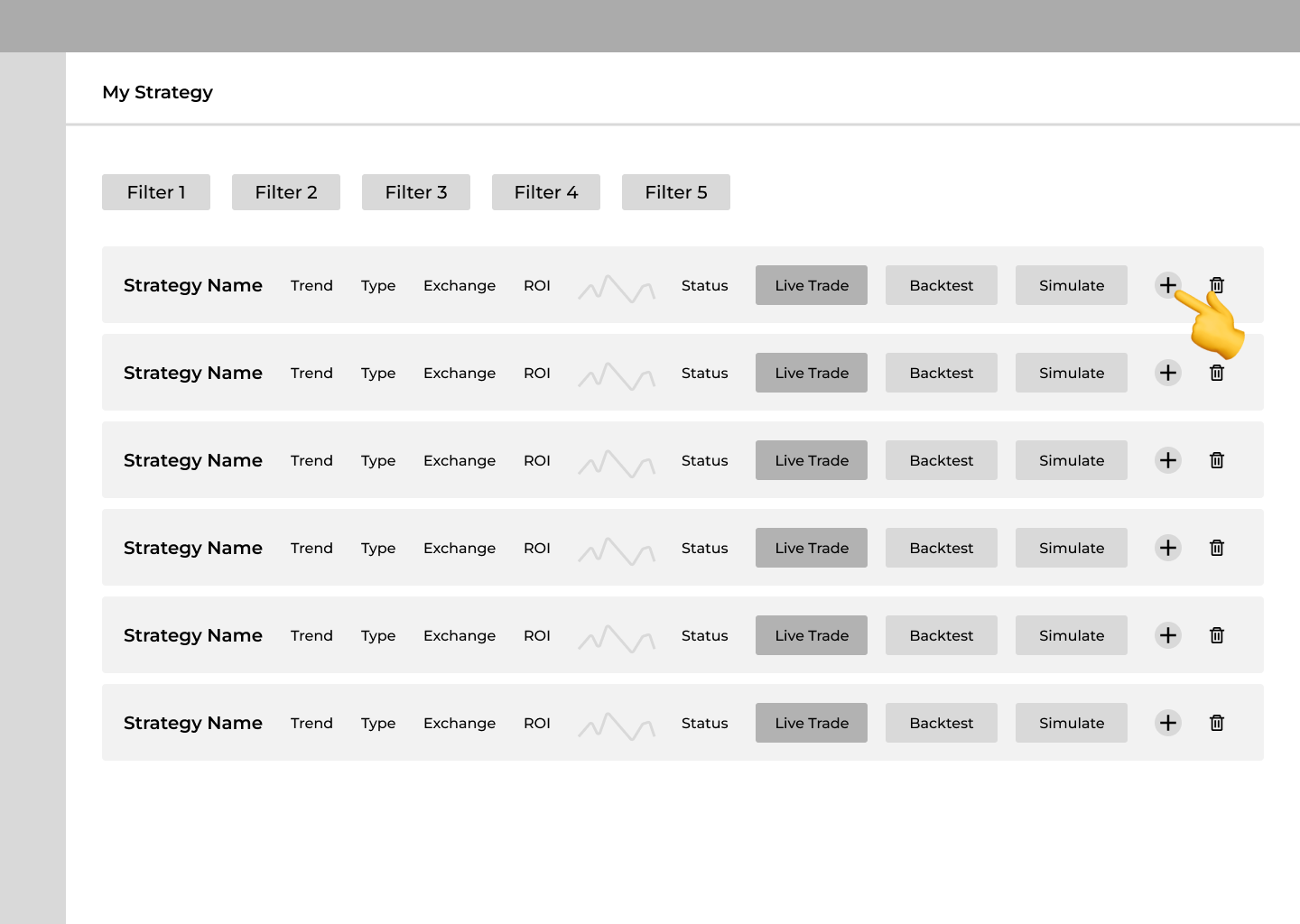

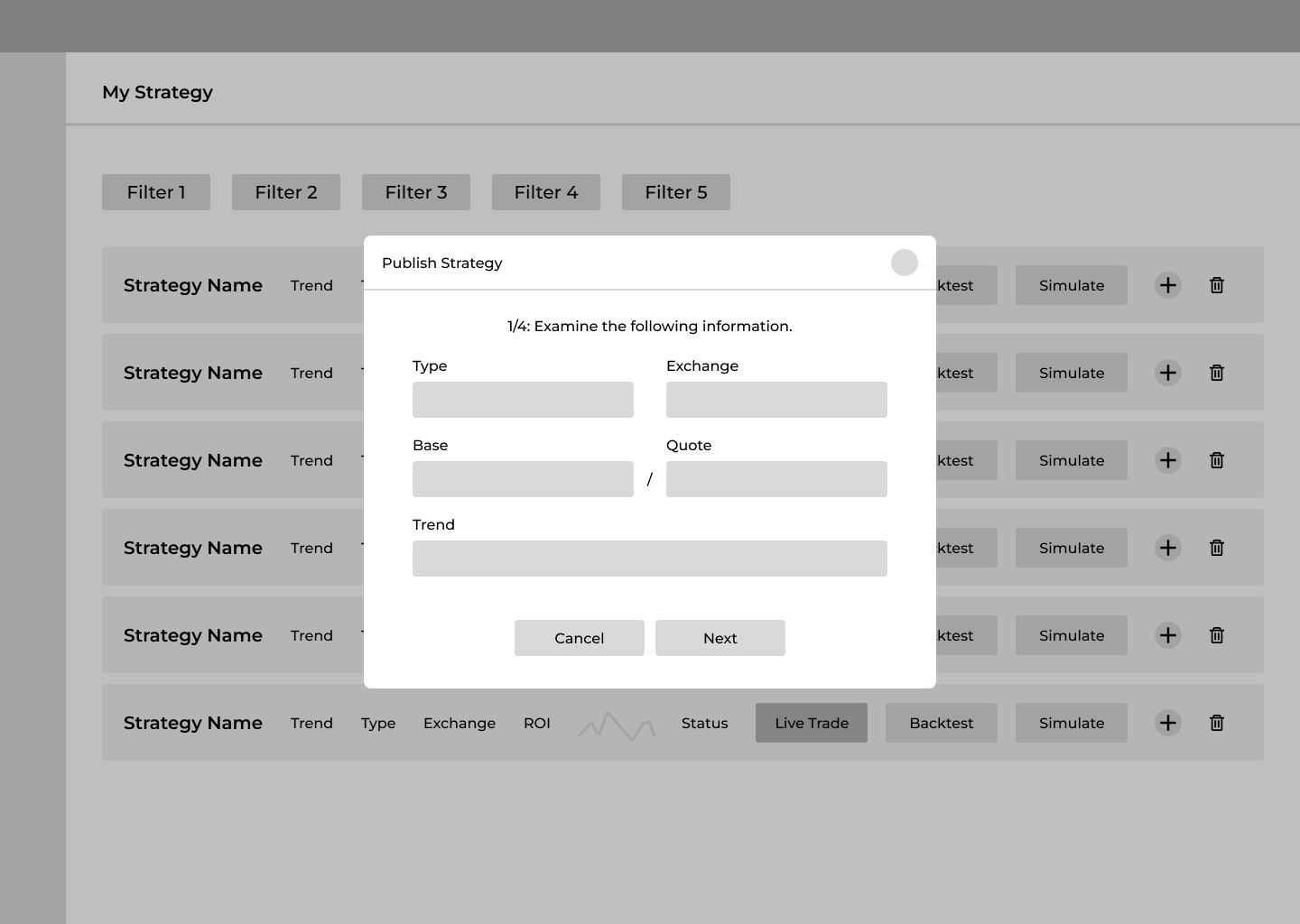

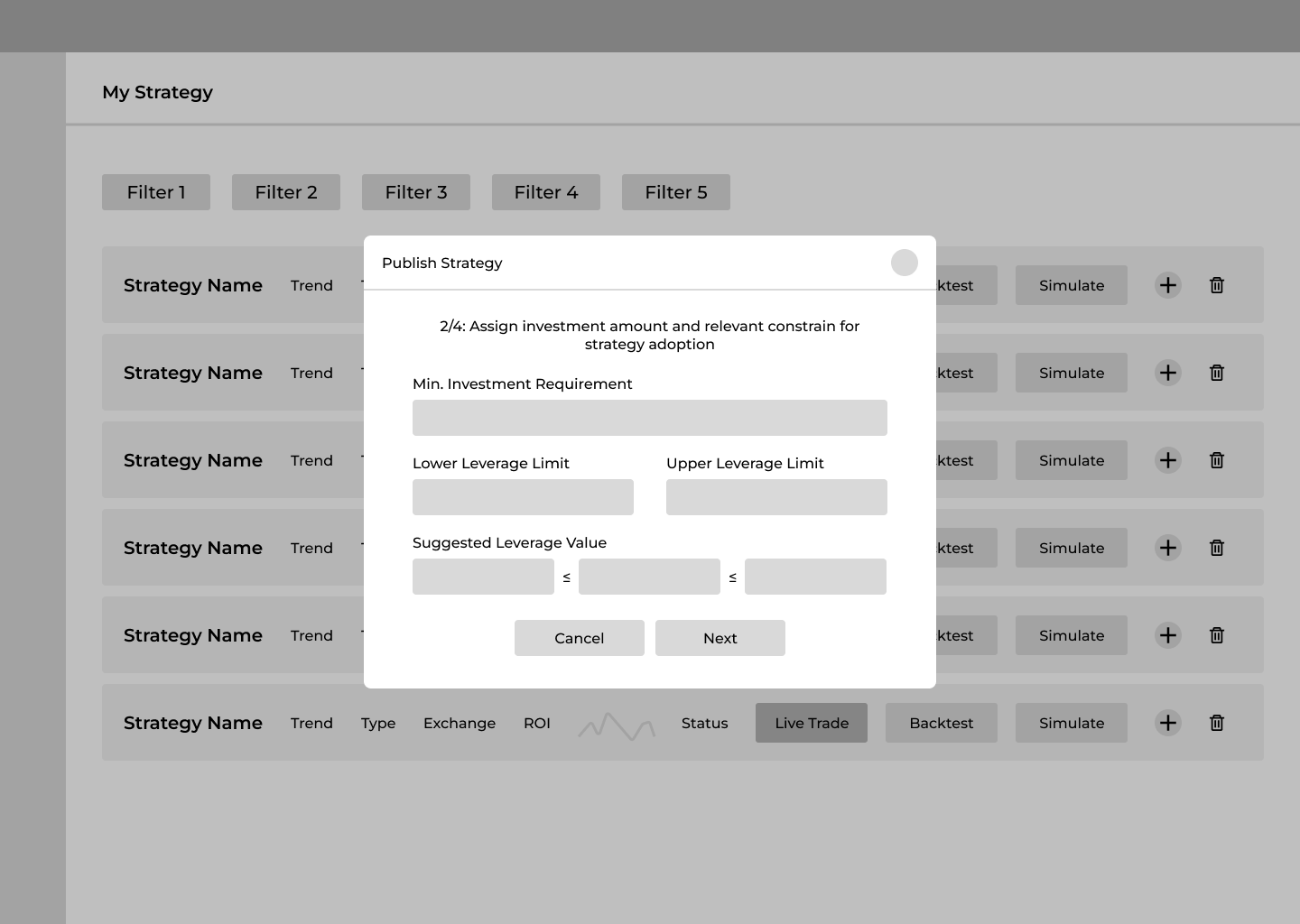

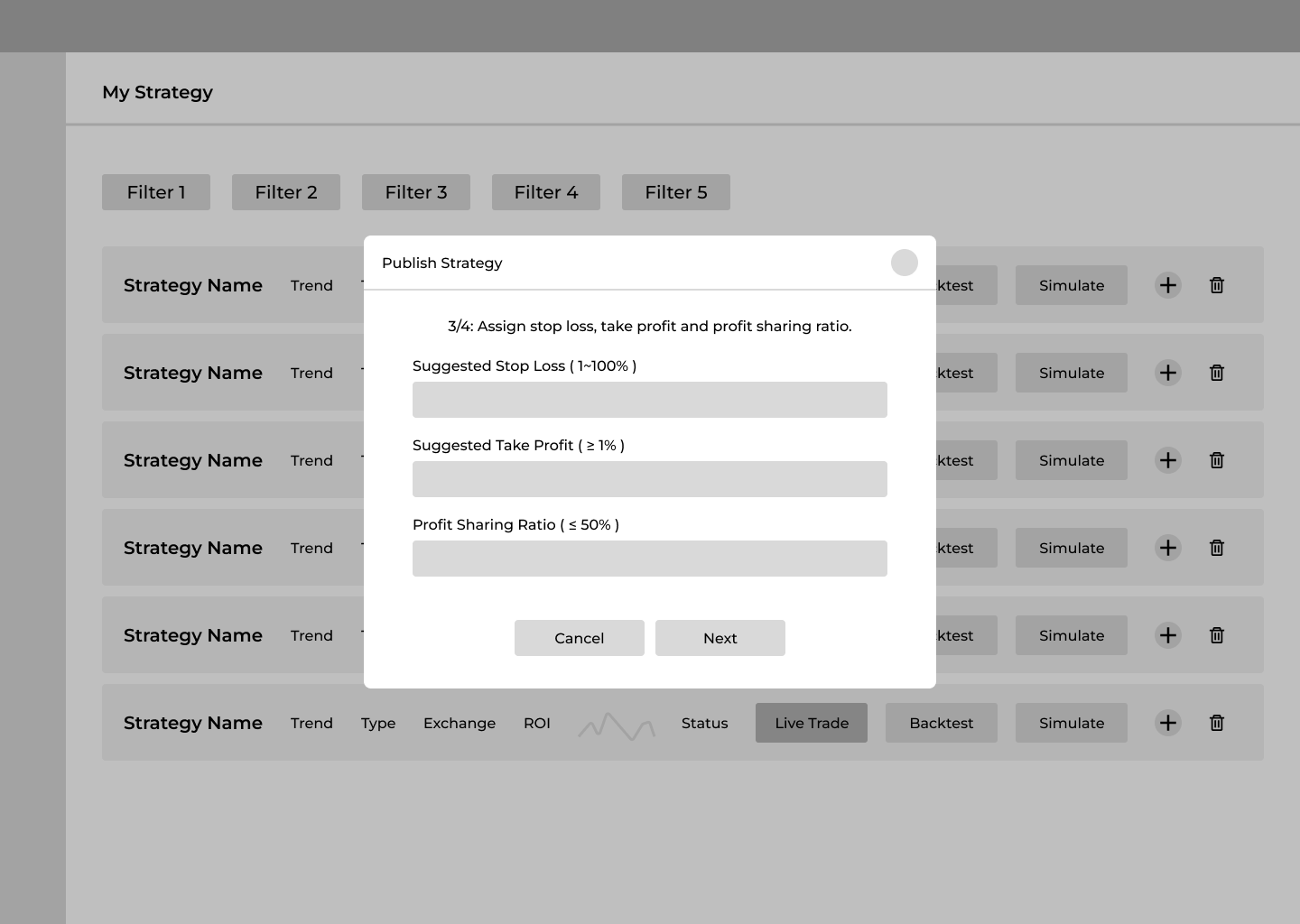

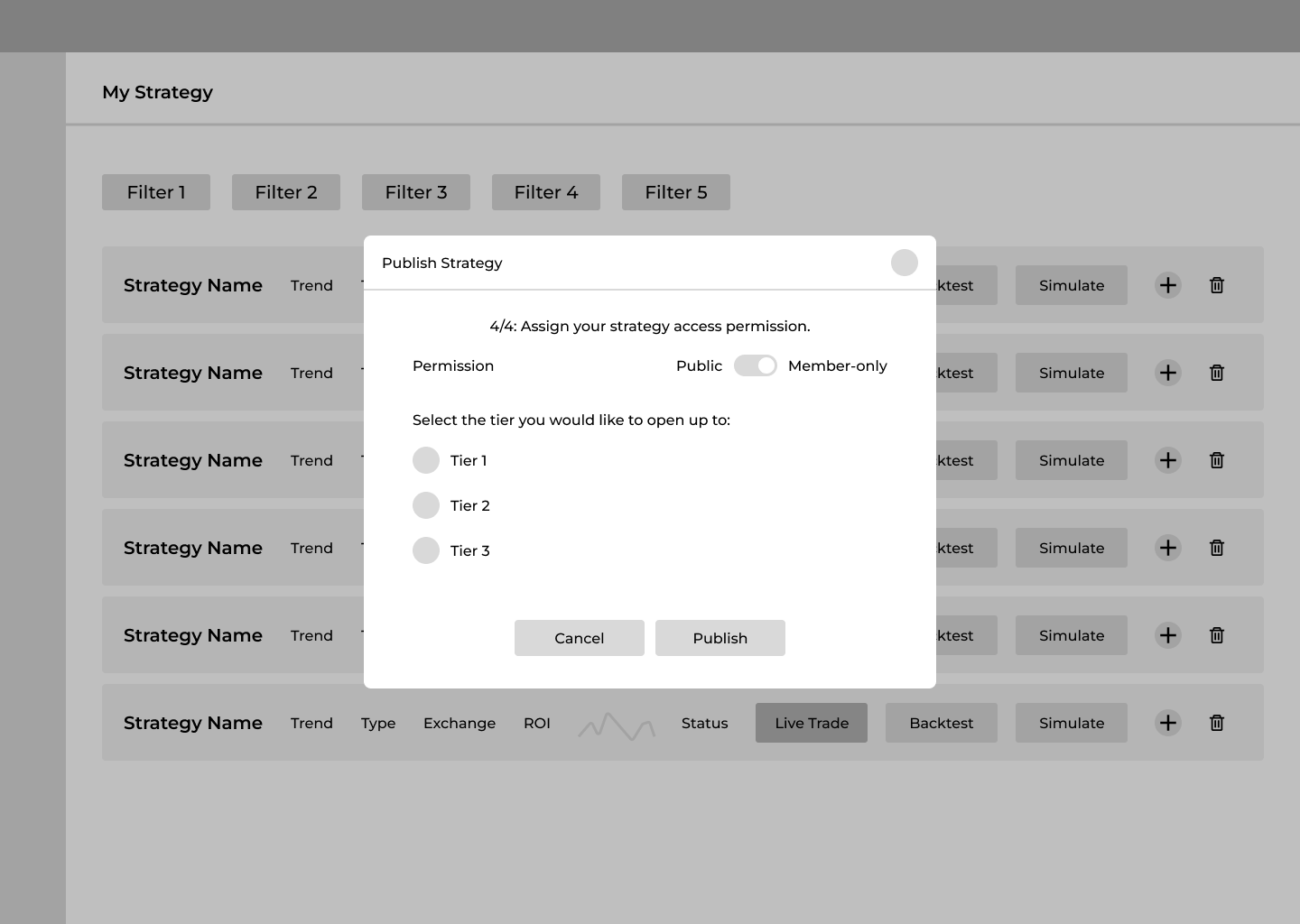

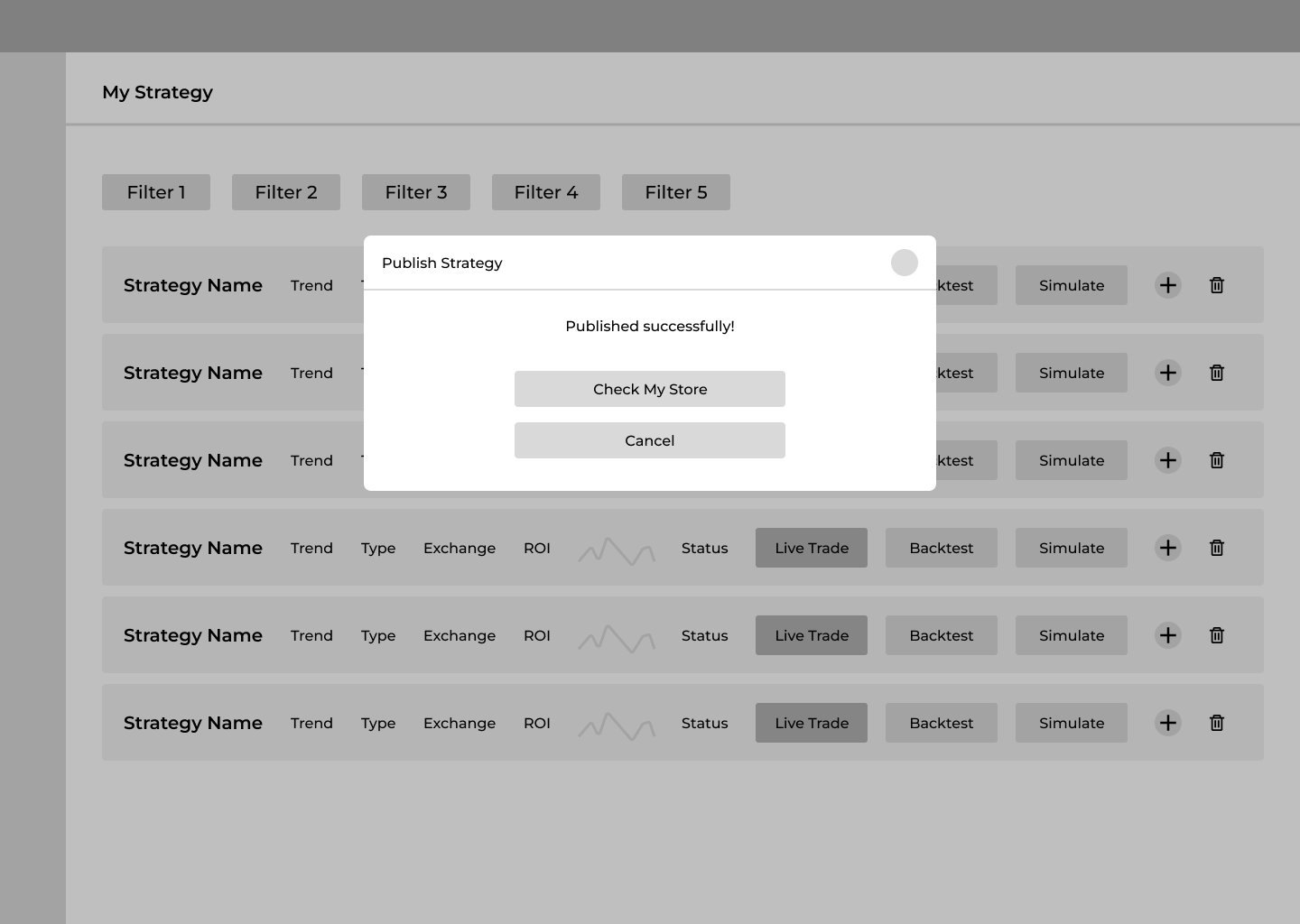

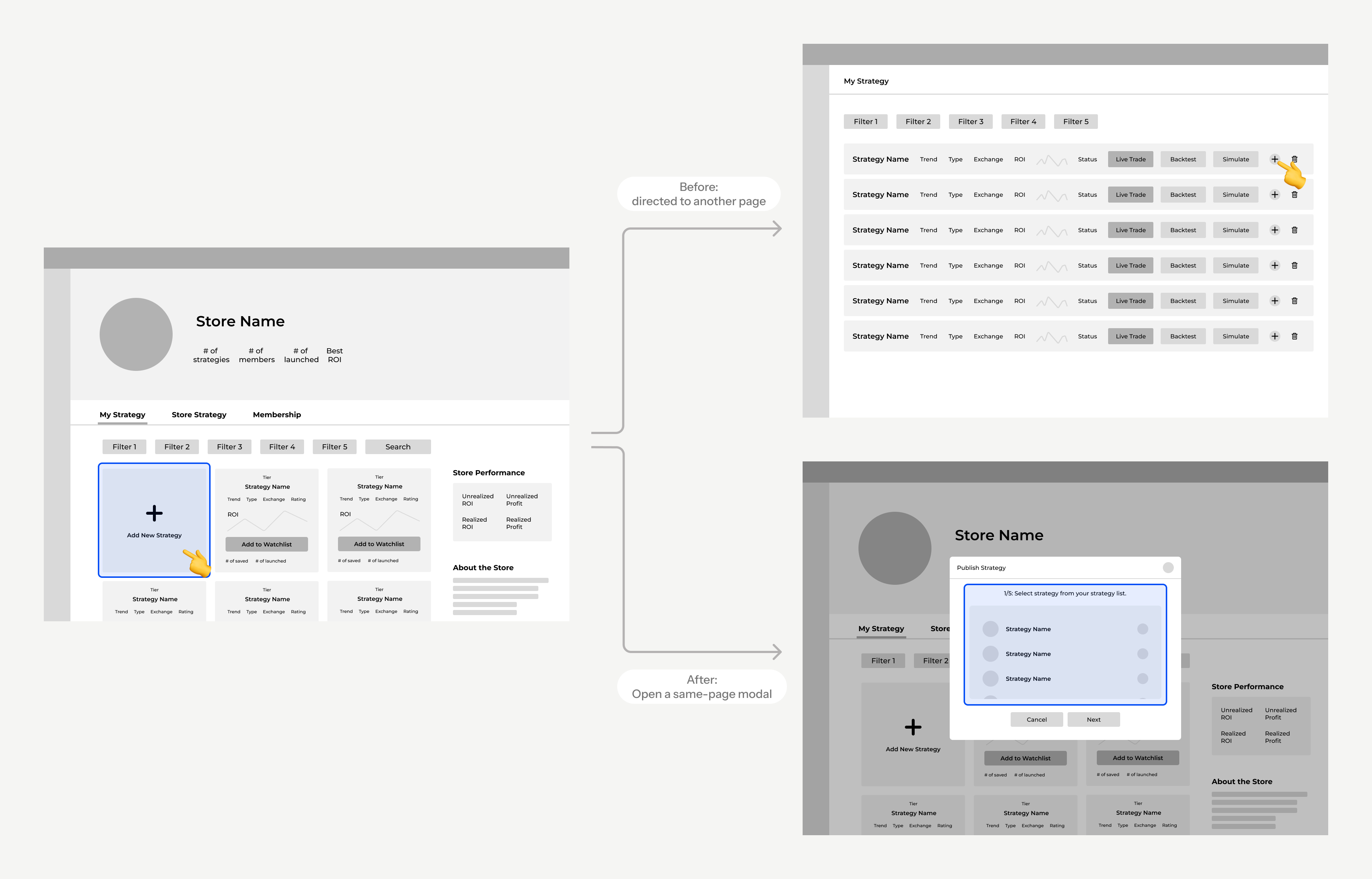

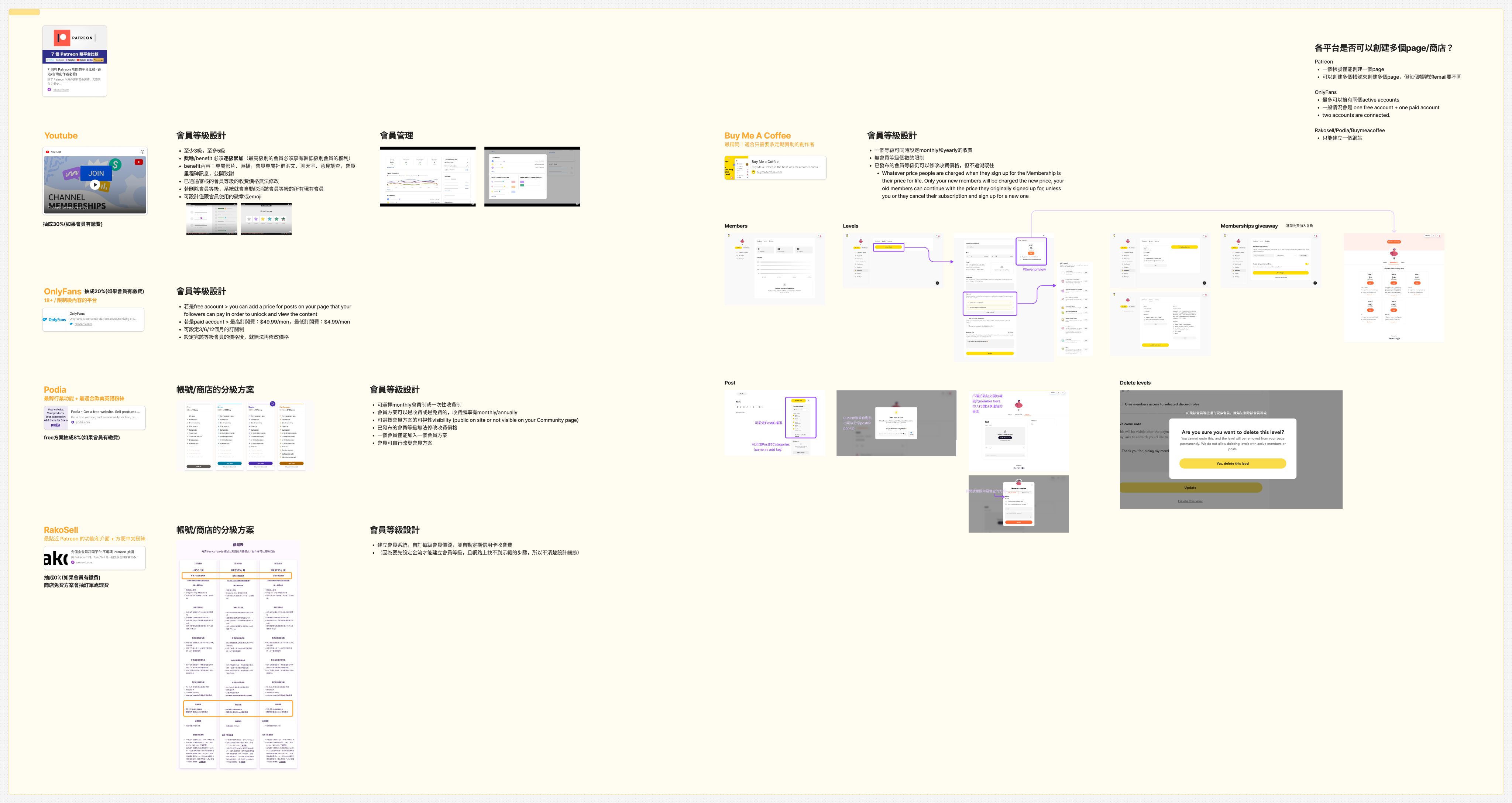

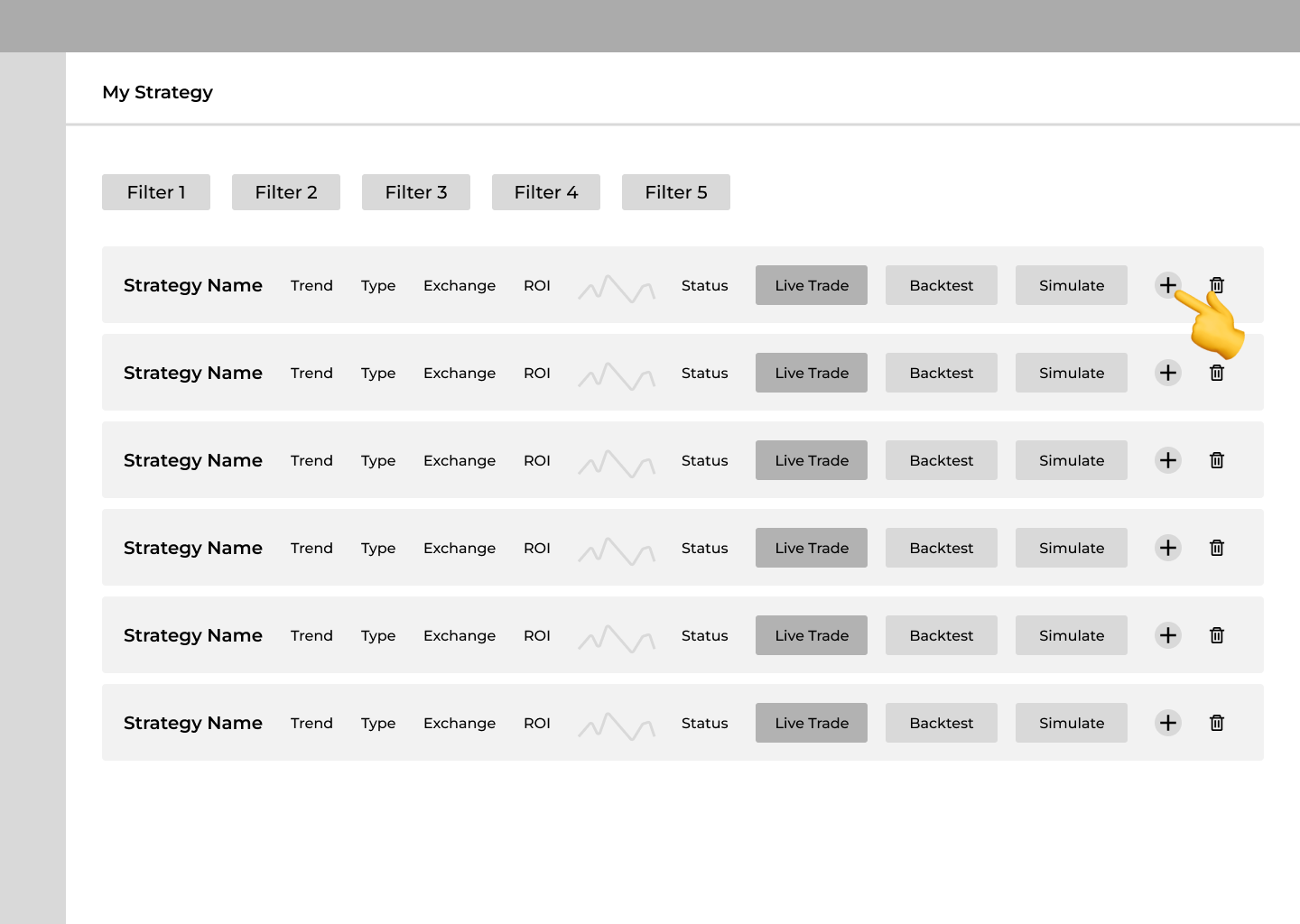

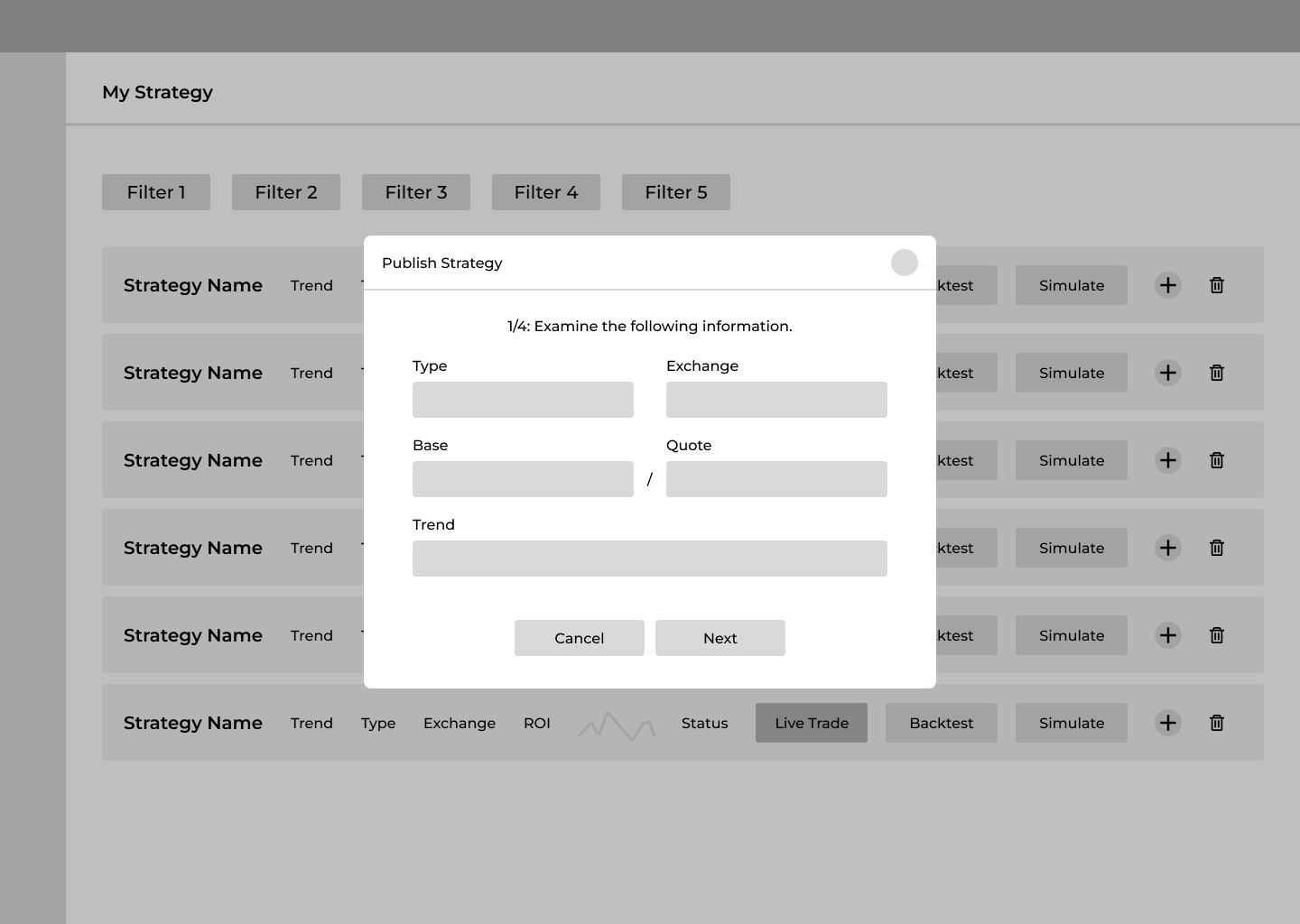

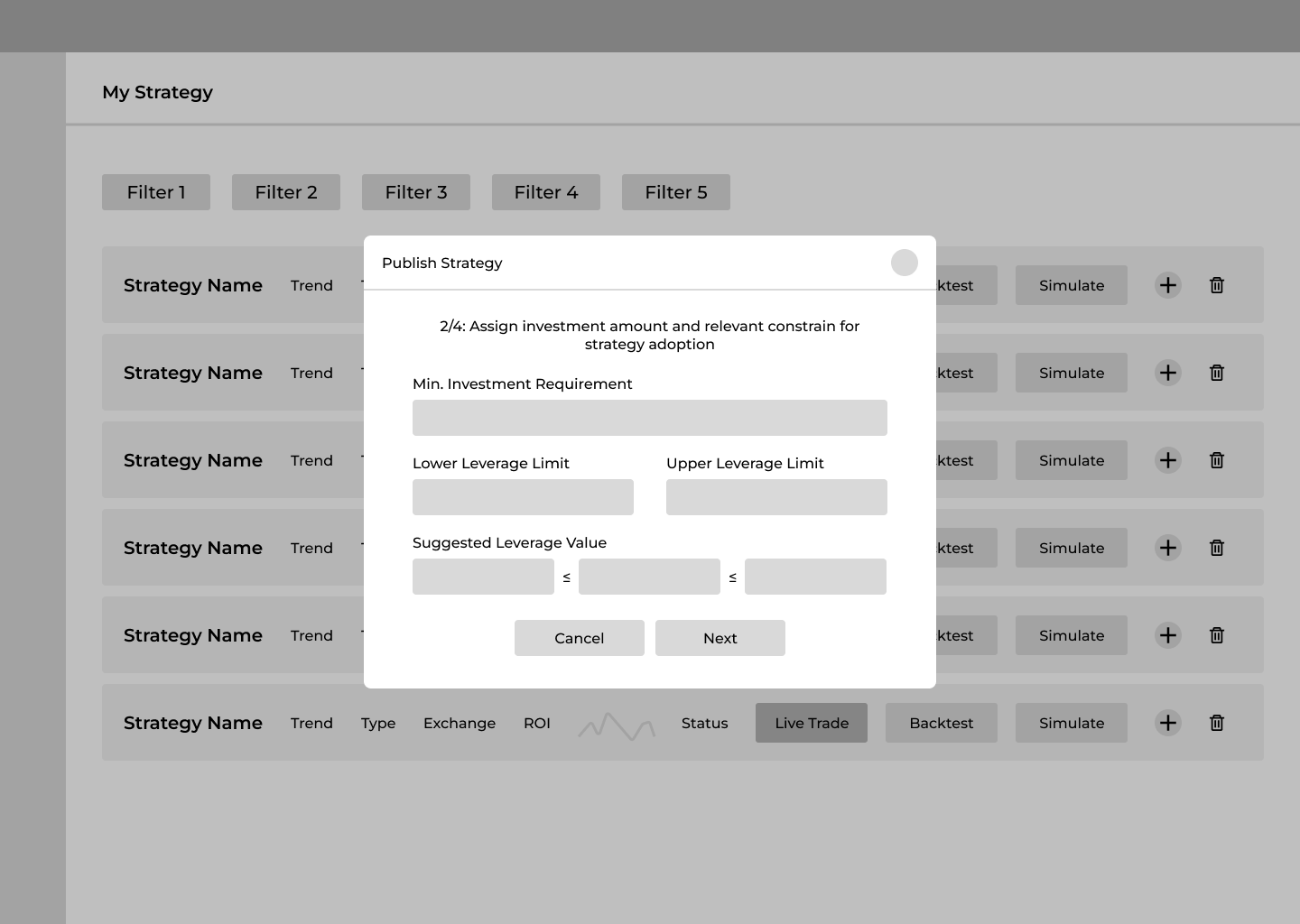

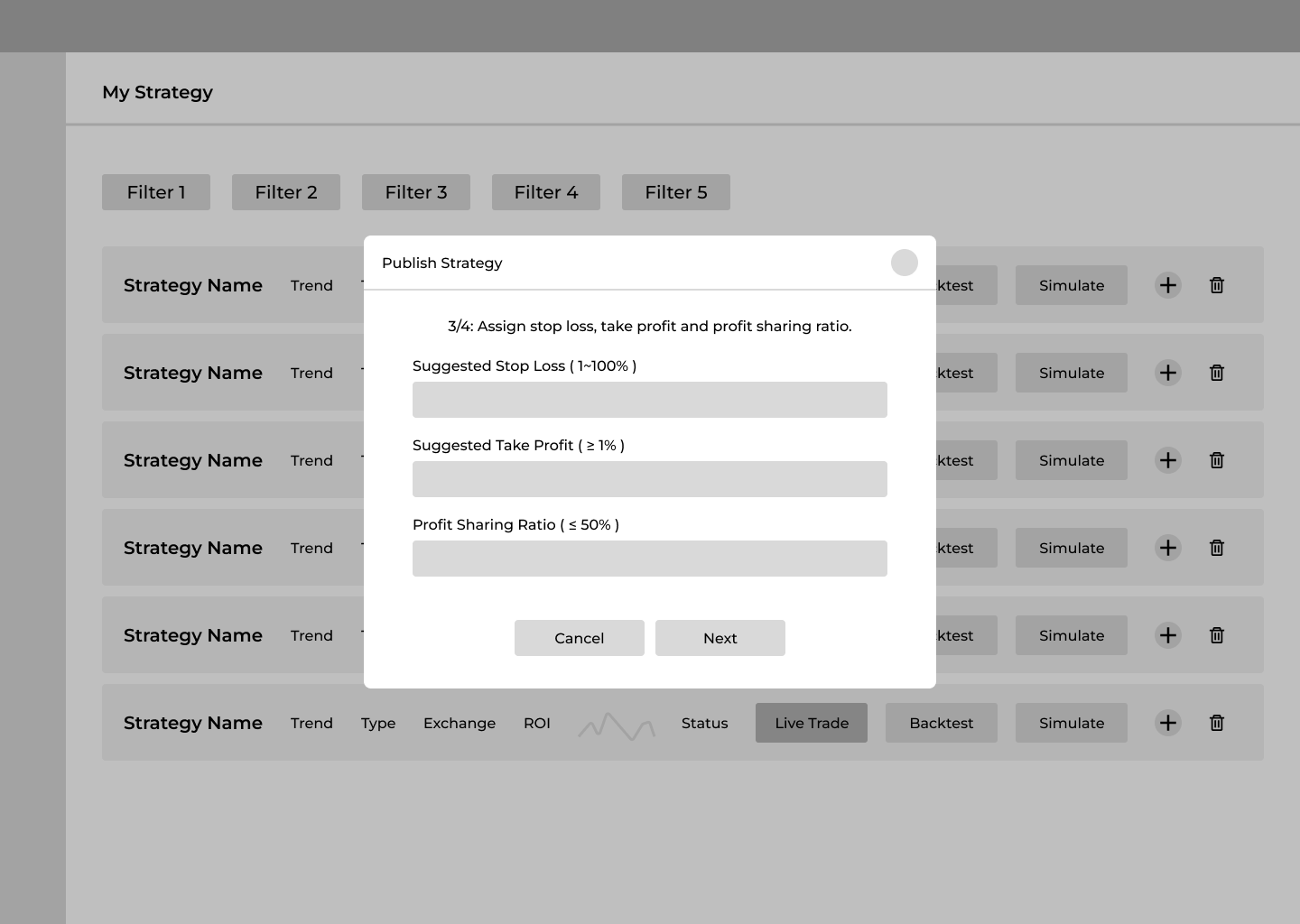

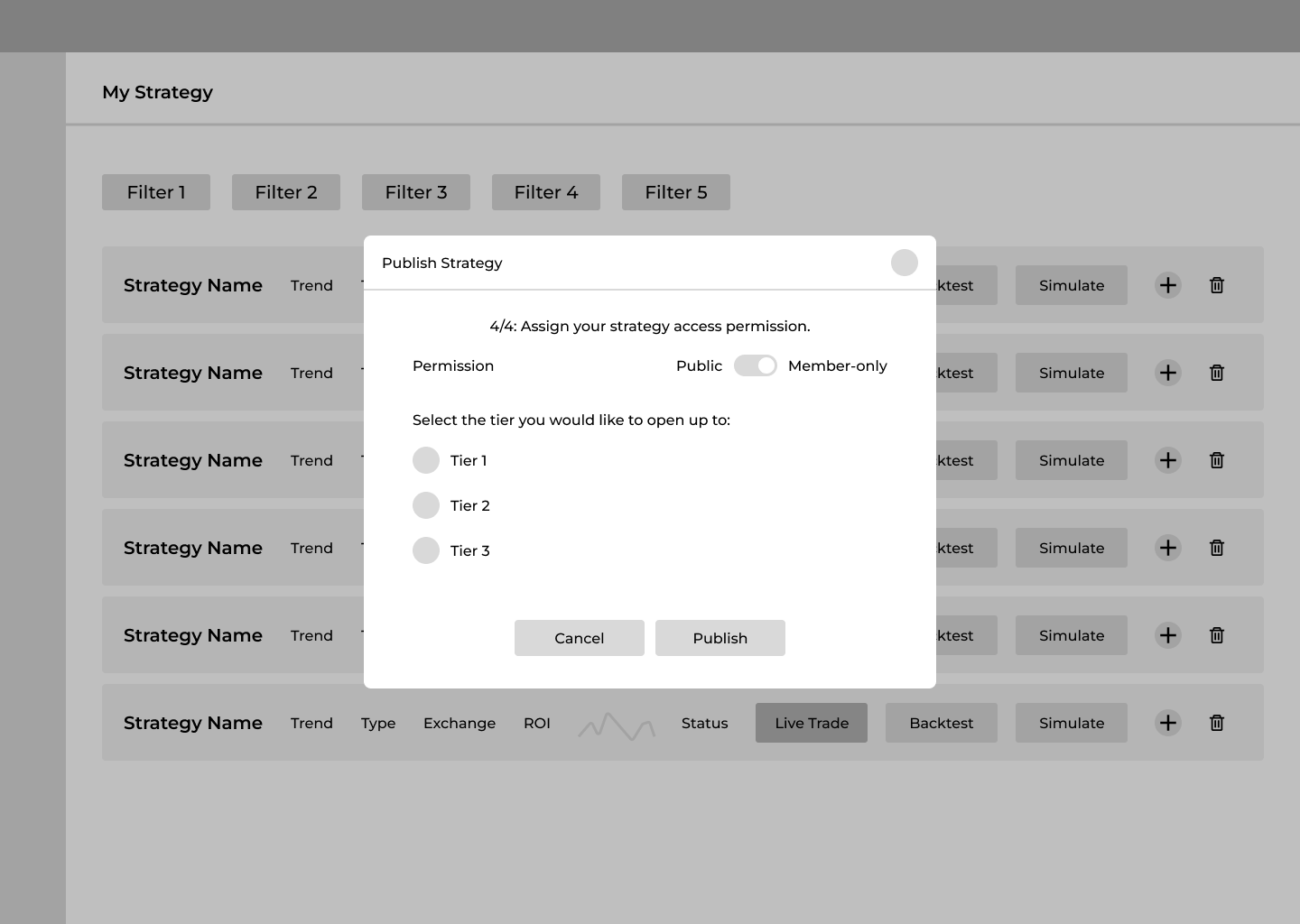

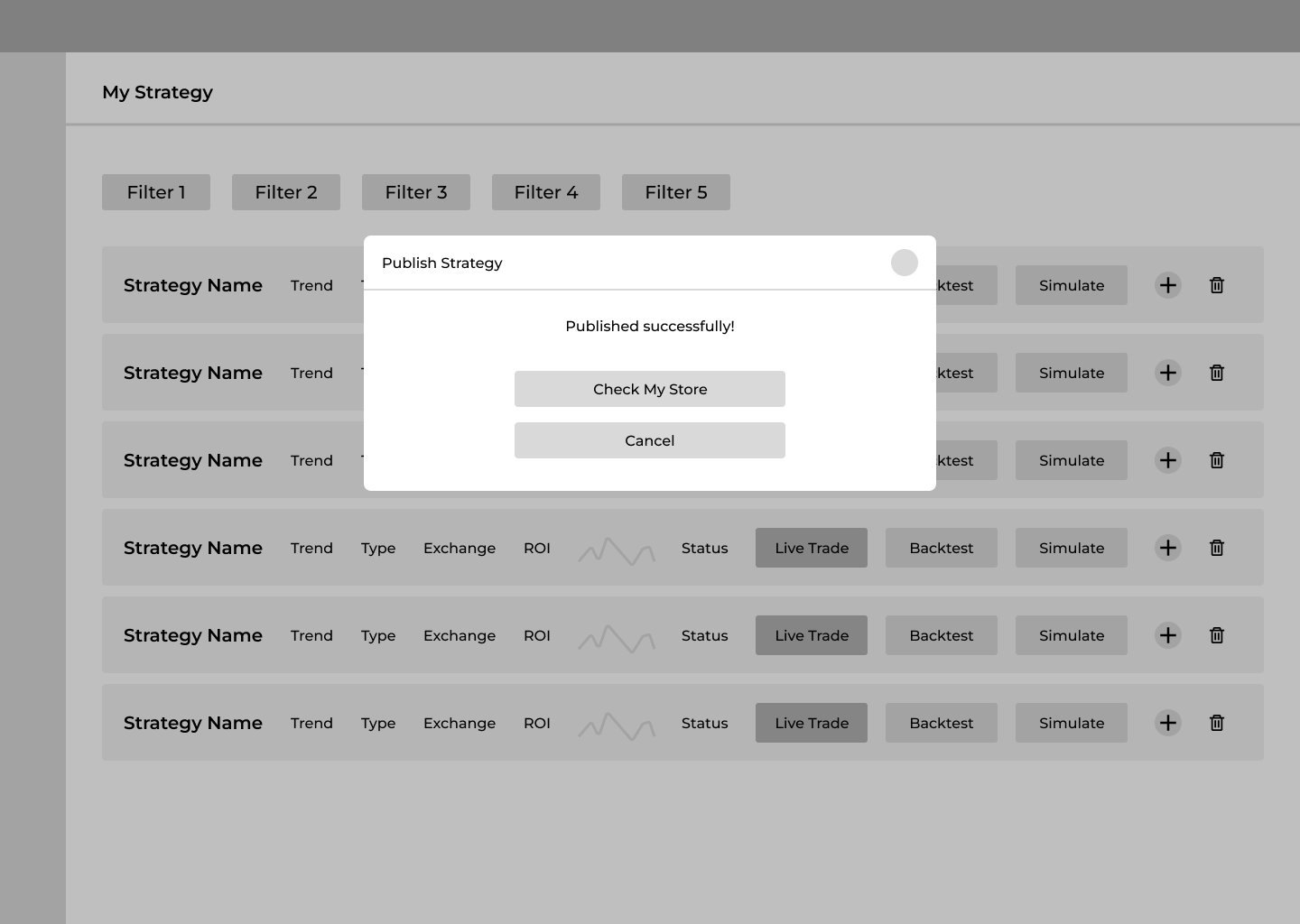

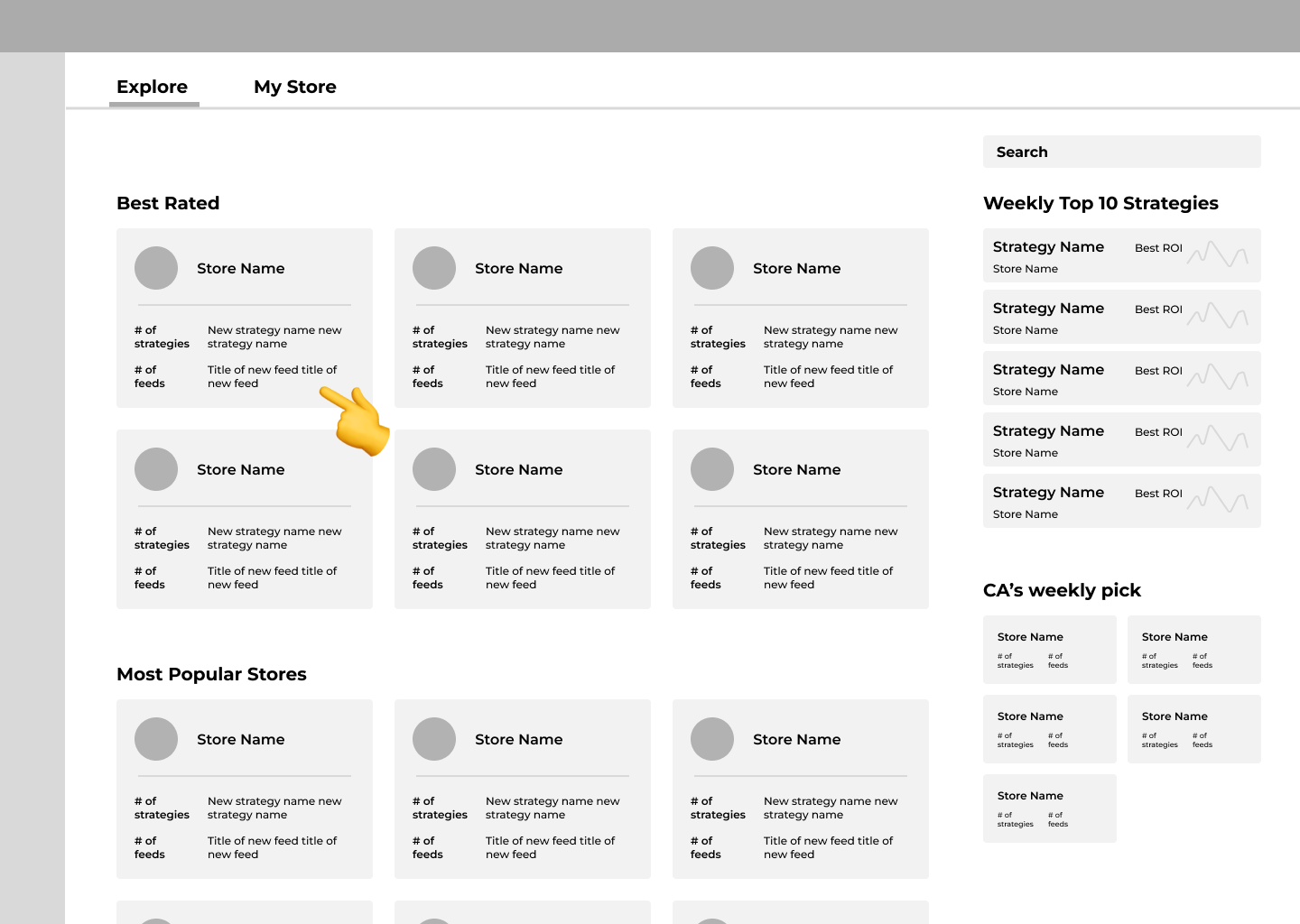

User Flow 1

Lead traders publish a strategy to their store.

In the original flow, when users wanted to publish a strategy to the store, they had to first navigate to a separate page that listed all of their strategies and then select the one they wanted to publish.

1/7: Select "Add New Strategy" button

2/7: Select "Add" to publish the strategy

3/7: Fill in the strategy basic settings

4/7: Fill in the investment-related settings

5/7: Fill in the profit-related settings

6/7: Set up the strategy access permission

7/7: Publish successfully!

During user testing, we found that the process of navigating to separate page disrupted the user experience, and the page switch caused unnecessary confusion.

So I redesigned the flow to allow users to complete the entire process directly on the store page.

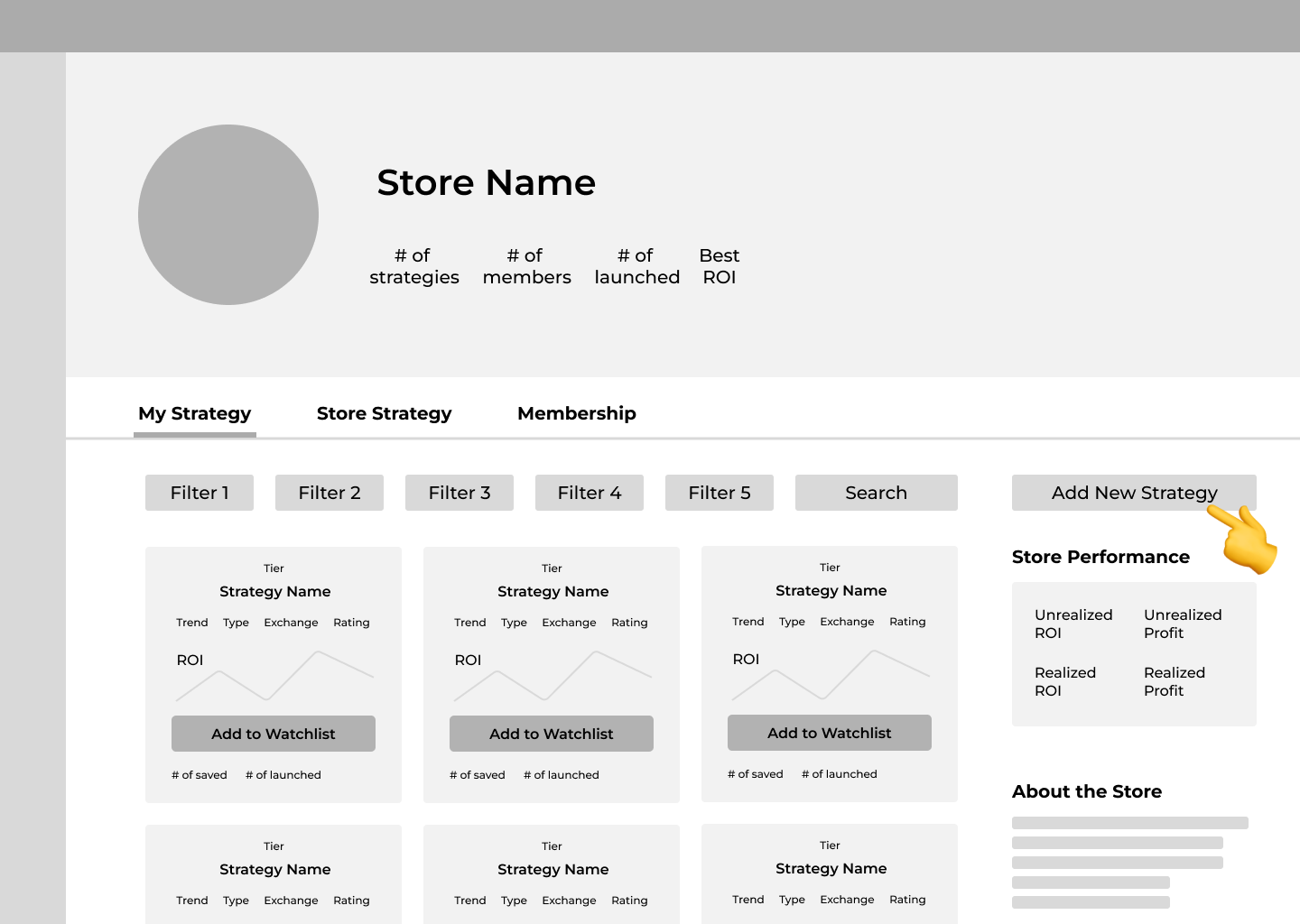

User Flow 2

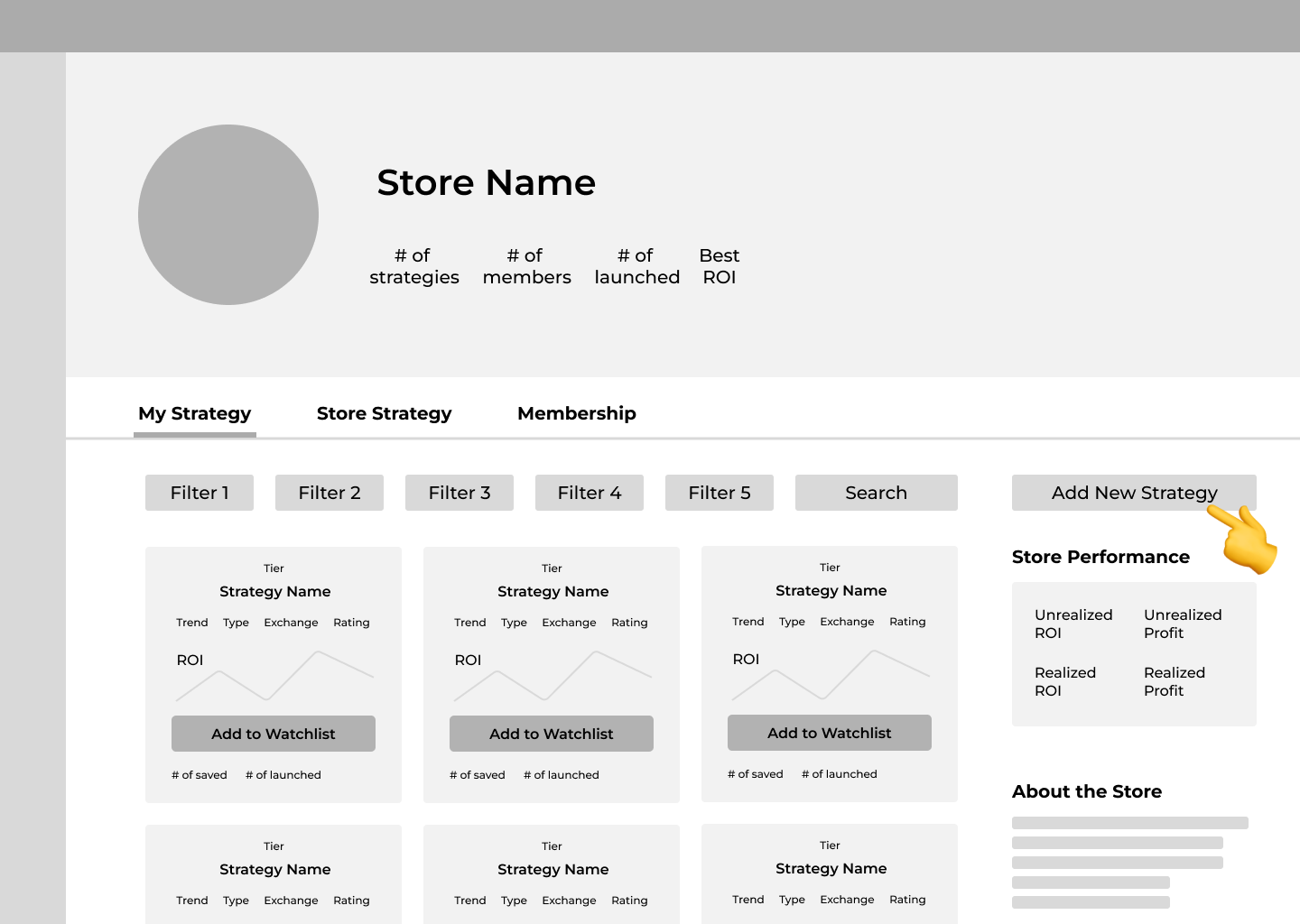

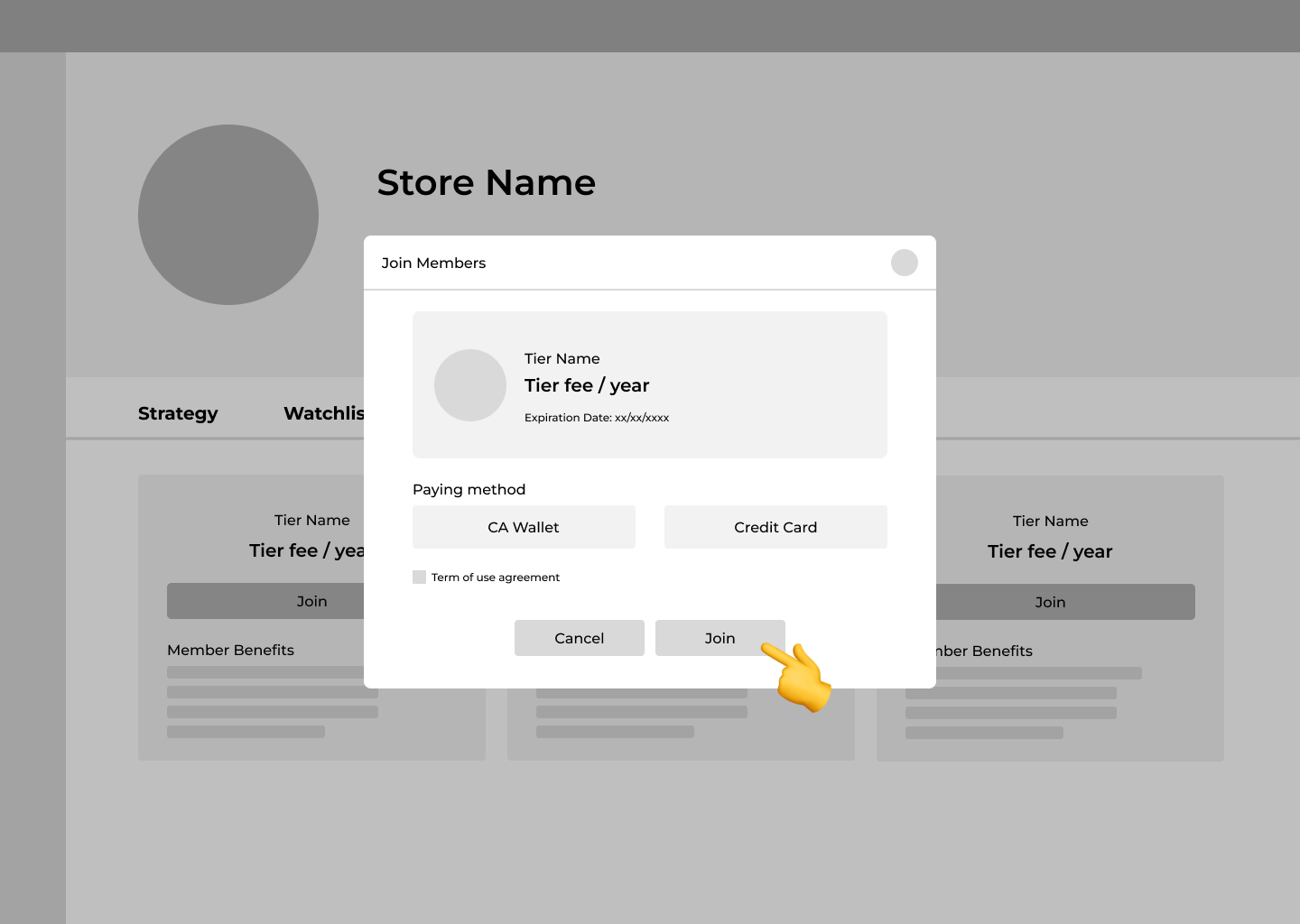

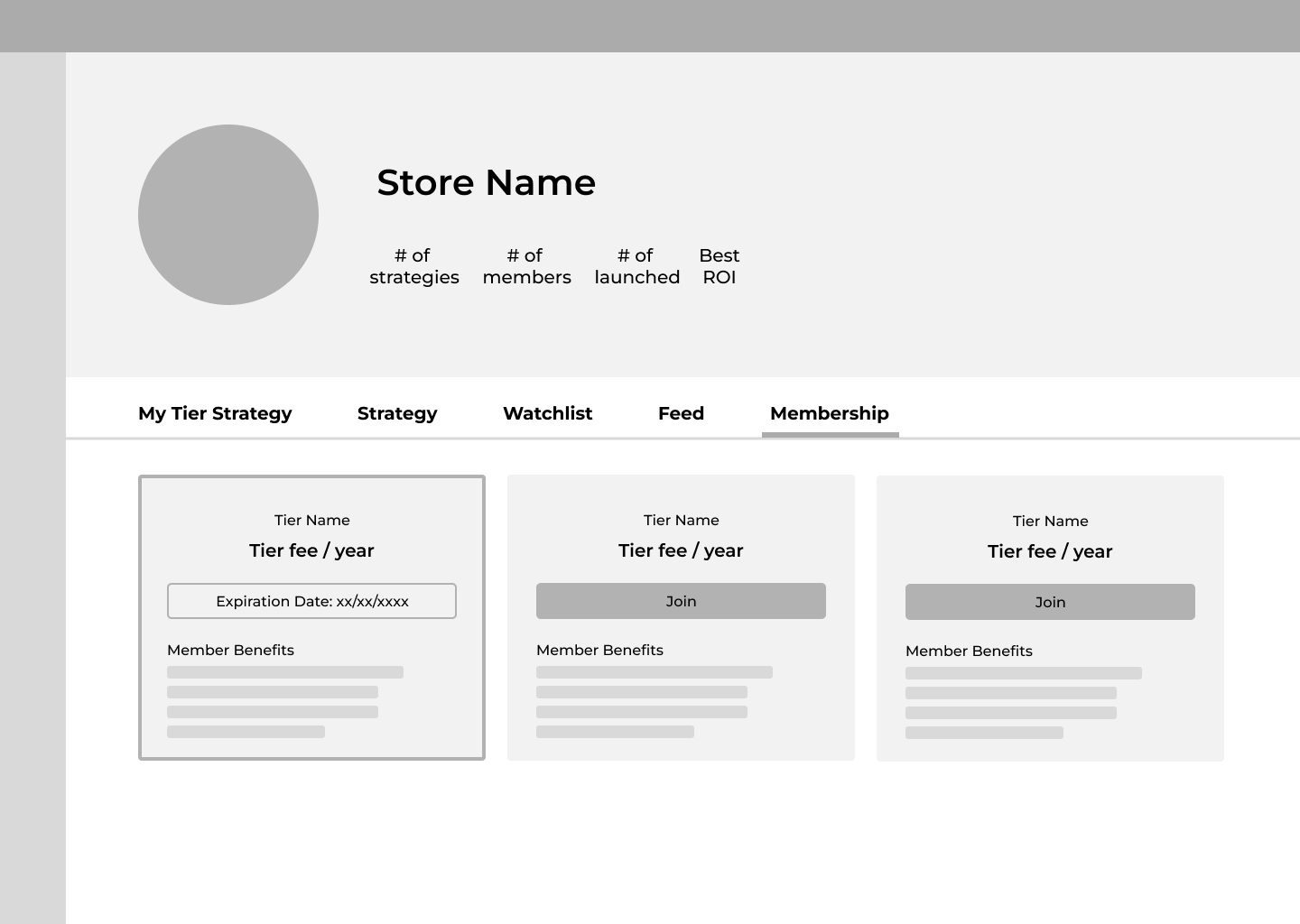

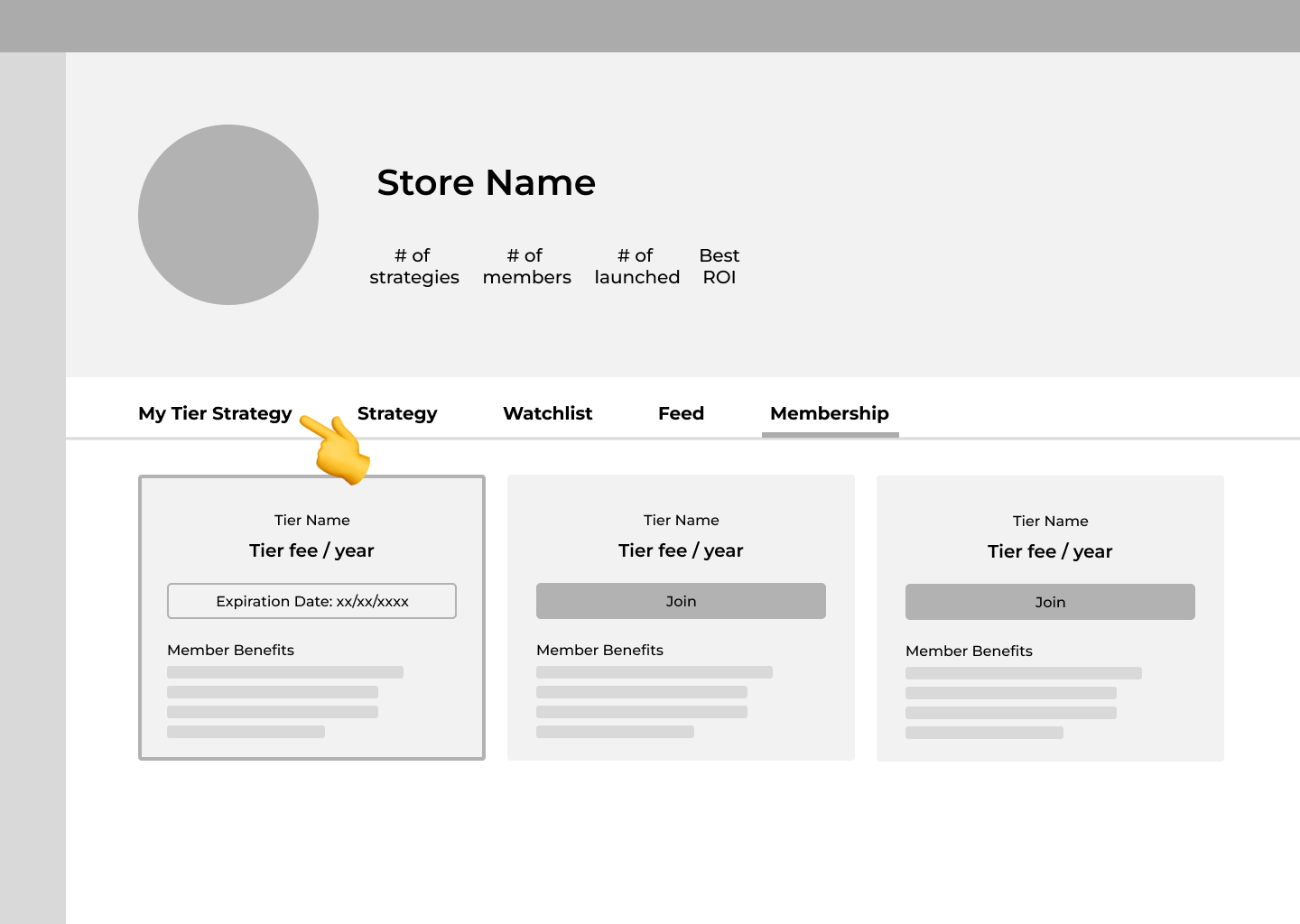

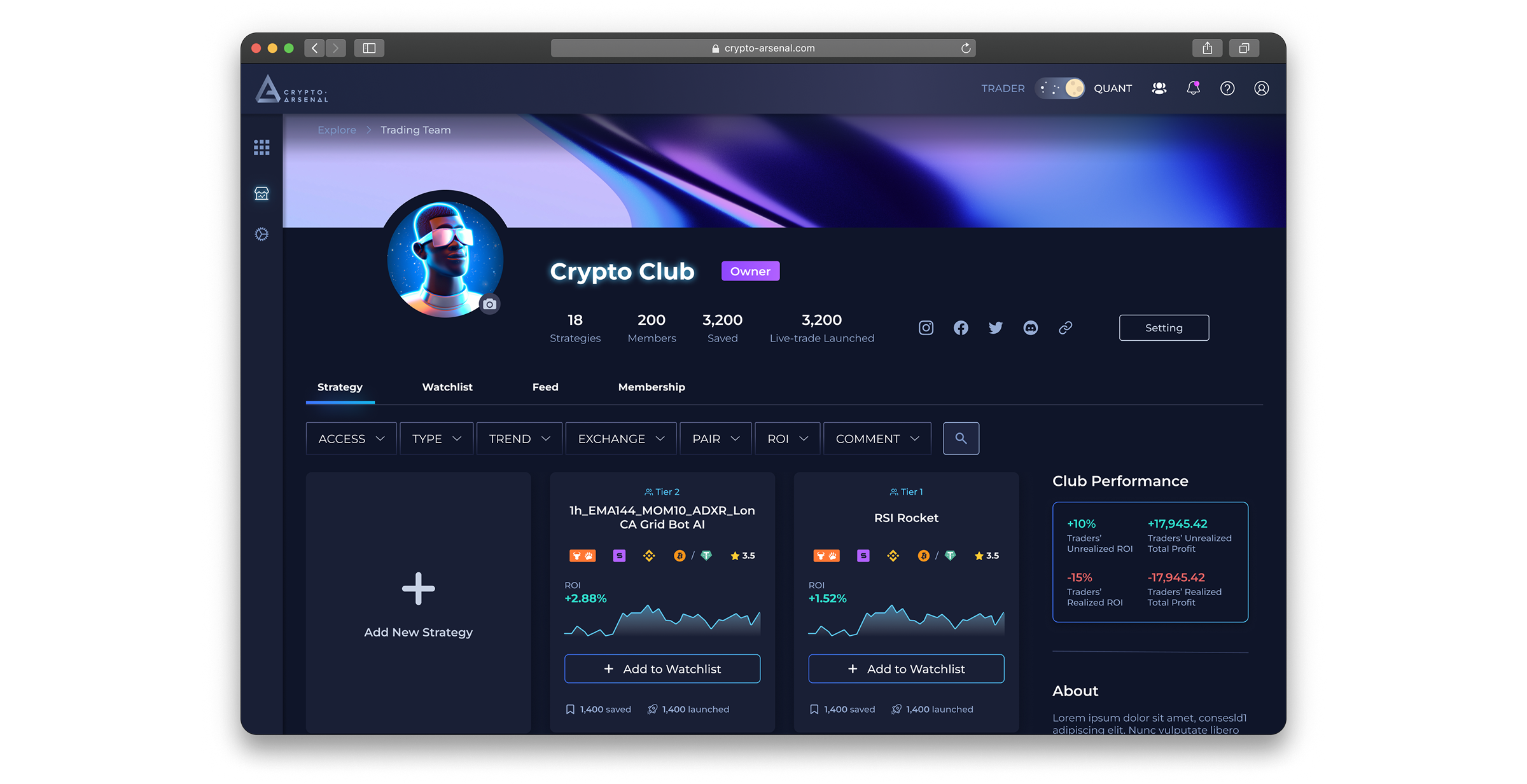

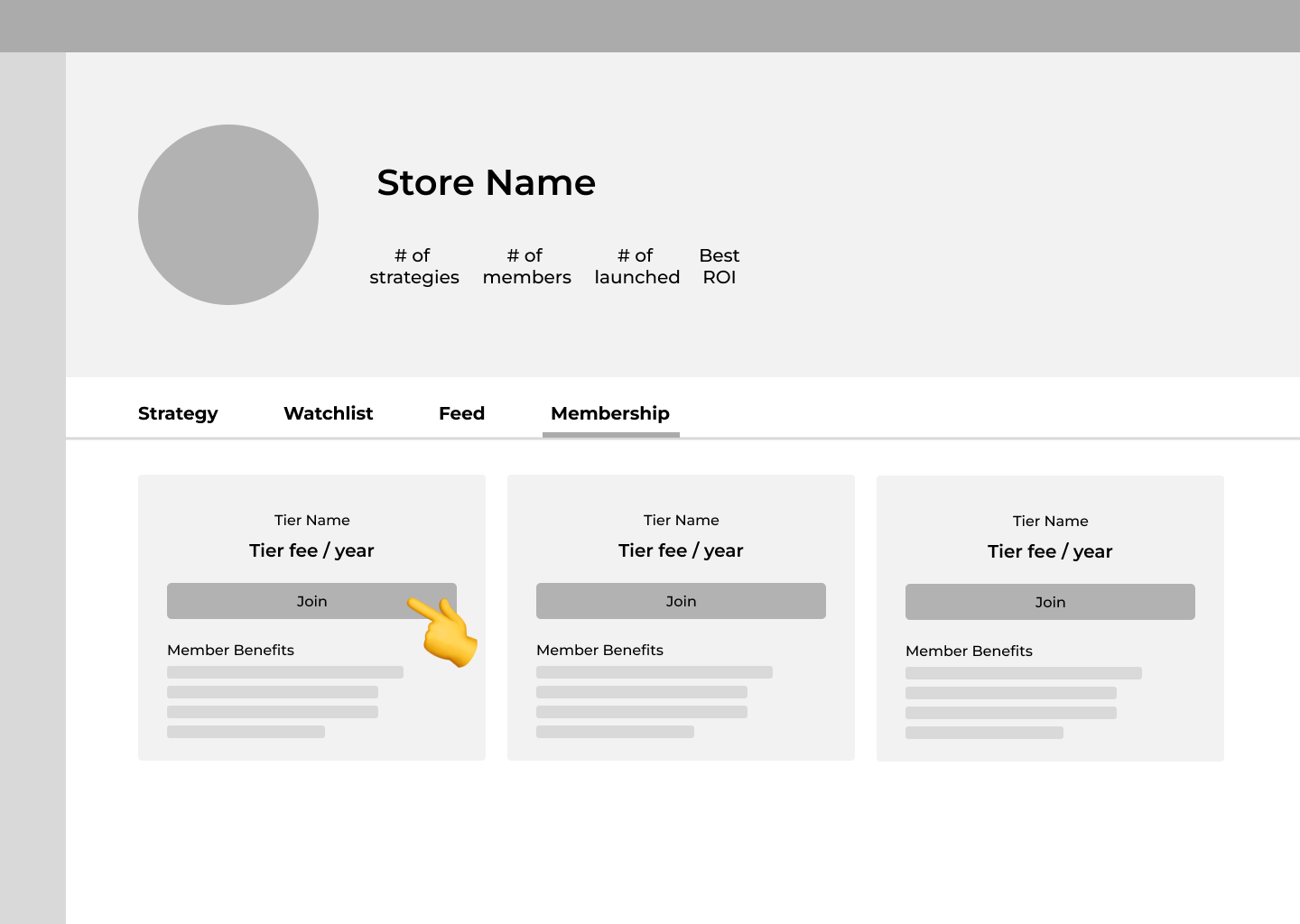

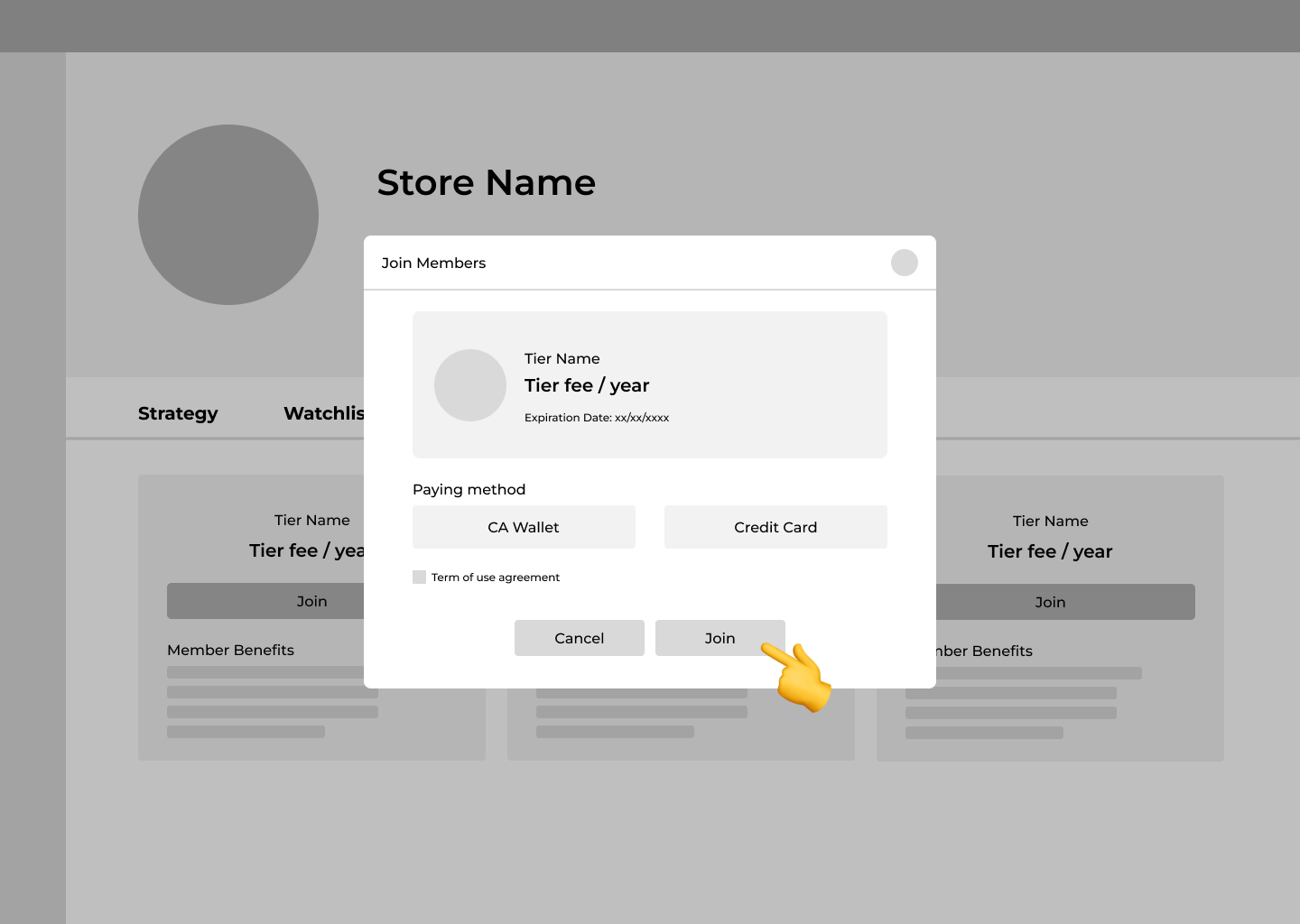

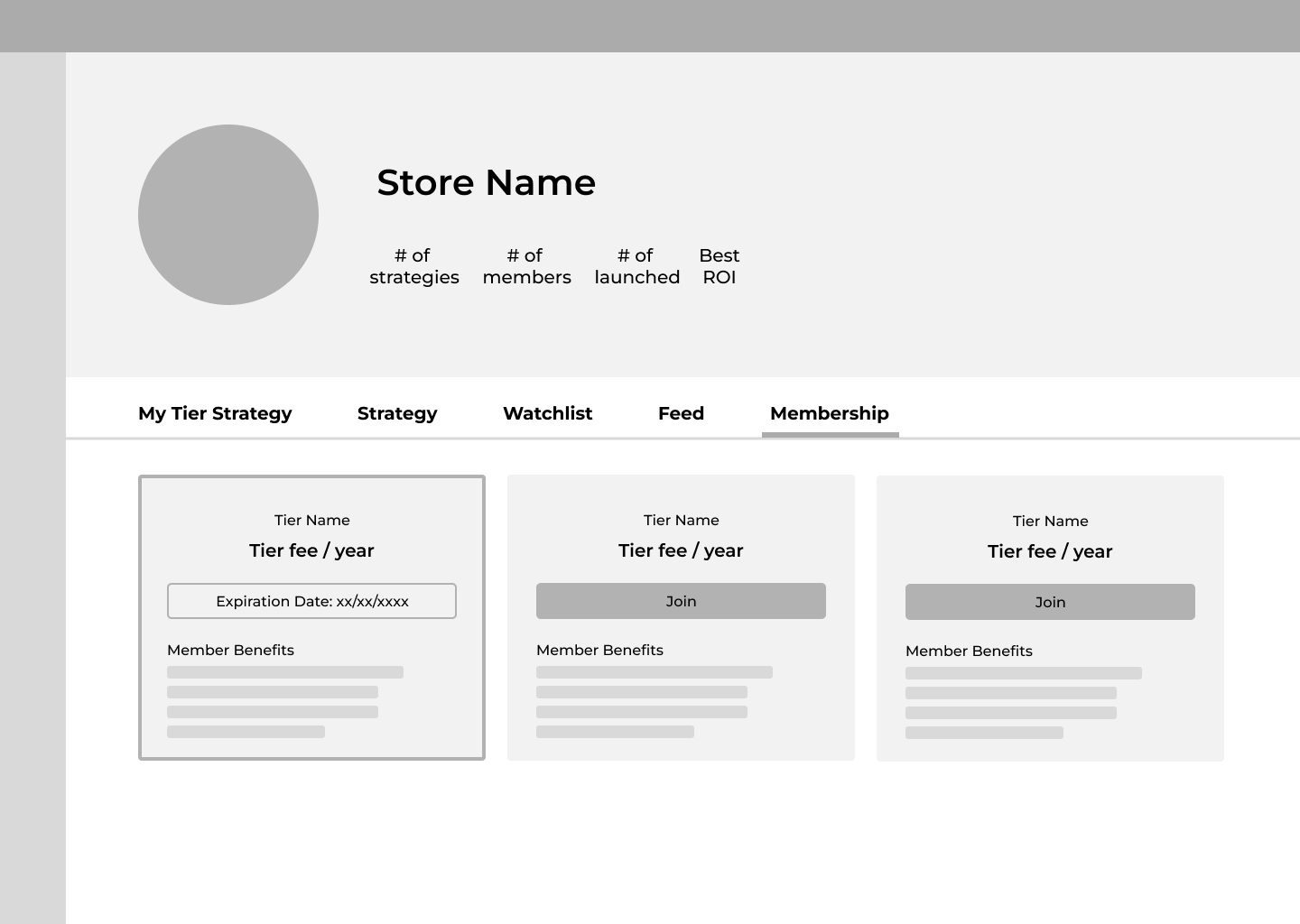

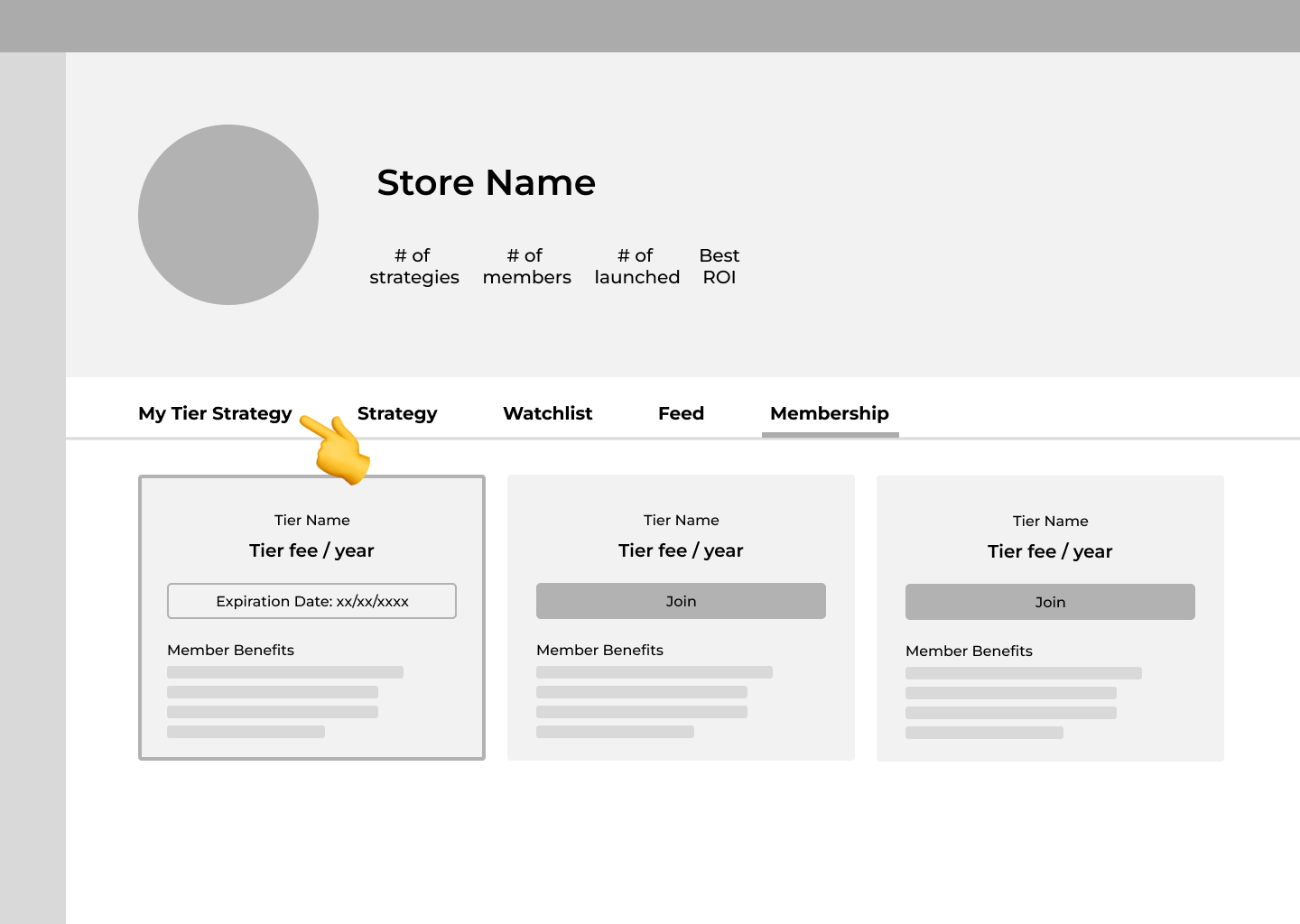

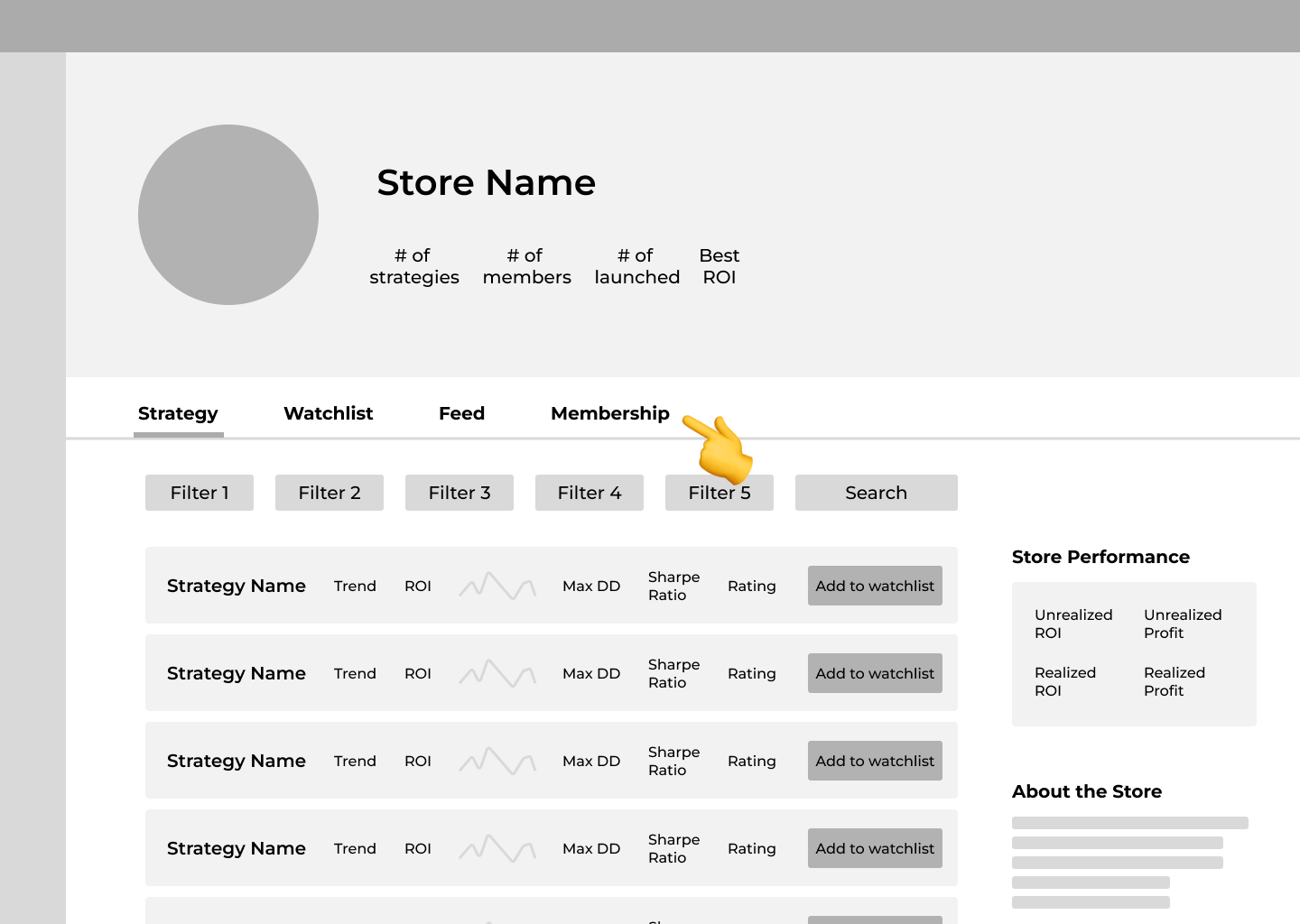

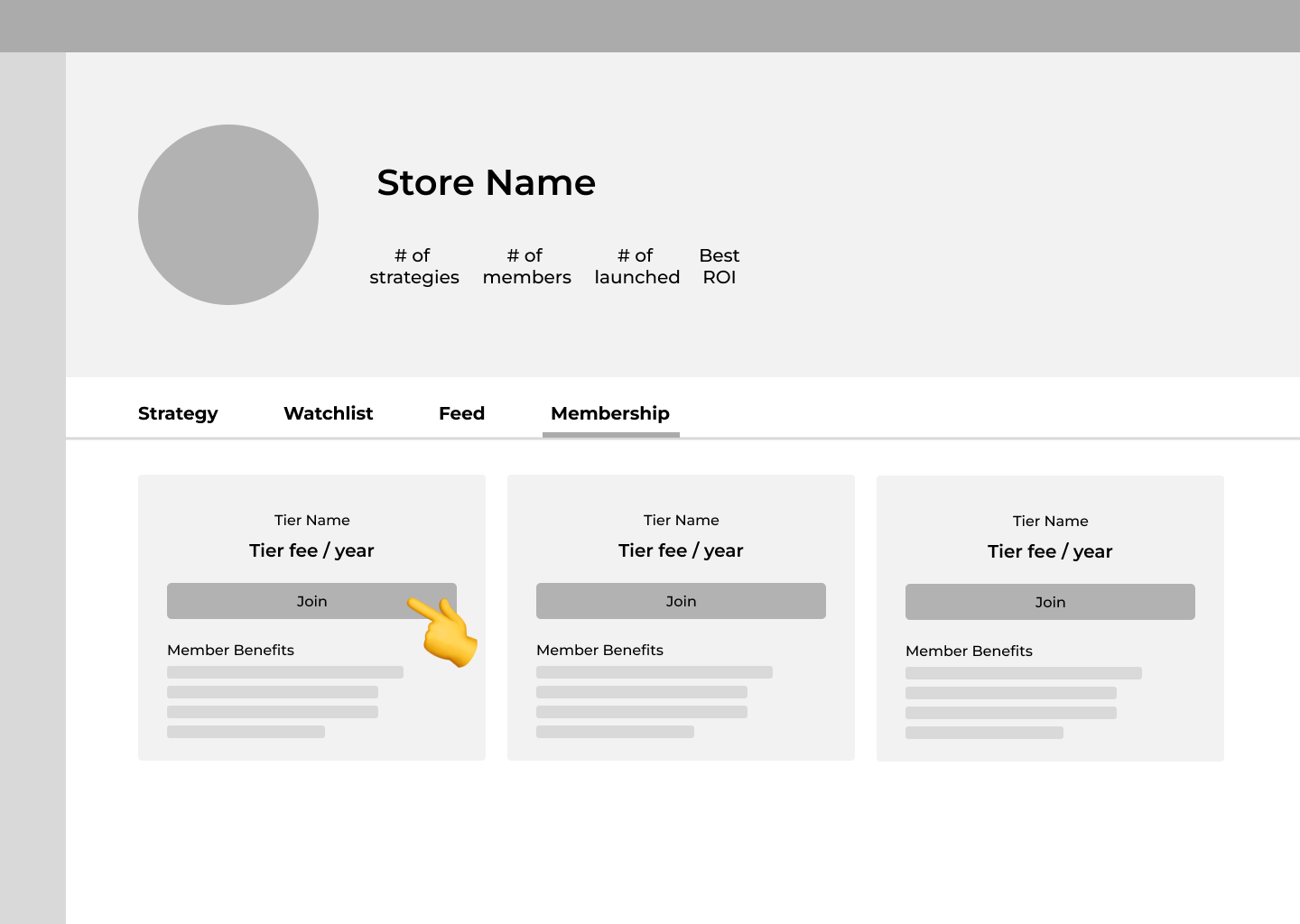

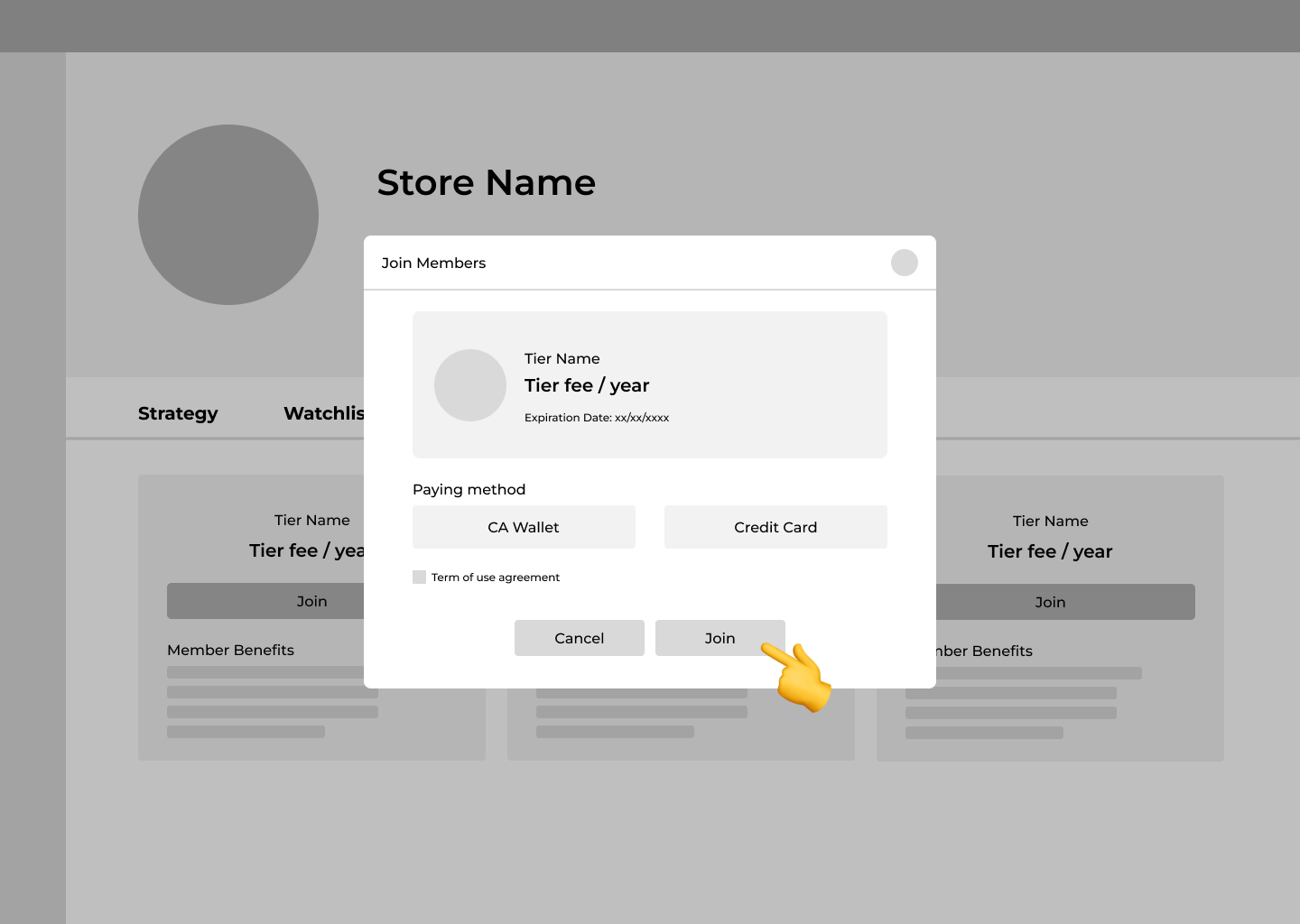

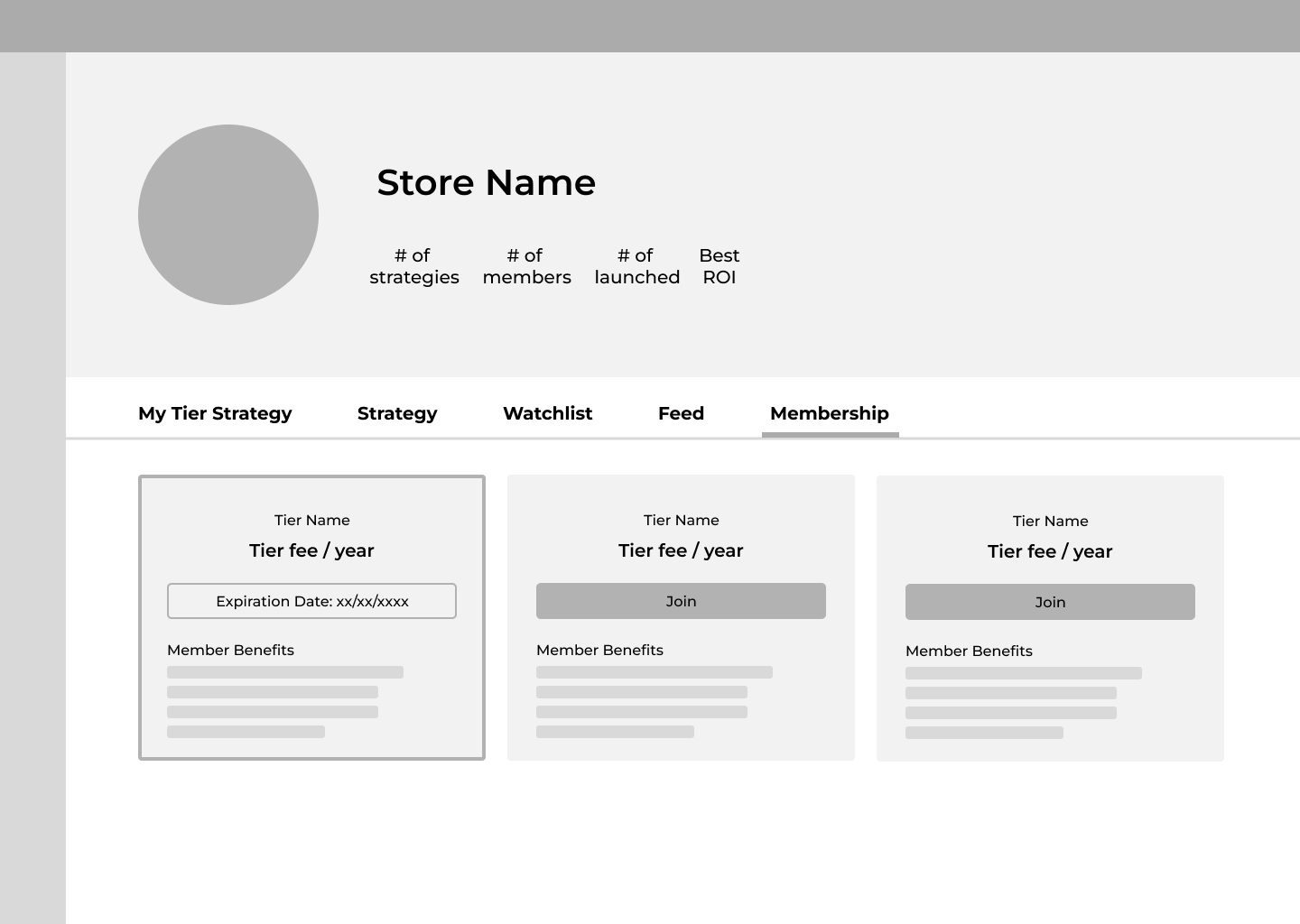

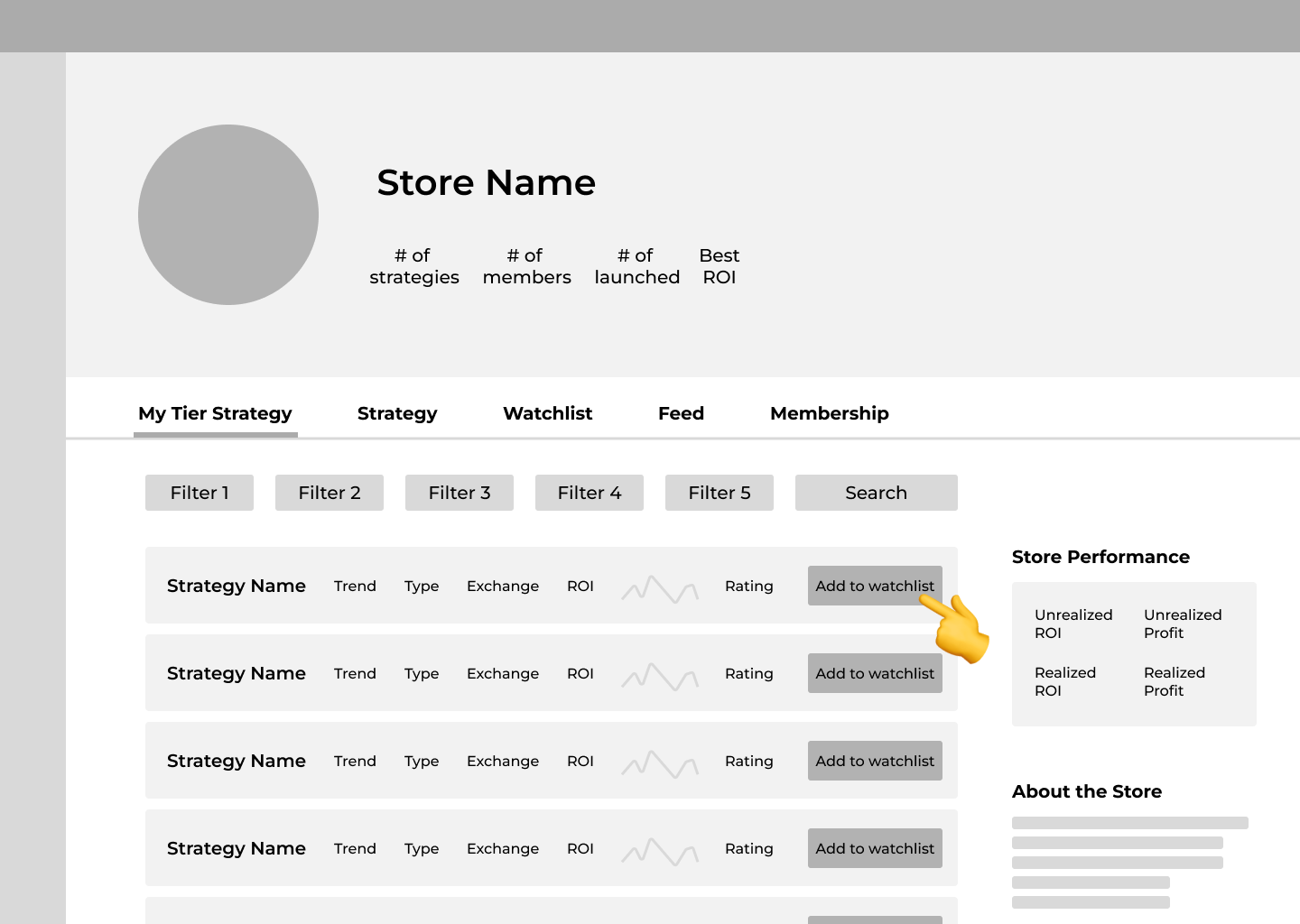

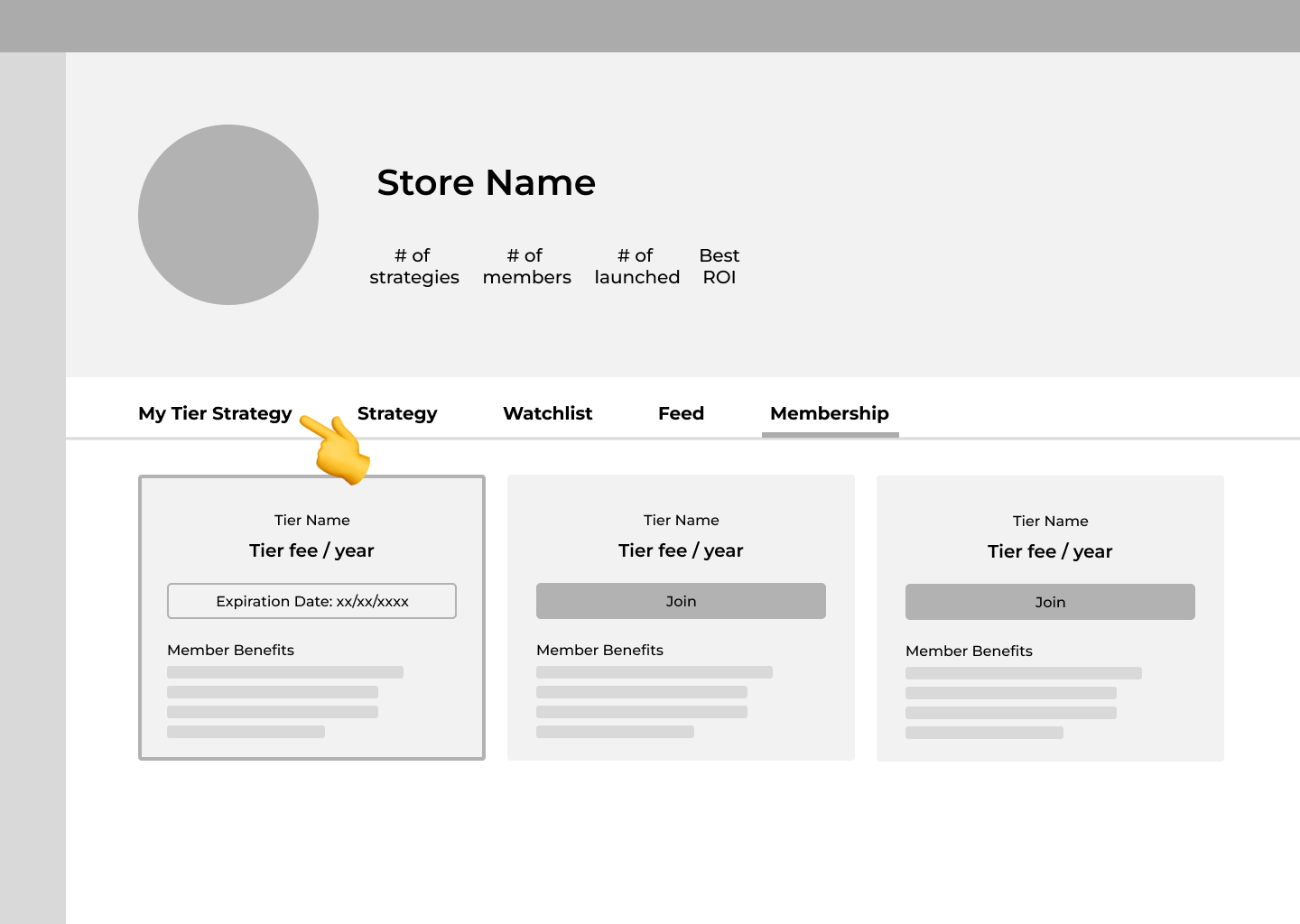

Traders select a lead trader’s store and join the membership.

1/5: Select a store

2/5: Navigate to "Membership" page

3/5: Select a membership tier

4/5: Confirm & Join membership

5/5: Join successfully

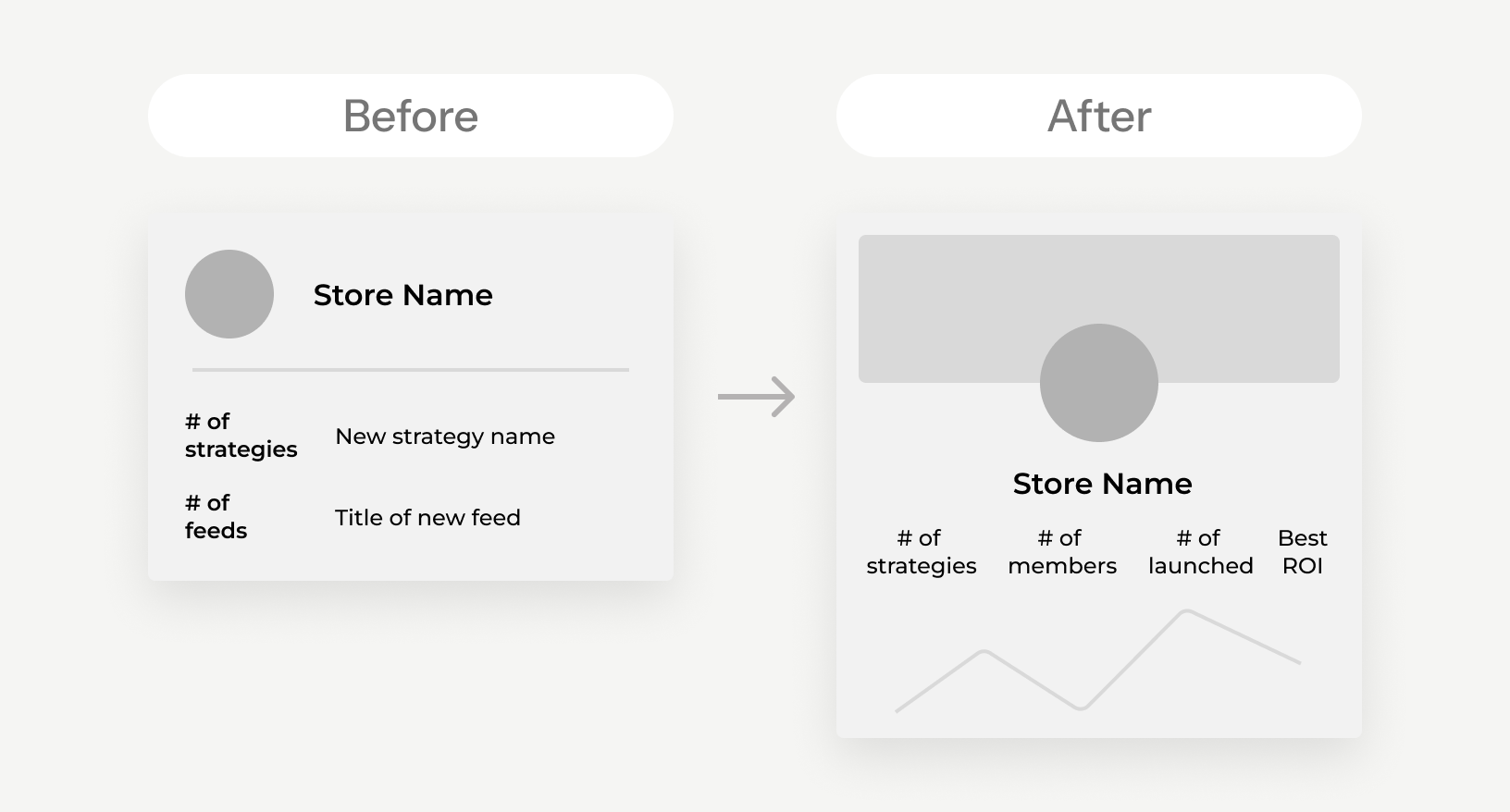

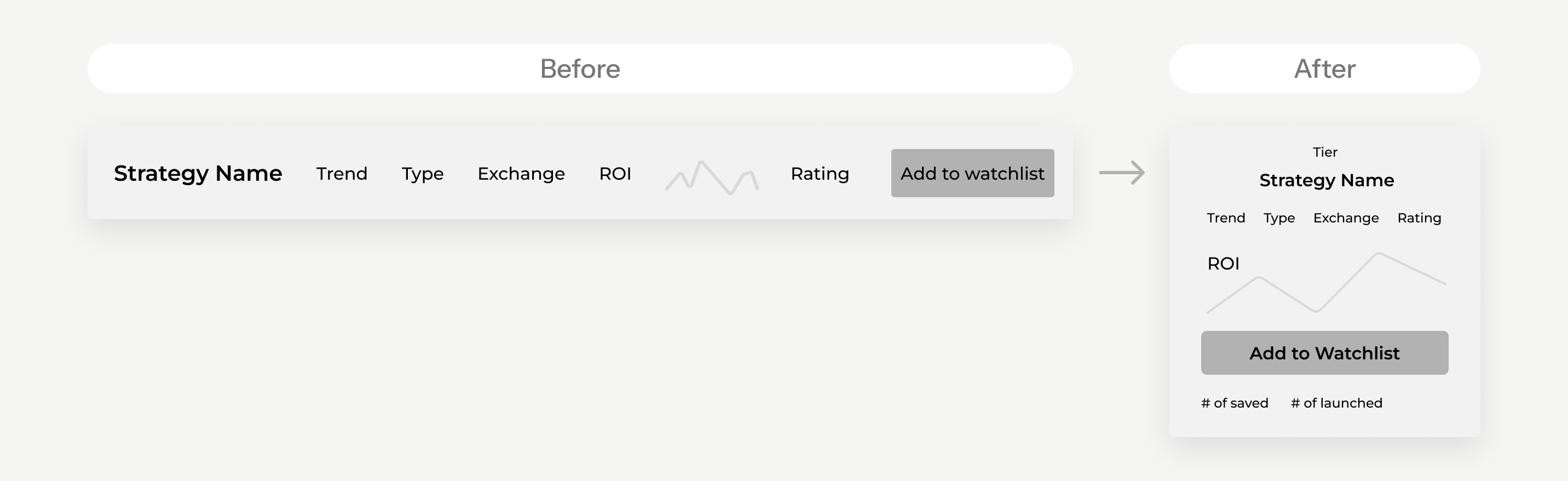

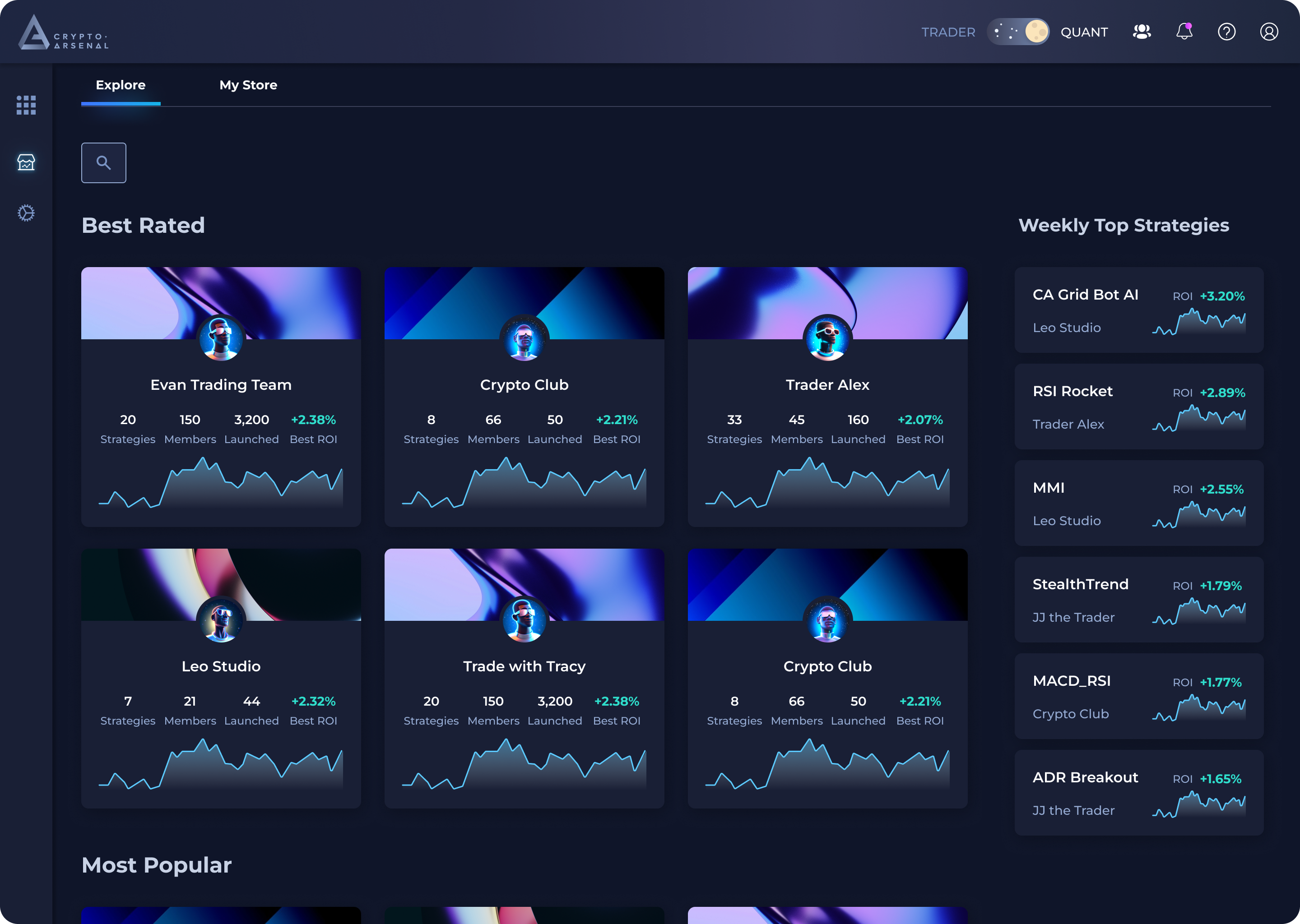

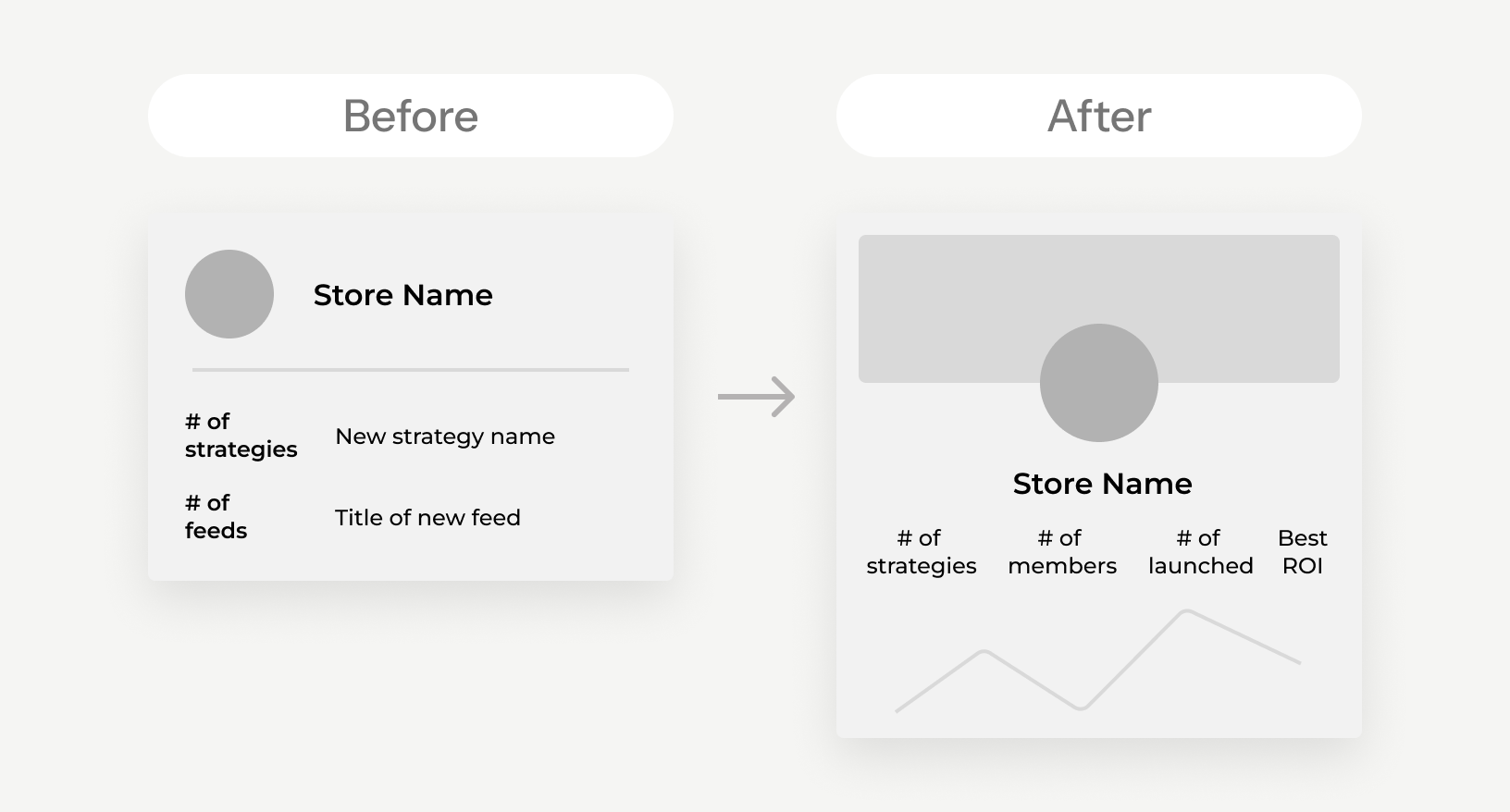

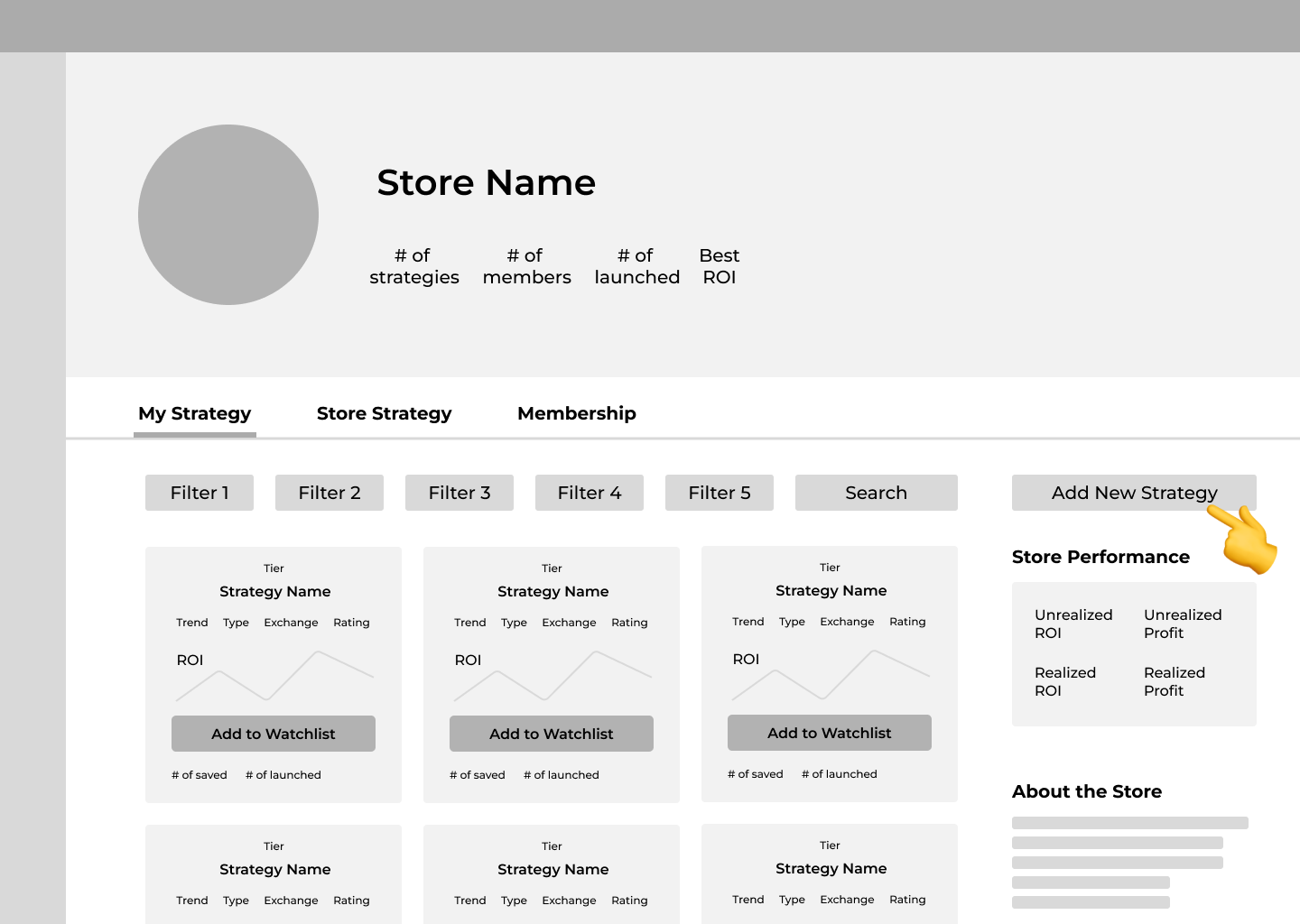

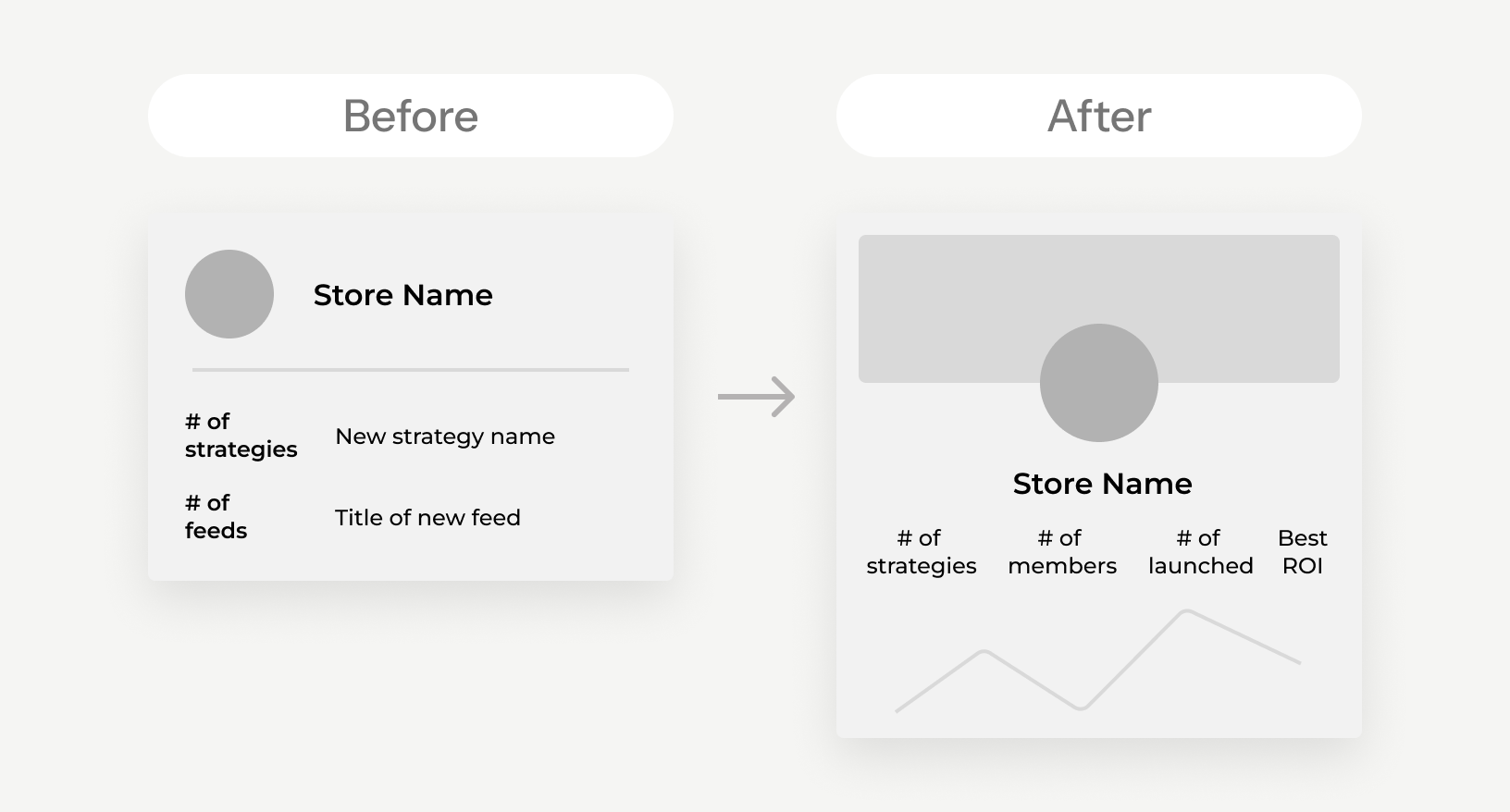

Based on feedback from internal design reviews, I refined the store card layout to highlight key performance metrics.

I prioritized data-driven information for clearer store performance, making better use of limited card space.

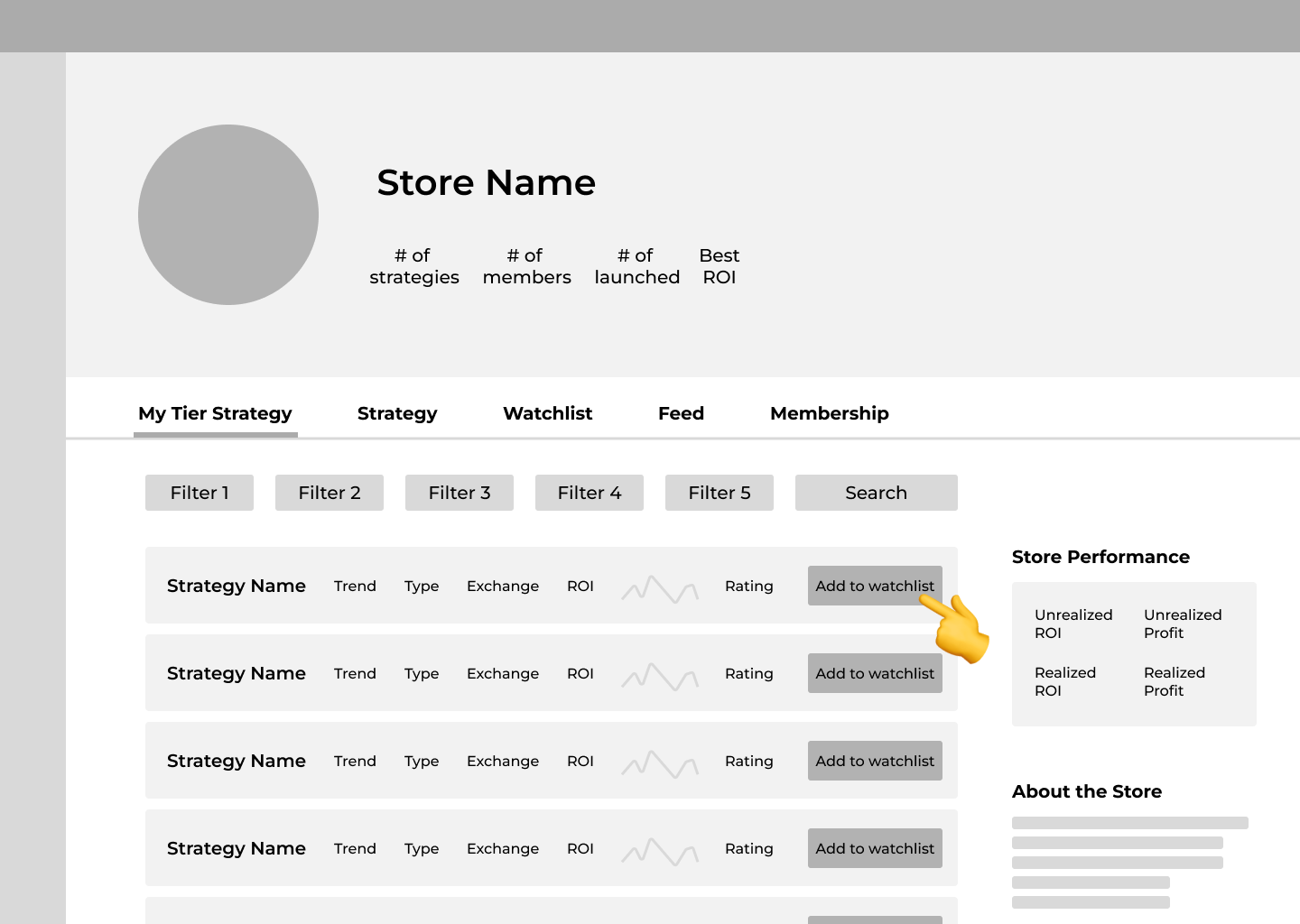

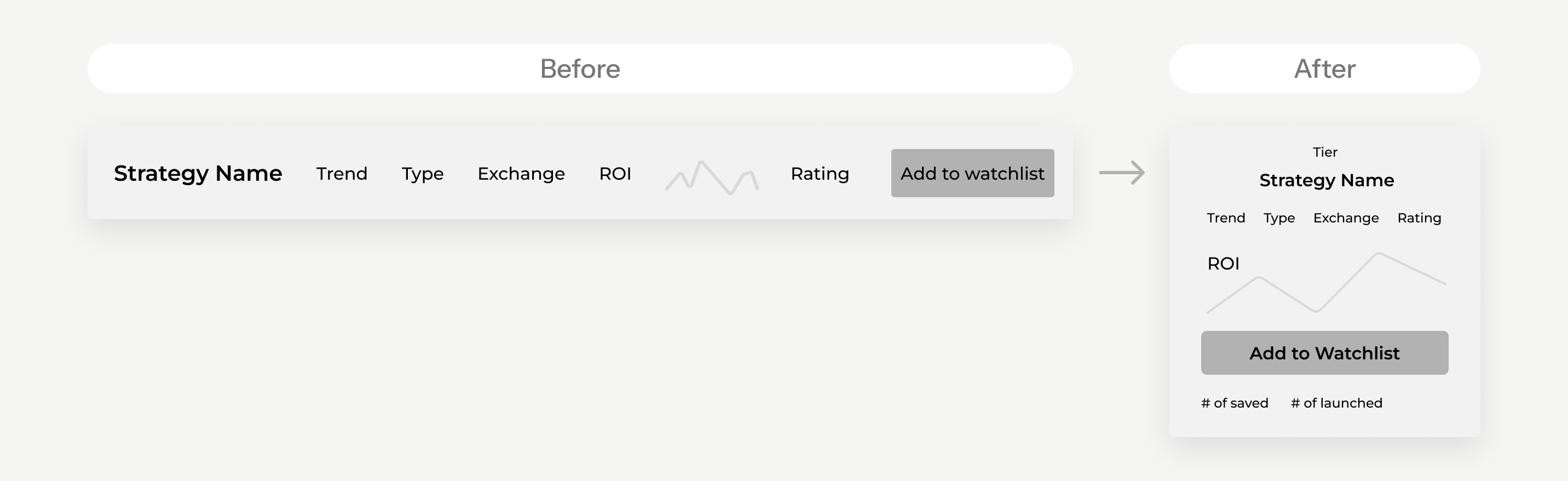

User Flow 3

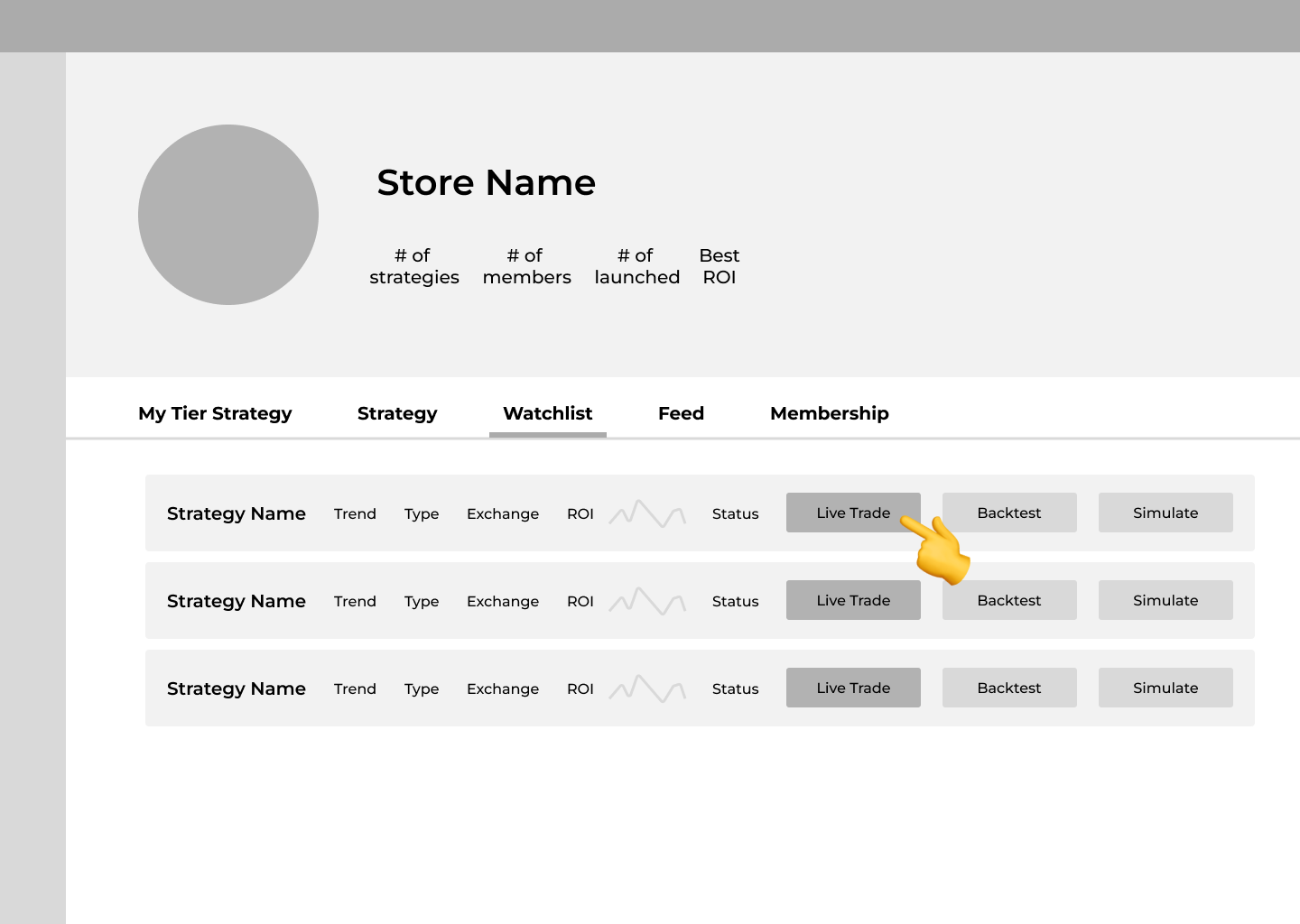

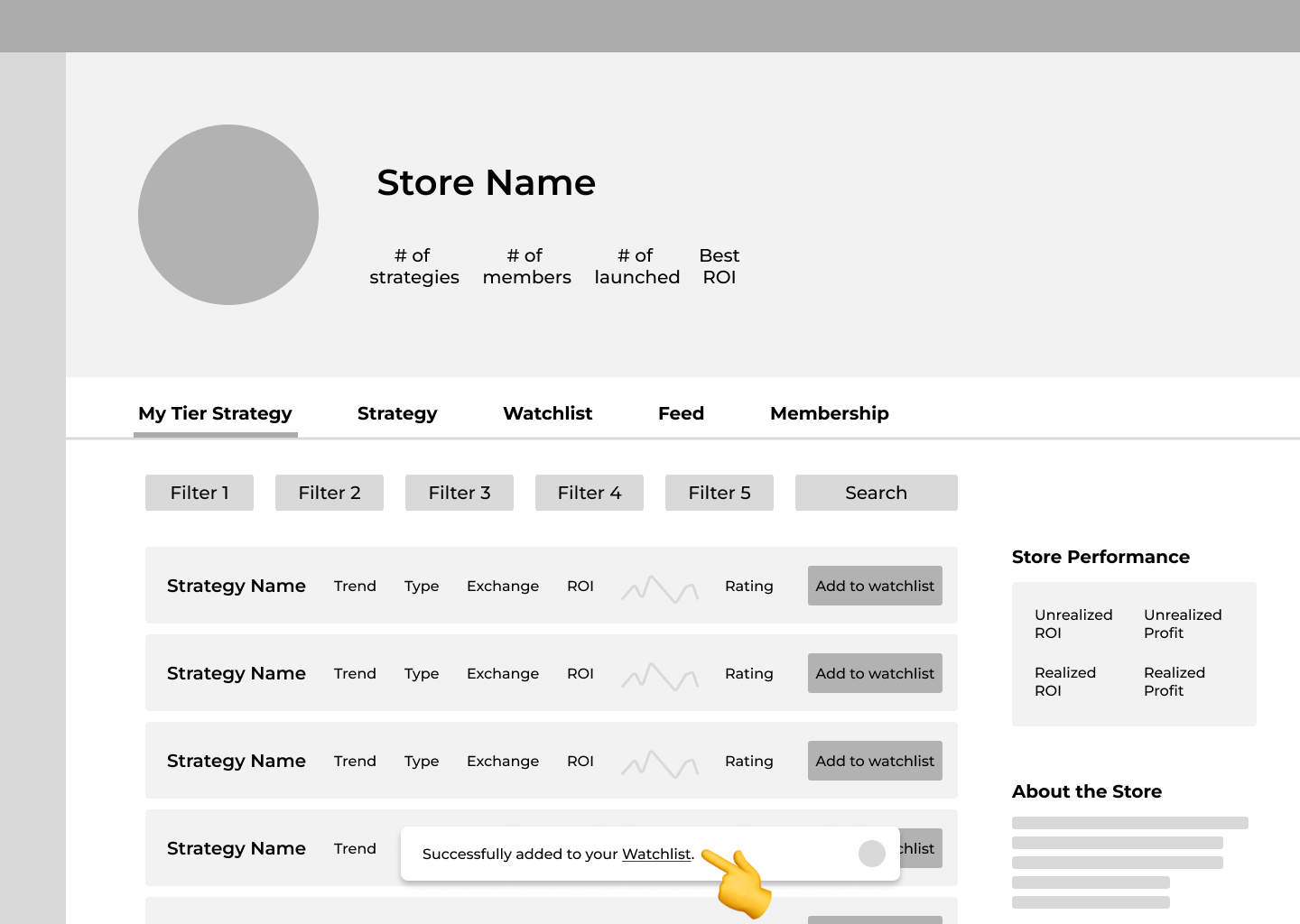

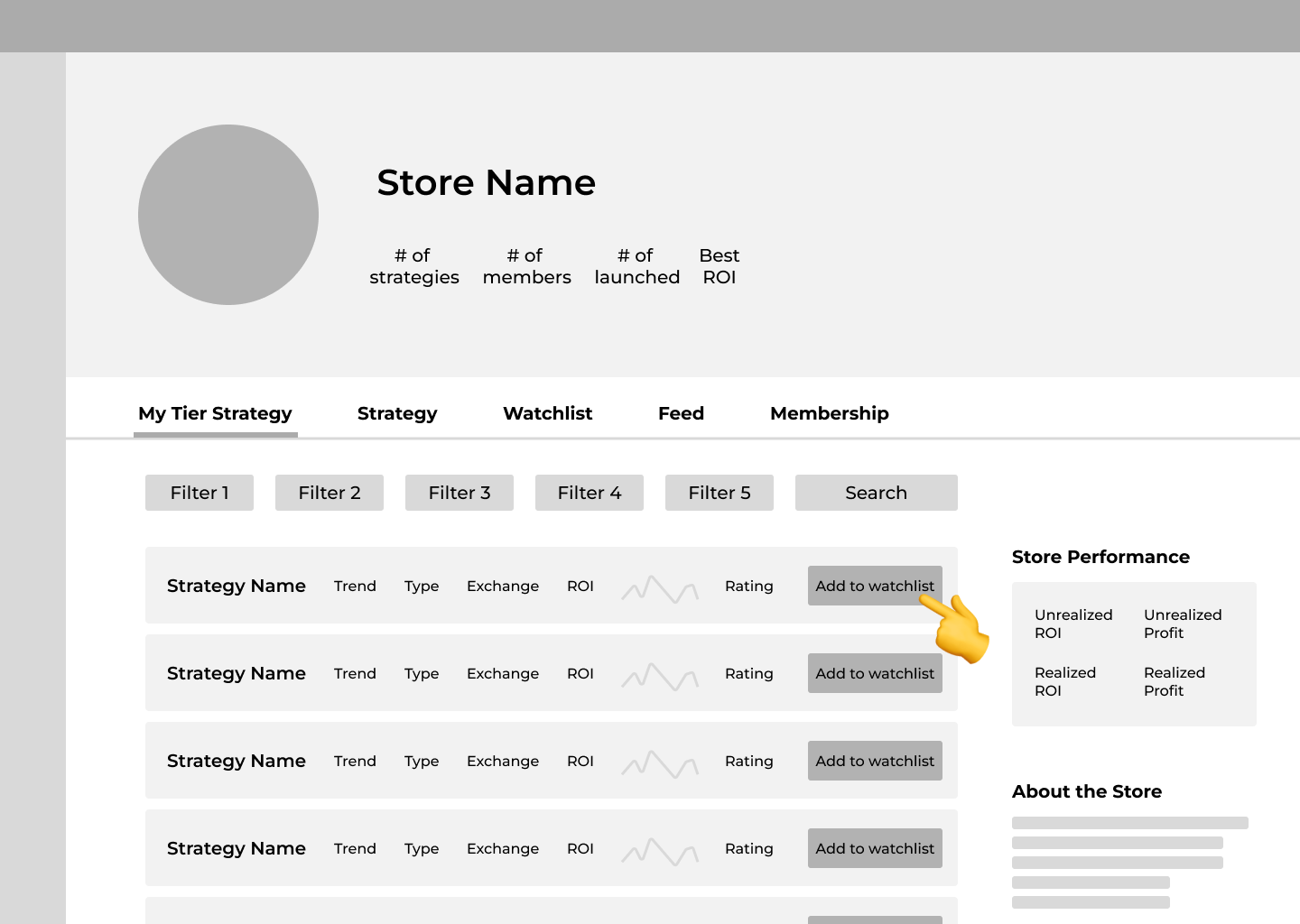

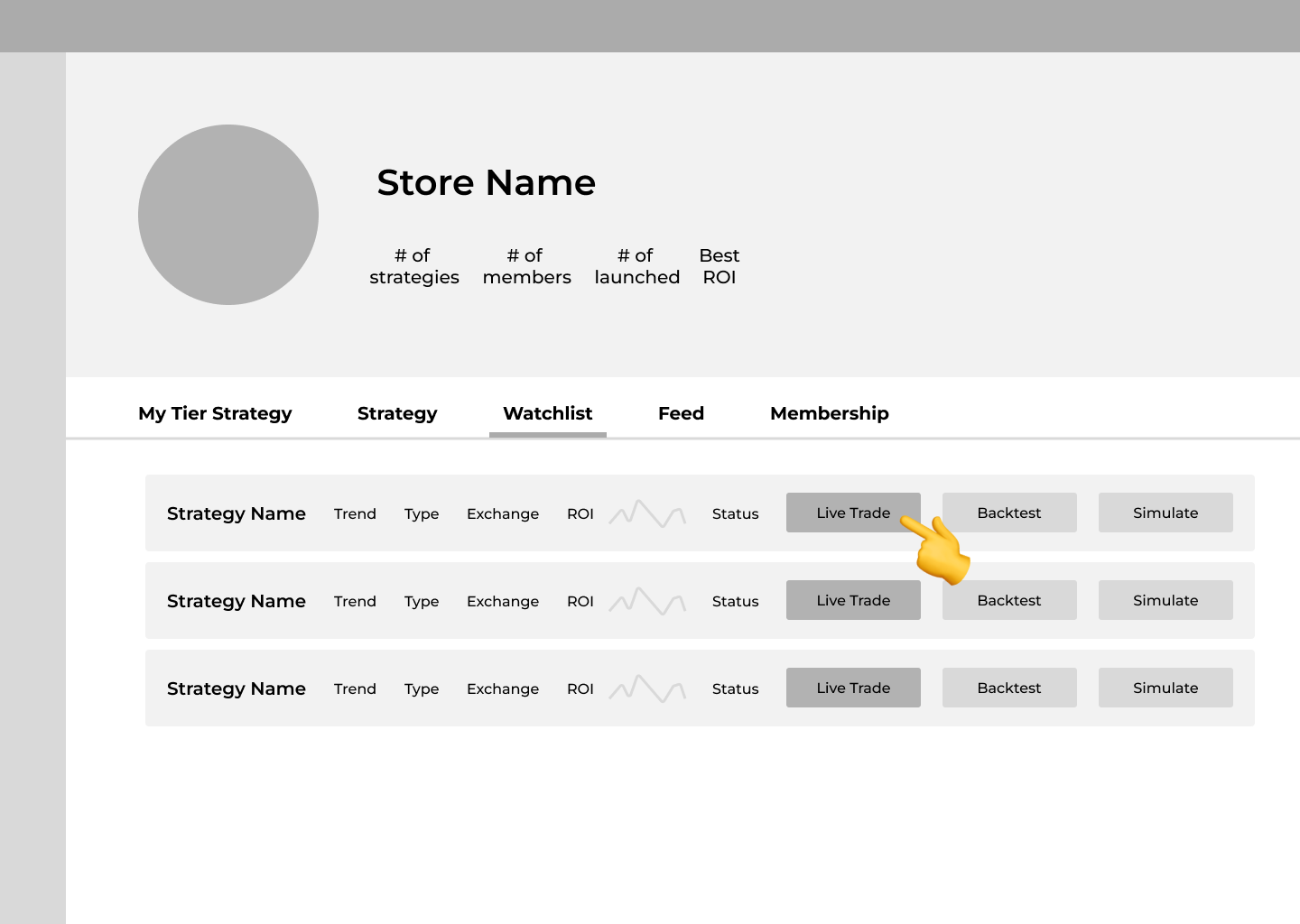

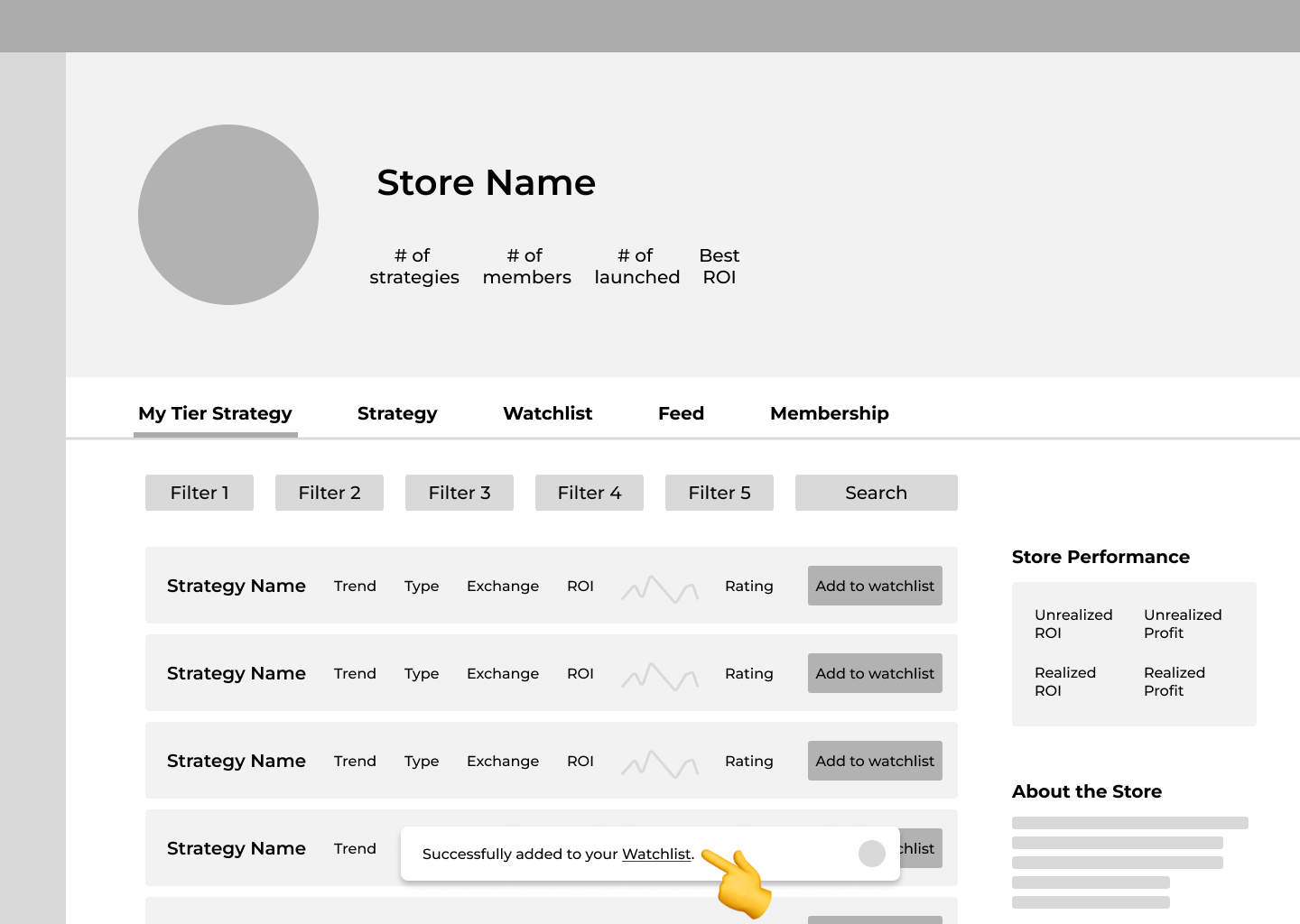

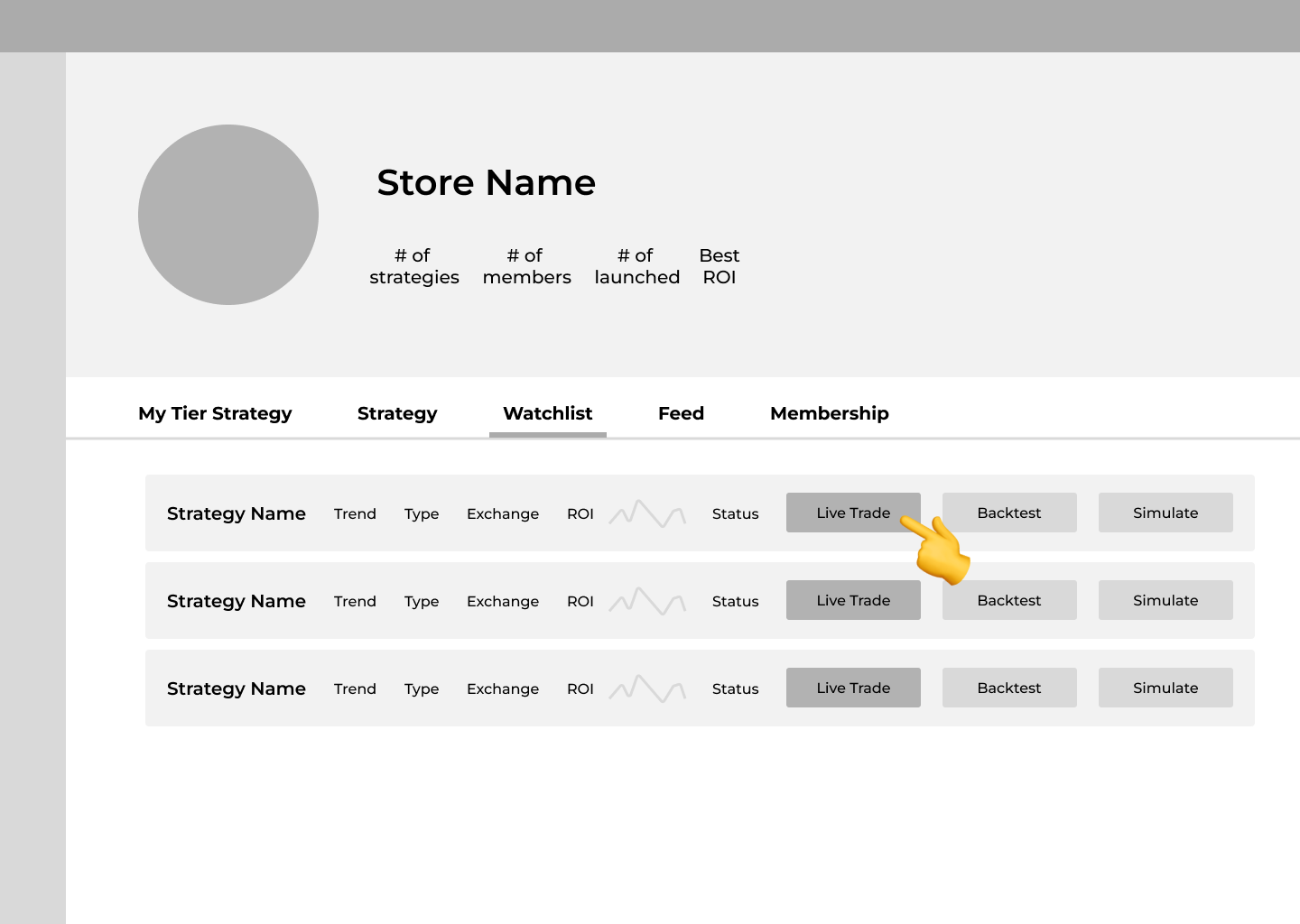

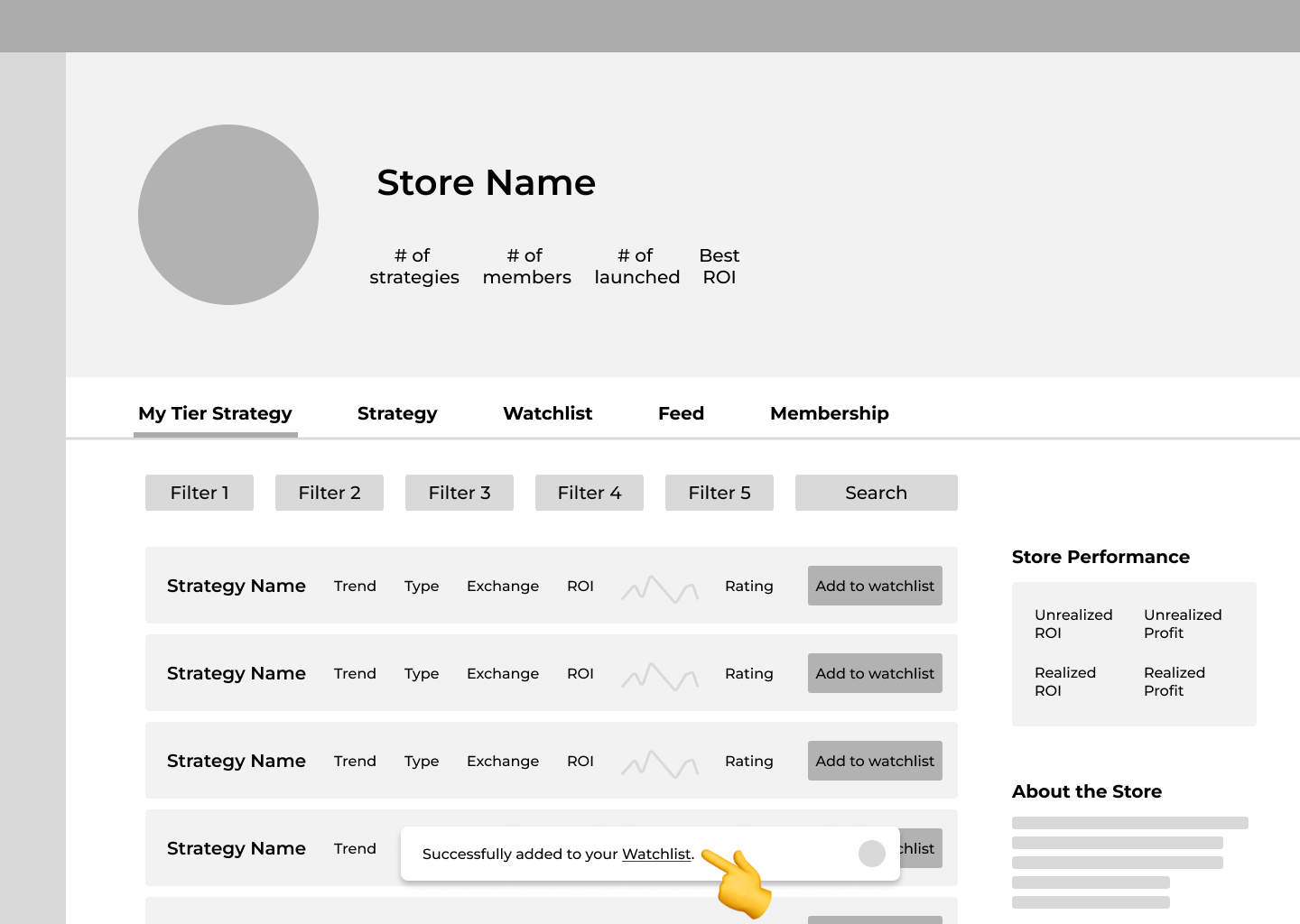

After joining the membership, traders select a strategy, add it to their watchlist, and trade.

1/4: Navigate to "My Tier Strategy" page

2/4: Add strategy into watchlist

3/4: Navigate to "Watchlist" page

4/4: Live trade with the strategy

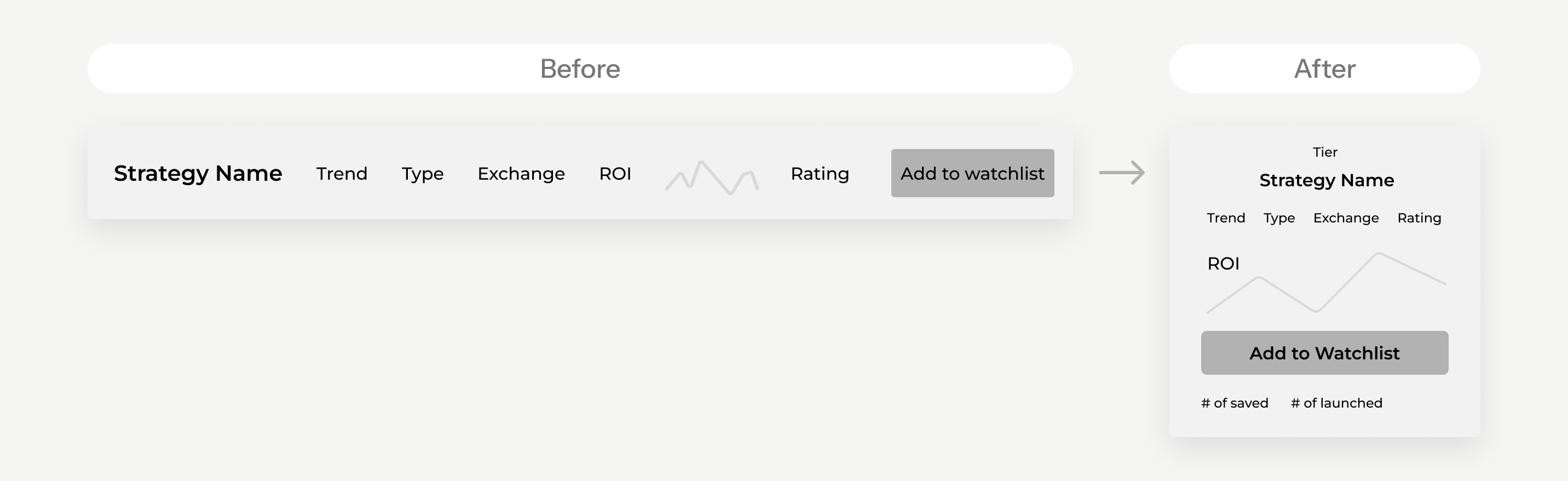

To create a more cohesive experience, I aligned the strategy layout with the updated store card design.

I switched to a vertical layout to enhance readability and emphasize the CTA button “Add to watchlist”, making key information more accessible.

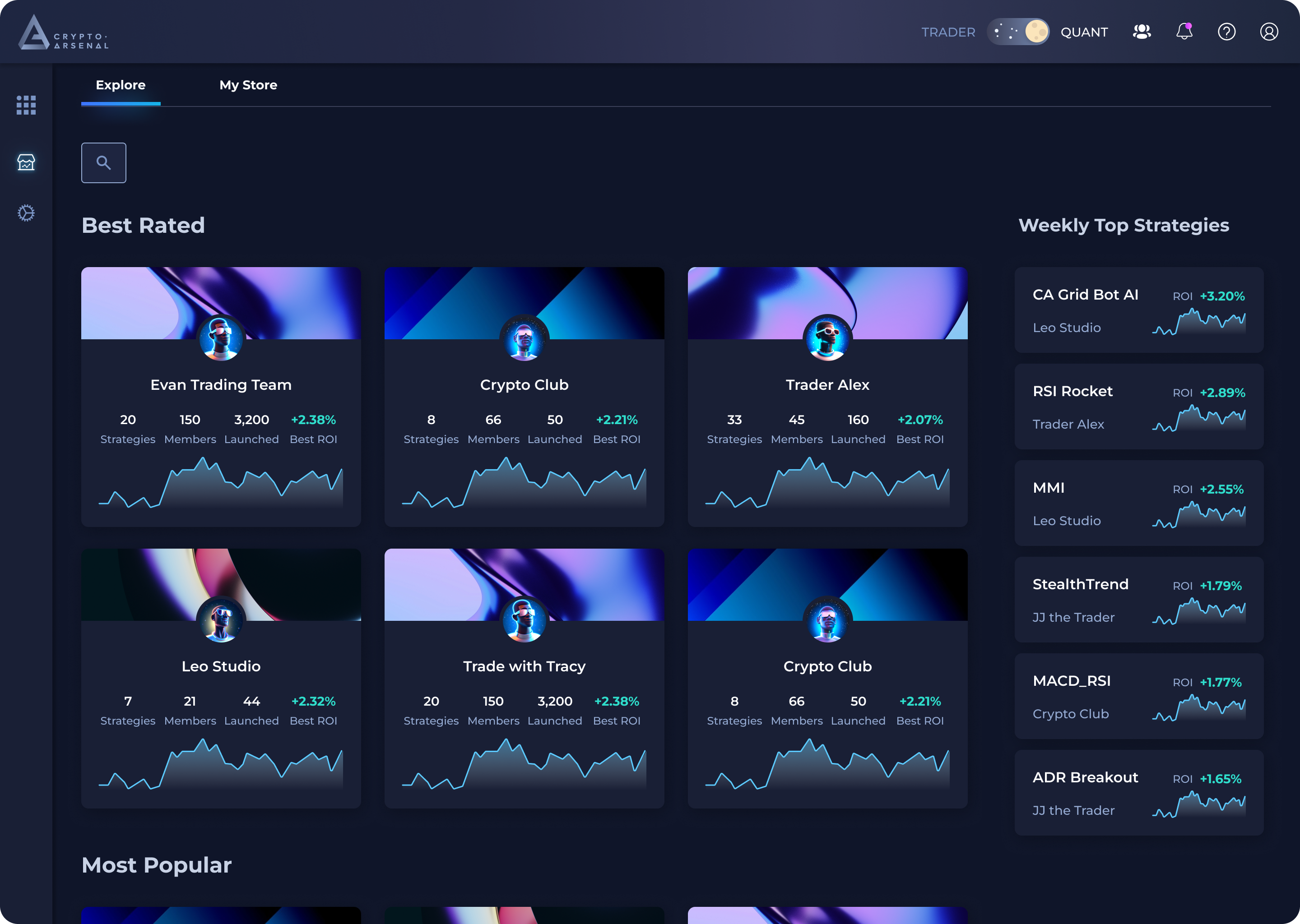

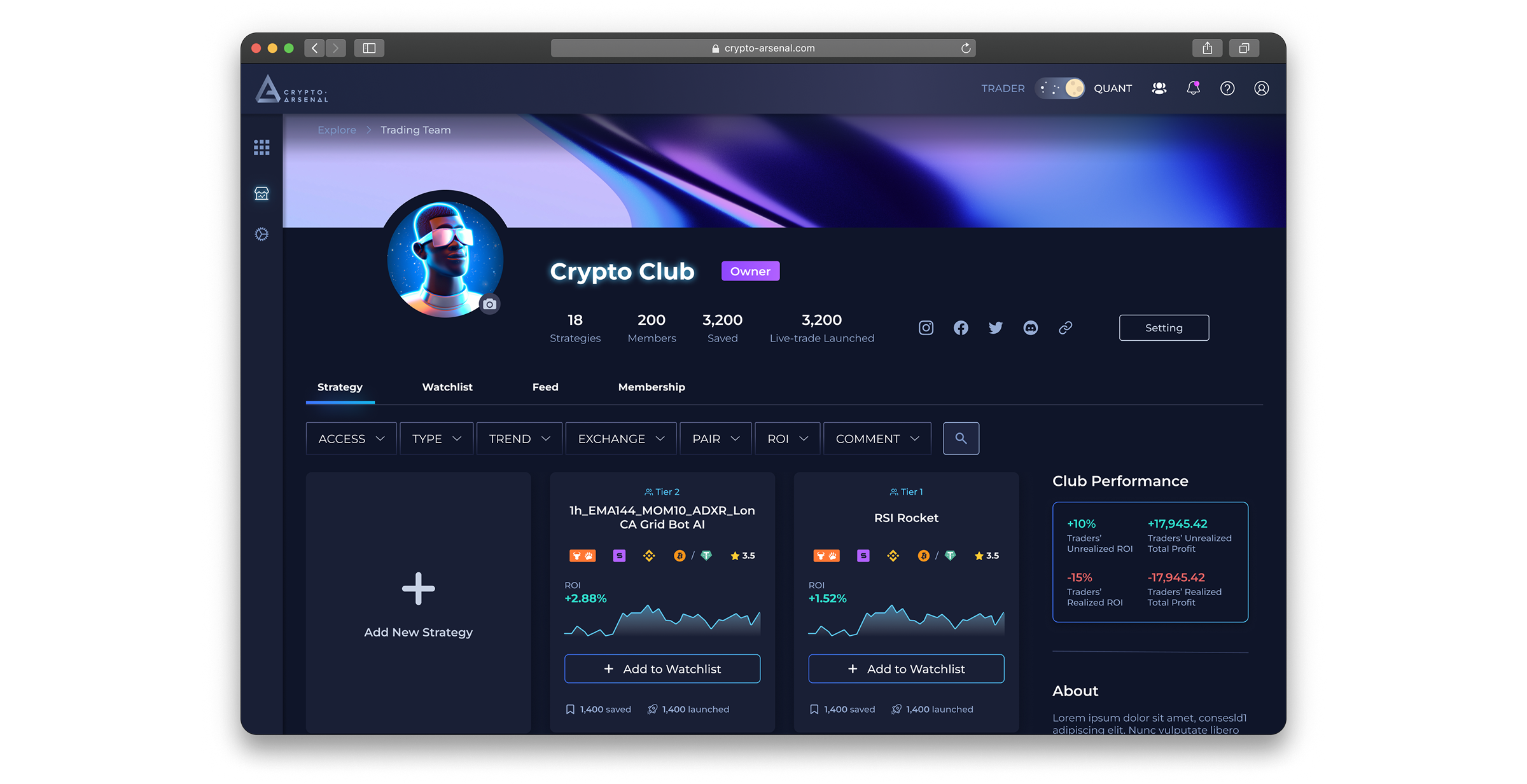

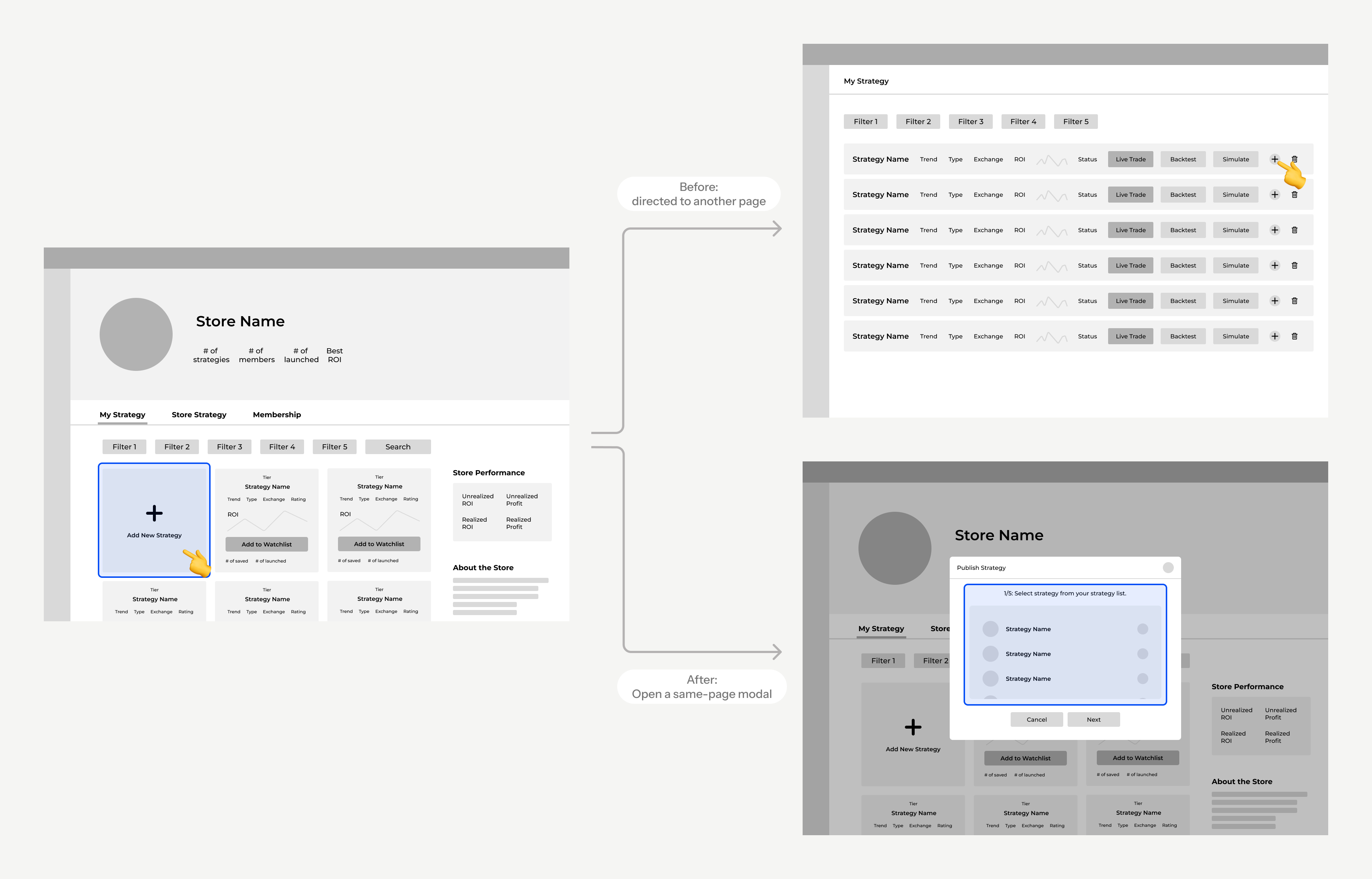

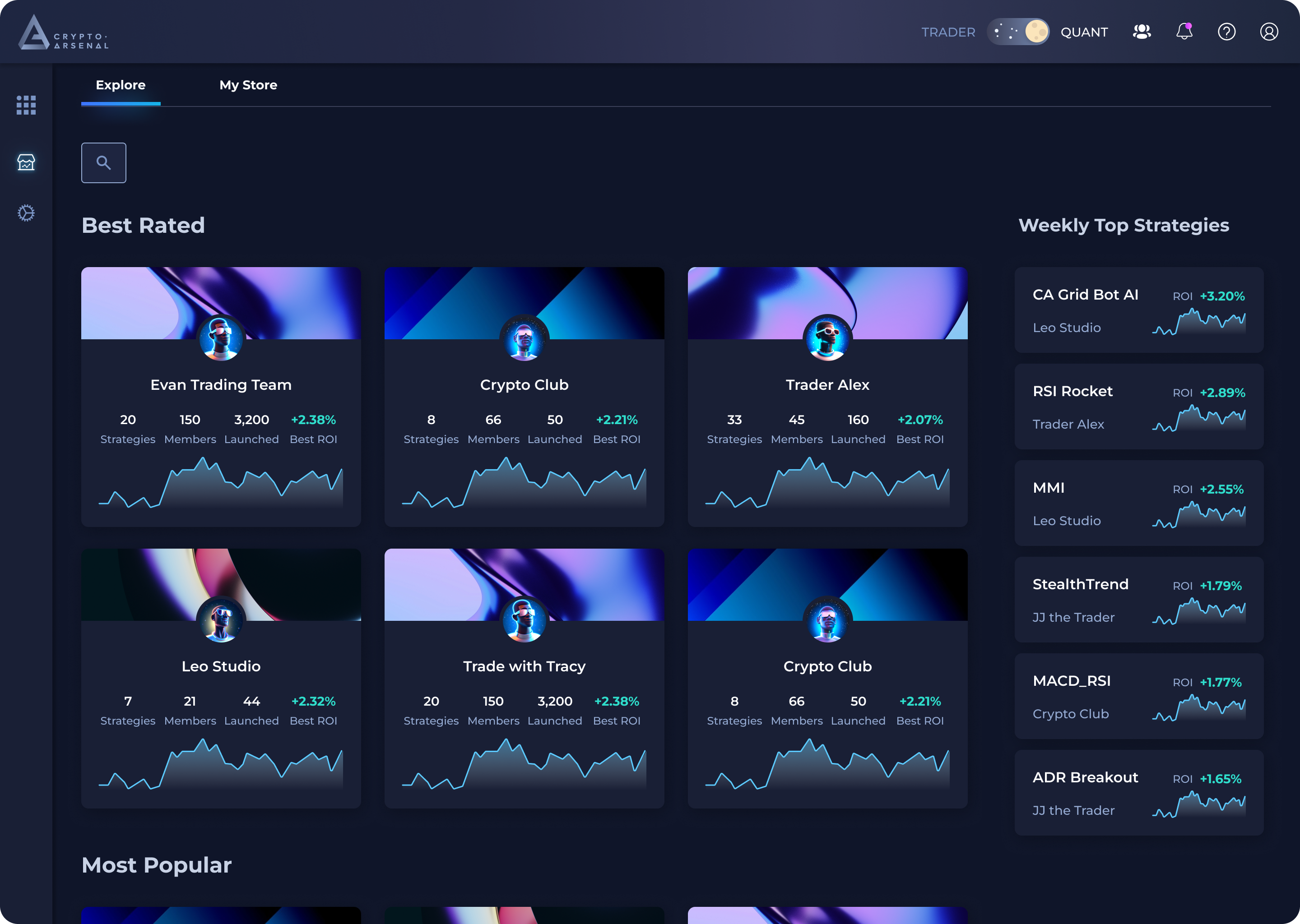

Final Designs

Homepage

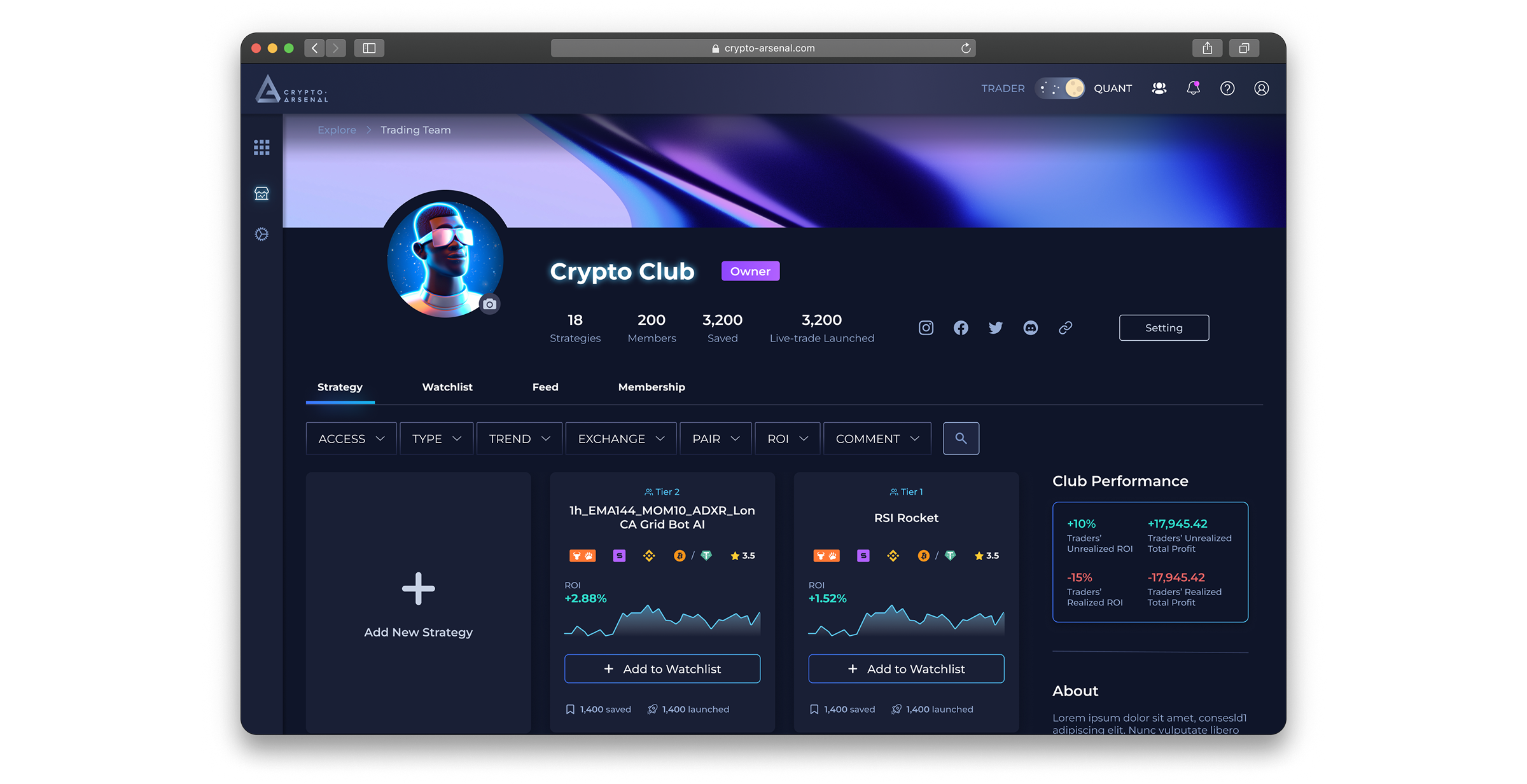

Store Detail Screens

Strategy Publishing Screens

Impact

🎉 The platform’s launch successfully attracted 10 strategy teams and 40+ daily traders in its first week, and boosted user engagement by 30% within its first month.

My Takeaways

- Balance between the limitations of resources and the deliverables.

- Communicate with cross-functional partners timely and think from different perspectives, e.g. consider the technical constraints, create clear design specs.

- Always keep users’ problems and goal in mind while looking for solutions and designing.

Scroll to top

Designing A More Connected Crypto Trading Experience

An all-in-one platform that streamlined the fragmented copy trading workflows, brings together real-time trader communication and tailored trading bots.

@Crypto-Arsenal

Timeline

Oct. 22 - Apr. 23

Tools

Figma, FigJam, Jira

My Role

Leading UX designer

with 1 Product Manager

& 3 Front-end Engineers

My Responsibilities

UX Research, Solution Ideating, Wireframing, Prototyping, Design System, User Testing

Starting with Crypto: What is it?

In crypto, trading strategies emerged to solve a key challenge — the need for traders to trade manually and constantly stay on top of the market.

These strategies are rules or algorithms that help traders monitor trends and execute trades more effectively.

And within this ecosystem, Crypto-Arsenal plays the role of a bridge — connecting directly with exchanges and enabling traders to access automated strategies created by experienced developers.

By linking both sides, it helps developers monetize their expertise, while allowing traders to trade smarter with confidence.

However, we identified a Problem...

Many traders don’t have the expertise or time to monitor and fine-tune their strategies,

and it became a barrier that prevents them from fully benefiting from automated trading.

How might we help non-technical traders benefit more from automated strategies?

💡 That’s where the idea of copy trading comes in.

What is copy trading? and why?

Many traders don’t have the expertise or time to monitor and fine-tune their strategies,

and it became a barrier that prevents them from fully benefiting from automated trading.

“So how might we help non-technical traders benefit more from automated strategies?”

Why we built this—

It’s a win-win for our users and our business

For our users

- A more engaging trading experience

- Offers more customization and flexibility

For our business

- Expands market reach & user base

- Strengthens company’s competitive edge

First, let’s ask our users

“I want to offer exclusive strategies to traders who’ve been loyal followers.”

Alex Hsu

Transport at Suite Nectar

“I want to offer exclusive strategies to traders who’ve been loyal followers.”

John Wang

Transport at Suite Nectar

“Having to use multiple platforms for copy trading feels inefficient.”

Richard Lee

Transport at Suite Nectar

“I want strategies that match my level, but it’s hard to find tailored options.”

Jade Huang

Transport at Suite Nectar

Through interviews with users about their current experience with trading , we validated the pain points and identified 3 key user needs:

💡 Integrated Platform

💬 Communication Space

🎯 Tailored Trading Bots

💭

We believe that creating a unified platform for traders to both trade and communicate could serve as a viable solution.

Next, knowing our competitors and the market

I found that other crypto trading platforms barely focus on building connections between lead traders and their copy traders. But it’s a crucial part because traders only do copy trades if they trust the lead traders.

💭

Besides trading and communicating, we need to focus on building trust and connections to create unique distinctions.

Our Unique Approach

Design a more connected and more seamless copy trading experience for both lead traders and copy traders.

With our platform,

lead traders can:

Publish trading bots and monetize their expertise

Share information with their copy traders easily

Classify and provide different types of bots t traders

With our platform,

copy traders can:

Discover and follow trusted traders and trade with them

Get timely trading info and updates from lead traders

Trade with the tailored bots that match their preferences

User Flow 1

Lead traders publish a strategy to their store.

In the original flow, when users wanted to publish a strategy to the store, they had to first navigate to a separate page that listed all of their strategies and then select the one they wanted to publish.

1/7: Select "Add New Strategy" button

2/7: Select "Add" to publish the strategy

3/7: Fill in the strategy basic settings

4/7: Fill in the investment-related settings

5/7: Fill in the profit-related settings

6/7: Set up the strategy access permission

7/7: Publish successfully!

During user testing, we found that the process of navigating to separate page disrupted the user experience, and the page switch caused unnecessary confusion.

So I redesigned the flow to allow users to complete the entire process directly on the store page.

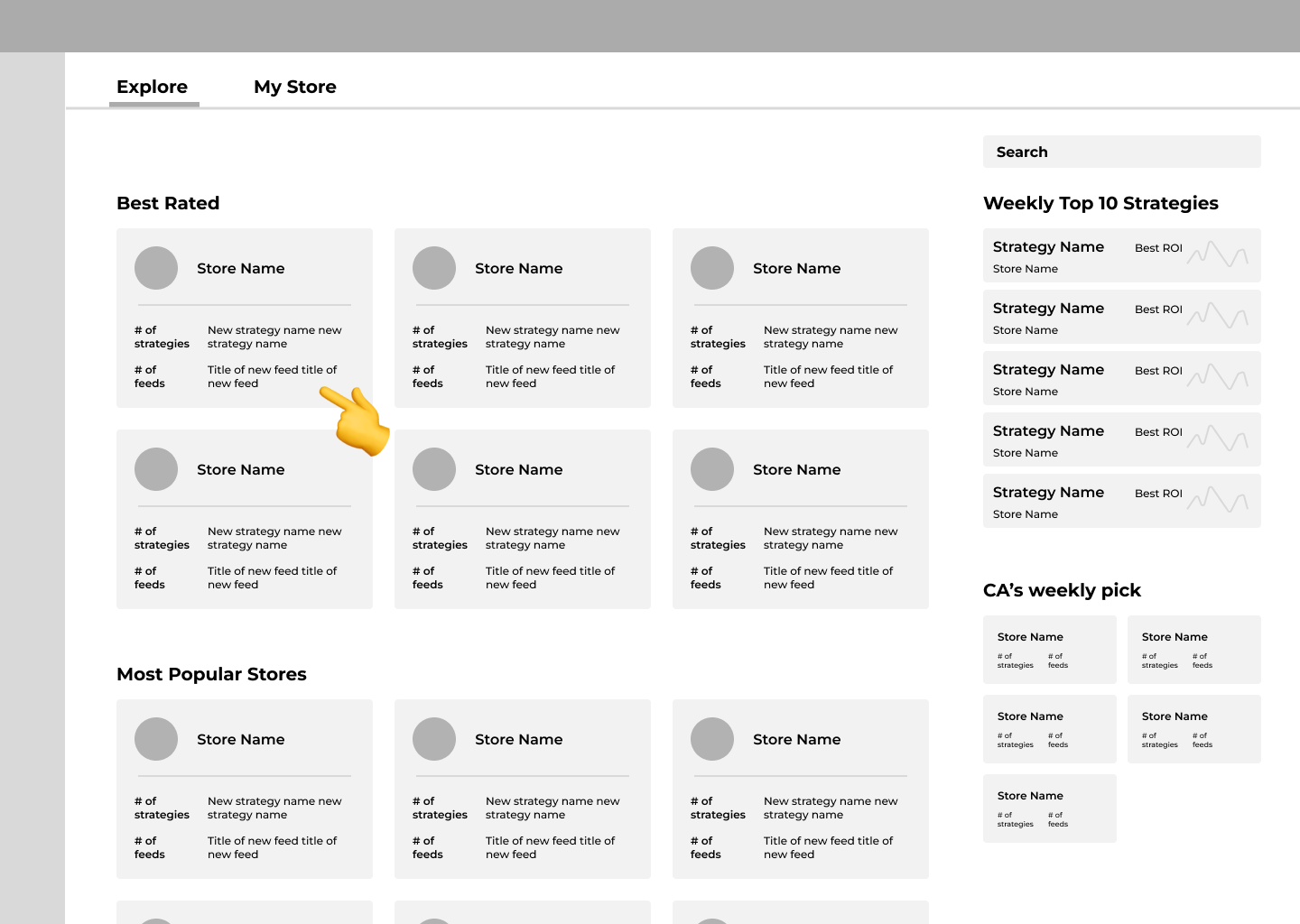

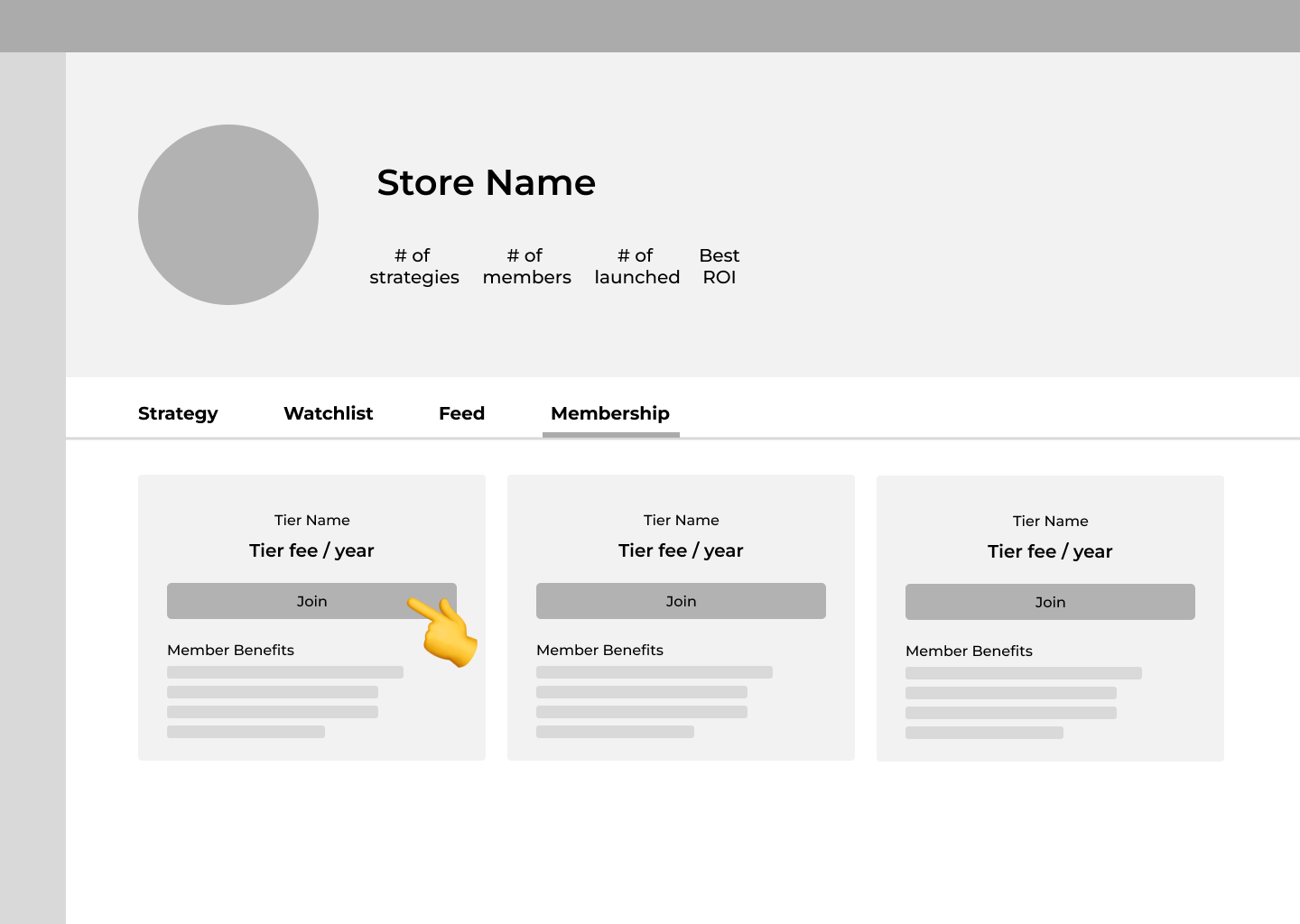

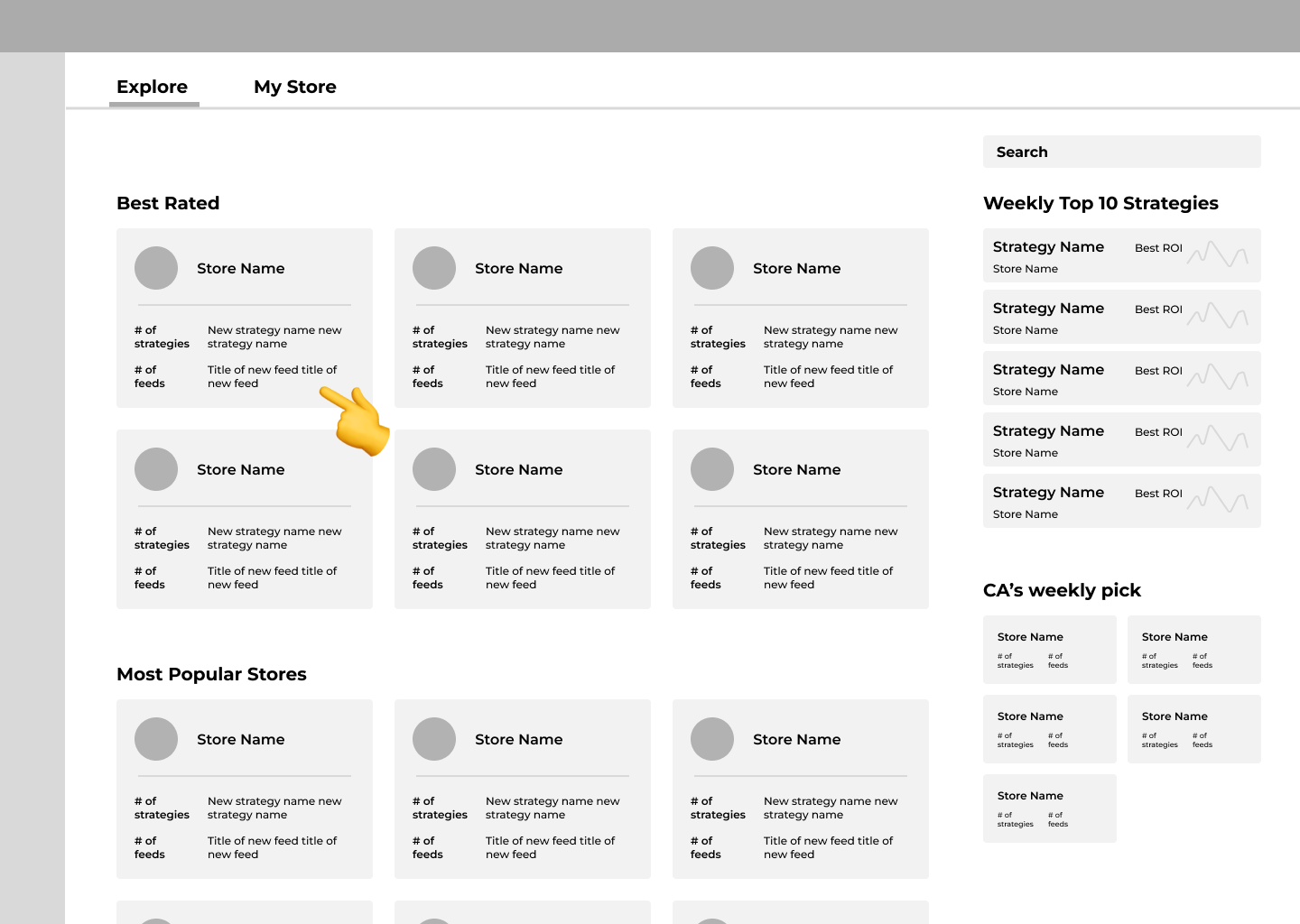

User Flow 2

Traders select a lead trader’s store and join the membership.

1/5: Select a store

2/5: Navigate to "Membership" page

3/5: Select a membership tier

4/5: Confirm & Join membership

5/5: Join successfully

Based on feedback from internal design reviews, I refined the store card layout to highlight key performance metrics.

I prioritized data-driven information for clearer store performance, making better use of limited card space.

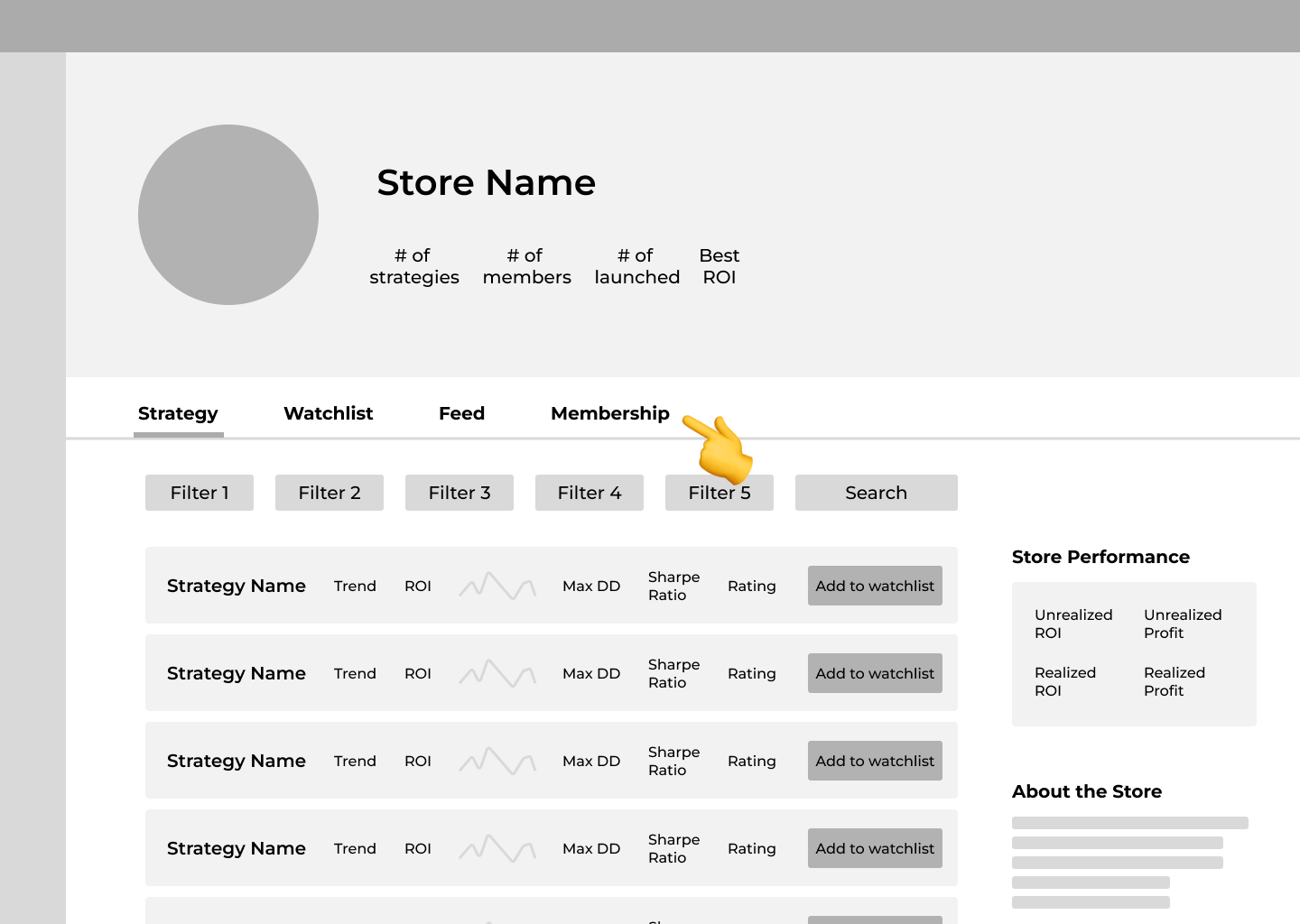

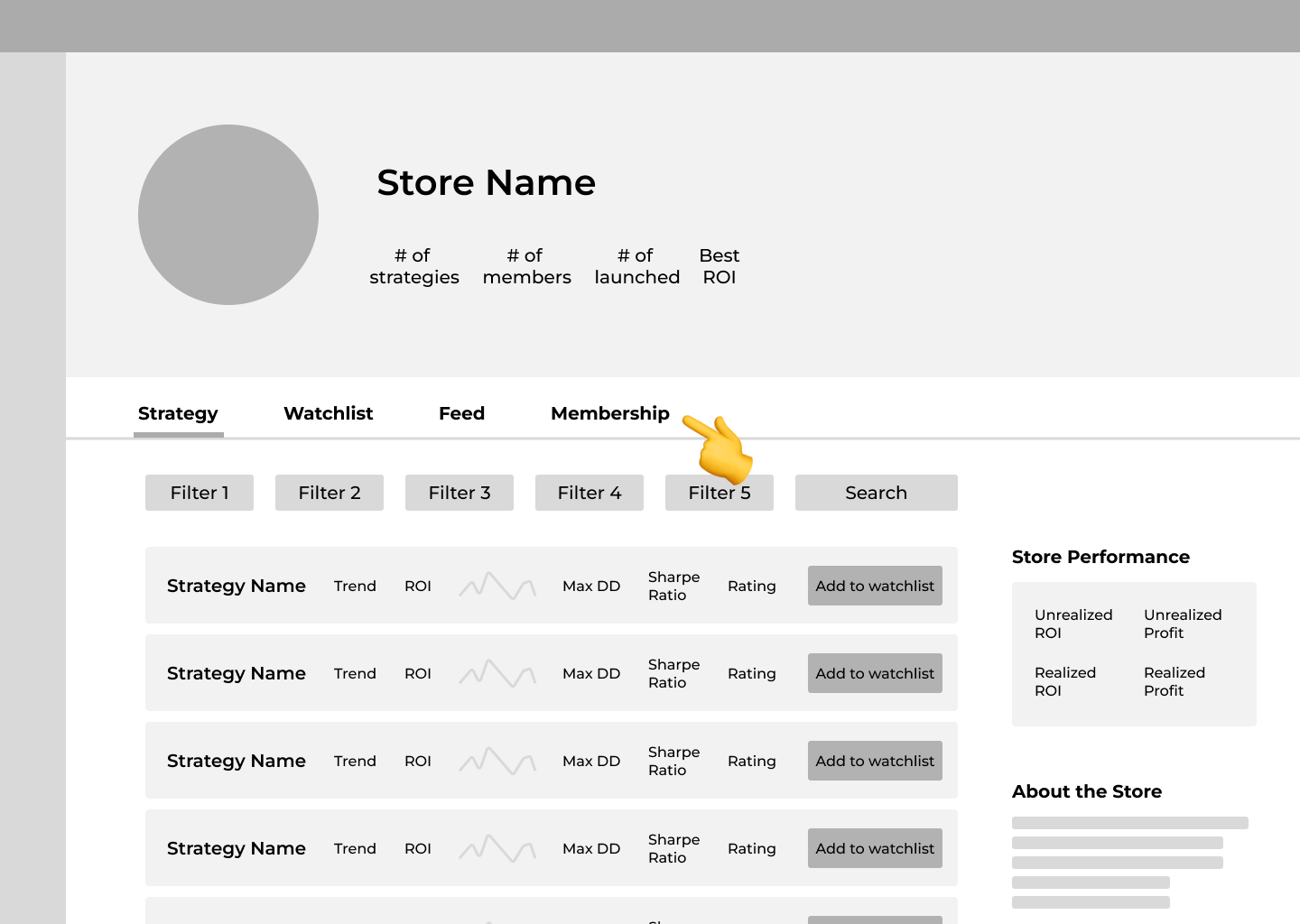

User Flow 3

After joining the membership, traders select a strategy, add it to their watchlist, and trade.

1/4: Navigate to "My Tier Strategy" page

2/4: Add strategy into watchlist

3/4: Navigate to "Watchlist" page

4/4: Live trade with the strategy

To create a more cohesive experience, I aligned the strategy layout with the updated store card design.

I switched to a vertical layout to enhance readability and emphasize the CTA button “Add to watchlist”, making key information more accessible.

Final Designs

Homepage

Store Detail Screens

Strategy Publishing Screens

Impact

🎉 The platform’s launch successfully attracted 10 strategy teams and 40+ daily traders in its first week, and boosted user engagement by 30% within its first month.

My Takeaways

- Balance between the limitations of resources and the deliverables.

- Communicate with cross-functional partners timely and think from different perspectives, e.g. consider the technical constraints, create clear design specs.

- Always keep users’ problems and goal in mind while looking for solutions and designing.

Scroll to top

Designing A More Connected Crypto Trading Experience

An all-in-one platform that streamlined the fragmented copy trading workflows, brings together real-time trader communication and tailored trading bots.

@Crypto-Arsenal

Timeline

Oct. 22 - Apr. 23

Tools

Figma, FigJam, Jira

My Role

Leading UX designer

with 1 Product Manager

& 3 Front-end Engineers

My Responsibilities

UX Research, Solution Ideating, Wireframing, Prototyping, Design System, User Testing

Starting with Crypto: What is it?

In crypto, trading strategies emerged to solve a key challenge — the need for traders to trade manually and constantly stay on top of the market.

These strategies are rules or algorithms that help traders monitor trends and execute trades more effectively.

And within this ecosystem, Crypto-Arsenal plays the role of a bridge — connecting directly with exchanges and enabling traders to access automated strategies created by experienced developers.

By linking both sides, it helps developers monetize their expertise, while allowing traders to trade smarter with confidence.

However, we identified a Problem...

Many traders don’t have the expertise or time to monitor and fine-tune their strategies,

and it became a barrier that prevents them from fully benefiting from automated trading.

How might we help non-technical traders benefit more from automated strategies?

That’s where the idea of copy trading comes in 💡

What is copy trading? and why?

Many traders don’t have the expertise or time to monitor and fine-tune their strategies,

and it became a barrier that prevents them from fully benefiting from automated trading.

“So how might we help non-technical traders benefit more from automated strategies?”

Why we built this—

It’s a win-win for our users and our business

For our users

- A more engaging trading experience

- Offers more customization and flexibility

For our business

- Expands market reach & user base

- Strengthens company’s competitive edge

First, let’s ask our users

“I wish there was a space where I could easily share trading tips and communicate with my copy traders.”

Alex Hsu

Lead Trader

“I want to offer exclusive strategies to traders who’ve been loyal followers.”

John Wang

Lead Trader

“Having to use multiple platforms for copy trading feels inefficient.”

Richard Lee

Copy Trader

“I want strategies that match my level, but it’s hard to find tailored options.”

Jade Huang

Copy Trader

Through interviews with users about their current experience with trading , we validated the pain points and identified 3 key user needs:

💡 Integrated Platform

💬 Communication Space

🎯 Tailored Trading Bots

💭

We believe that creating a unified platform for traders to both trade and communicate could serve as a viable solution.

Next, knowing our competitors and the market

I found that other crypto trading platforms barely focus on building connections between lead traders and their copy traders. But it’s a crucial part because traders only do copy trades if they trust the lead traders.

💭

In addition to trading and communication, it's essential to foster traders’ connections to establish unique differentiators.

Our Unique Approach

Design a more connected and more seamless copy trading experience for both lead traders and copy traders.

With our platform,

lead traders can:

Publish trading bots and monetize their expertise

Share information with their copy traders easily

Classify and provide different types of bots t traders

With our platform,

copy traders can:

Discover and follow trusted traders and trade with them

Get timely trading info and updates from lead traders

Trade with the tailored bots that match their preferences

User Flow 1

Lead traders publish a strategy to their store.

In the original flow, when users wanted to publish a strategy to the store, they had to first navigate to a separate page that listed all of their strategies and then select the one they wanted to publish.

1/7: Select "Add New Strategy" button

2/7: Select "Add" to publish the strategy

3/7: Fill in the strategy basic settings

4/7: Fill in the investment-related settings

5/7: Fill in the profit-related settings

6/7: Set up the strategy access permission

7/7: Publish successfully!

During user testing, we found that the process of navigating to separate page disrupted the user experience, and the page switch caused unnecessary confusion.

So I redesigned the flow to allow users to complete the entire process directly on the store page.

User Flow 2

Traders select a lead trader’s store and join the membership.

1/5: Select a store

2/5: Navigate to "Membership" page

3/5: Select a membership tier

4/5: Confirm & Join membership

5/5: Join successfully

Based on feedback from internal design reviews, I refined the store card layout to highlight key performance metrics.

I prioritized data-driven information for clearer store performance, making better use of limited card space.

User Flow 3

After joining the membership, traders select a strategy, add it to their watchlist, and trade.

1/4: Navigate to "My Tier Strategy" page

2/4: Add strategy into watchlist

3/4: Navigate to "Watchlist" page

4/4: Live trade with the strategy

To create a more cohesive experience, I aligned the strategy layout with the updated store card design.

I switched to a vertical layout to enhance readability and emphasize the CTA button “Add to watchlist”, making key information more accessible.

Final Designs

Homepage

Store Detail Screens

Strategy Publishing Screens

Impact

🎉 The platform’s launch successfully attracted 10 strategy teams and 40+ daily traders in its first week, and boosted user engagement by 30% within its first month.

My Takeaways

- Balance between the limitations of resources and the deliverables.

- Communicate with cross-functional partners timely and think from different perspectives, e.g. consider the technical constraints, create clear design specs.

- Always keep users’ problems and goal in mind while looking for solutions and designing.

Scroll to top